Market Brief

Risk appetite was softer in the Asian session, as equities fell as traders paired back longs ahead of this data filled week. The Nikkei fell -0.59%, the Hang Seng dropped -0.20% and Shanghai dipped -0.91, S&P futures are pointing lower (following historic rise above 2,000). However, buying pressure built up from yesterday’s UK bank holiday is pushing FTSE futures higher. Europe is looking at a mixed session as excitement over new stimulus measure from the ECB is now being tempered with commonsense expectations. Report that China’s economy expanded in July as the Conference board leading economic index reported at 1.30% rise following a 1.30% rise in June failed to generate any positive spillover. USD was marginally weaker. EURUSD pushed off the session lows at 1.3180 rallying to 1.3215. USDJPY dropped to 103.75 from 104.10.

AUDUSD initially fell to 0.9270 on the back of a RBA watcher Terry McCann article suggesting room for additional policy cuts. Later in the session the AUD reverse earlier losses coinciding with broader USD selling. Rumors of decent AUDNZD profit-taking assisted with the cross coming off the highs at 1.1170 to 1.1133. New Zealand’s trade balance reached a deficit of NZ$692mn in July for the first time in nearly a year. NZDJPY dropped from 86.83 to 86.47 after a soft trade report but recovered later with S&P upholding New Zealand’s sovereign rating and outlook (AA/AA+ sovereign / local currency ratings). In EM Asia, USD was also broadly weaker. KRW continued its two day winning streak and USDCNY fixed 10pips higher. That said weakness in long USD looks to be a function of thinning positions and locking in profits rather than any longer-term change in sentiment. That said, some risk aversion is creeping into markets as Russian President Vladimir Putin is scheduled to meet Ukrainian Presisent Petro Poroshenko in Minsk, Belarus suggesting slight event in geopolitical tensions. There is little optimism that any meaningful resolution will result.

Eyes on US data

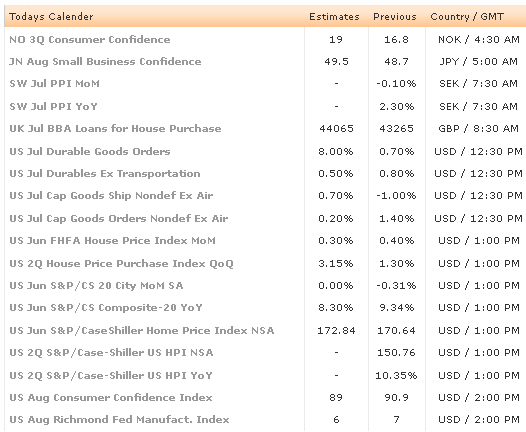

Traders will be watching the performance of stock markets in light of recent confirmation of monetary policy divergence. On the data front, US durable goods and consumer confidence will take center stage. New durable goods orders in July was heavy in transportation equipment, placing headline durable goods orders at solid 8.0% and ex-transportation a lighter 0.5%. US consumer confidence should fall marginally to 89.0 from prior read of 90.9. In the EM space, Hungary central bank is widely expected to hold rates at 2.10% following last month meeting where it announced the end of the easing cycle. South Africa Q2 GDP is expected to recovery 0.9% annualized q/q from its negative print in Q1.

Currency Tech

EURUSD

R 2: 1.3239

R 1: 1.3210

CURRENT: 1.3208

S 1: 1.3178

S 2: 1.3146

GBPUSD

R 2: 1.6611

R 1: 1.6596

CURRENT: 1.6583

S 1: 1.6565

S 2: 1.6533

USDJPY

R 2: 104.35

R 1: 104.12

CURRENT: 103.88

S 1: 103.74

S 2: 103.59

USDCHF

R 2: 0.9200

R 1: 0.9180

CURRENT: 0.9143

S 1: 0.9138

S 2: 0.9116