Well, I’m going to take a break from my so-called vacation to do a post from my undisclosed tropical location. The old “Tim is traveling, so the market must fall” meme has stopped working, in spite of Monday’s minuscule sink. As I type this, equities are stronger across the board, and word on the street is that VIX, already at the lowest level in history, is heading toward 8.

I remain focused strongly on energy, and the yellow tint marks the “things get even suckier for the bears” market. Of course, by tomorrow morning we should have clarity on this, since the weekly inventory report rolls out. As for now, I remain long NYSE:DRIP, which has a nice profit (again, for the moment).

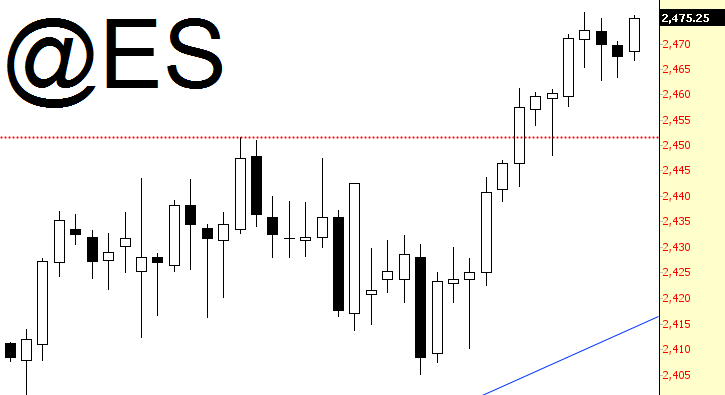

As I mentioned, equities are at lifetime highs (again), as the ES marches higher, thanks to strong Dow component earnings.

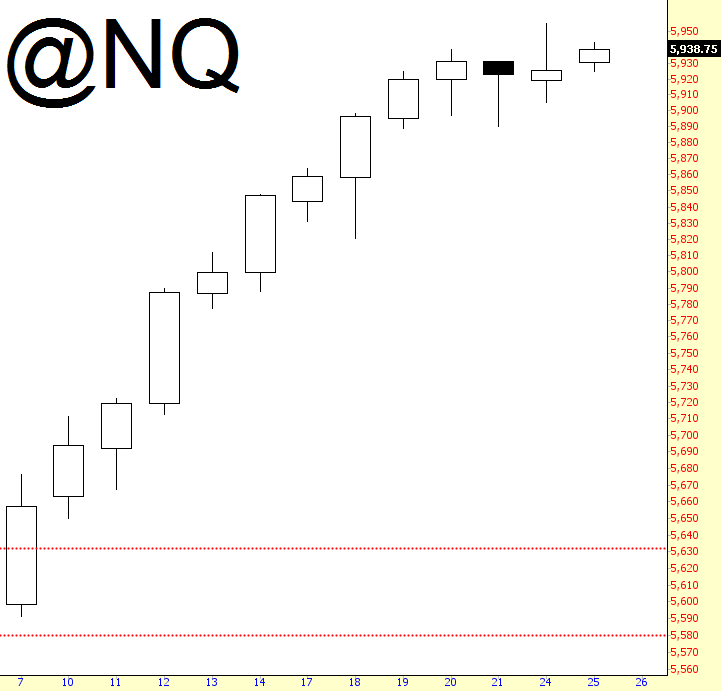

And, in spite of Google’s post-earnings weakness (off nearly 3% pre-market), the NQ doesn’t care and is steadily storming to new lifetime highs.

I’m also long NYSE:DUST (triple-bearish on gold miners) and short GLD (NYSE:GLD). If the US dollar can get a bit of strength, gold should kick in with some meaningful weakness.

OK, back to my faux relaxation. See you much later.