Market Brief

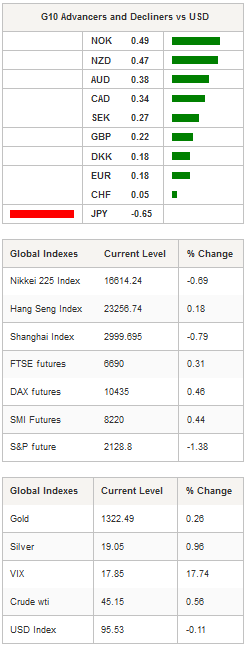

The global equity market sell-off continued on Wednesday as investors started to question whether current equity valuations still make sense against the backdrop of anaemic global growth and subdued inflationary pressure. In Asia, equity indices were trading broadly lower as Japanese shares took the largest hit. The Nikkei and Topix were down 0.76 and 0.65% respectively, while the yen fell 0.36% against the greenback with USD/JPY grinding higher to 103.20. Since yesterday, the pair has been trading with a solid uptrend bias and will most likely continue to push higher as investors fear the BoJ will further increase its monetary policy easing. On the upside, a first resistance can be found at 104.32 (high from September 2nd), while on the downside, a support lies at 101.21 (low from September 7th).

Emerging market currencies had a tough session yesterday as investors reduced their risky positions. The Brazilian real, Colombian peso and Chilean peso were all off more than 1% against the greenback. Over the last two days, the Brazilian real was the worst performer in Latin American falling 2% against the USD, with USD/BRL moving above the 3.30 threshold. The pair has finally escaped its downtrend channel to the upside and is now trading sideways at between 3.15 and 3.50. We maintain our bearish view on the real as we believe the market has been overly optimistic regarding the potential outcome of Rousseff’s impeachment. The market will continue to pay more and more attention to the fundamentals and will gradually realize that the economic prospect is not that bright, even with a brand new government.

EUR/USD rose slightly in Tokyo as it edged up 0.10% to 1.1230. We remain neutral on the short-term as we get closer to the September FOMC meeting. After taking a big hit on Tuesday, the pound sterling consolidated at around 1.32 in Asia. The market is still waiting to see the first negative effects of the Brexit vote but it seems that nothing has changed yet. Investors will however remain shy and will limit their long GBP positions until they get better clarity on the UK outlook.

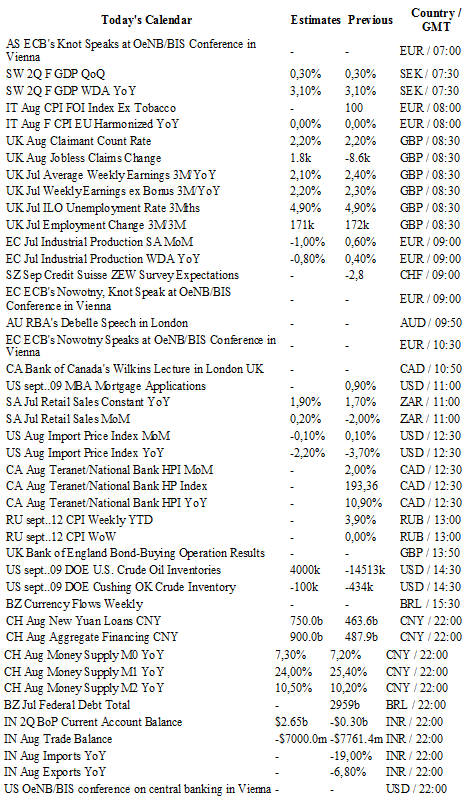

Today traders will be watching Q2 GDP figures from Sweden; CPI from Italy and Russia; unemployment report from UK; industrial production from the euro zone; ZEW survey from Switzerland; MBA mortgage application, import prices and crude oil inventories from the US; ECB Nowotny will also speak in Vienna.

Currency Tech

EUR/USD

R 2: 1.1616

R 1: 1.1428

CURRENT: 1.1234

S 1: 1.1046

S 2: 1.0913

GBP/USD

R 2: 1.5018

R 1: 1.3534

CURRENT: 1.3225

S 1: 1.3024

S 2: 1.2851

USD/JPY

R 2: 107.90

R 1: 104.32

CURRENT: 103.23

S 1: 99.02

S 2: 96.57

USD/CHF

R 2: 0.9956

R 1: 0.9885

CURRENT: 0.9764

S 1: 0.9522

S 2: 0.9444