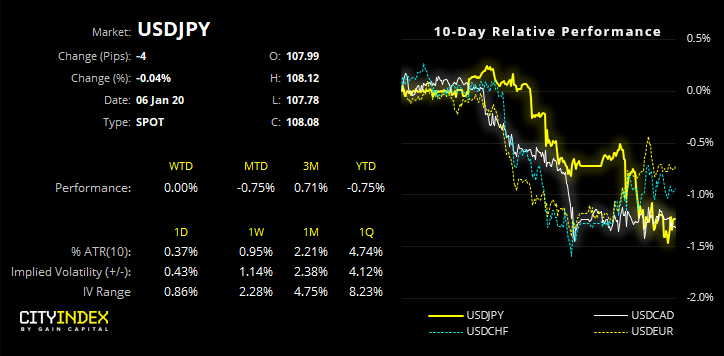

As noted earlier, there were some impressive gaps at this week’s open for Gold, WTI and S&P futures after a slew of headlines over the weekend saw tensions in the Middle East escalate further. Yet it’s worth noting that the gap didn’t make it over to USD/JPY, despite then yen being clearly bid on Friday.

So, what does this suggest? If bad news didn’t make it drop, then it could leave USD/JPY vulnerable to a corrective bounce if markets (somehow) revert to risk-on. Although it may not even require risk-on to take over, as bears may be tempted to close out if tensions don’t escalate further from here, would which help lift USD/JPY from its lows.

However, it’s too soon to be complacent and assume all is well. It's also plausible that market’s haven’t fully priced in the magnitude of these events. Therefore, our core view is for USD/JPY to break to new lows, but for now we’re left wondering how large a corrective bounce we could be in for, ahead of its next bearish leg.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.