Market Brief

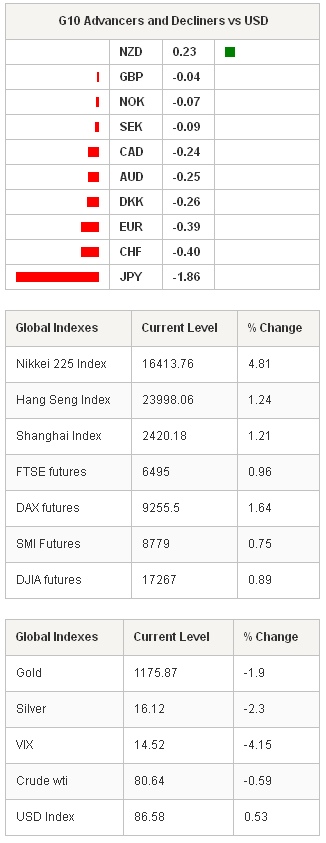

Forex markets were handed a surprise decision by the Bank of Japan which sent JPY significantly lower across the board. The BoJ announced an increase in the speed of expansion in its monetary base by “about” JPY80 trn per year (verse JPY60-70 trn). Previously the expansion was conducted through a combination of JGB purchases, liquidity through loan support programs and purchase of other assets. However now it looks as if a vast majority will be straight JGB purchases. Importantly to equity markets the speed of ETF and J-Reit purchases will increase as well (sending Nikkei higher). The vote was 5-4 with the majority citing downward pressure on prices as the key reason for more QQE. The market’s reaction to the unexpected decision (please note we had projected this outcome- see Weekly Market Report) drove USD/JPY to new multi-years high at 111.53. Foreign exchange trading strategies kick into full gear as USD/JPY took out critical levels in 110.67 August 2008 high and 111.47 the 1998 peak while EUR/JPY rallied above the 138.60 pivot, and the 200-dma at 139.06. Equity markets are broadly stronger across Asia. The Nikkei rallied a massive 4.83% (supported by the additional QQE and reallocation in GPIF) , the Hang Seng up 1.09% and Shanghai rose 1.22% and the Kospi has risen 0.23%. S&P 500 futures are currently trading higher up 0.2%.

Elsewhere, in Japan, the media is reporting that Japan's Government Pension Investment Fund (GPIF) will report alterations in its asset allocation structure today. The press reports that GPIF domestic debt allocation will drop to 355 from 60% and foreign holding will increase to 15% from 11%. On the data front, Japan’s CPI increased 3.2% y/y below consensus and prior read of 3.3% in August. Core inflation rose 3.0% y/y in September, in line with expectations but slower than the 3.1% increase previously reported. USD/JPY rally has run its course for today and our forex trading strategy would be short for a quick reversion to 110.80-111.00 support.

Russia might transition to a Free-float

Traders will be focused on Russia today as the central banks will report decisions on rates and possible Foreign exchange. The market is anticipating a 50bp hike to 8.50% in response to the collapse of the RUB and higher inflation outlook. However, we suspect that 50bp will be too little to discourage the mass exodus from RUB and expect a surprise move more in the lines of 75-100bp. There is also significant risk that today the rate announcement will be accompany with news of a transition to a free-float exchange rate regime. The CBR has spent roughly $24bn in October defending the upper-band. However, there is a probably that CBR would slight delay the transition in order to see improvement in current account due to winter fuel export revenue and avoid the colliding with external debt repayments allowing a more stable transition. Day trading strategies have helped push USD/RUB to all time highs at 43.89 ( 1 month vols spiked to 23)

Mexico to hold rates

In Mexico, the central bank is expected to keep rates unchanged with a slight outside chance of a 25bp cut. The combination of higher inflation in Mexico and the Feds hawkish tone are the basis for our no-change call. Any hawkish development will be good for MXN as traders has a big appetite for EM with solid growth and monety policy in a non-easing cycle.

Currency Tech

EURUSD

R 2: 1.2896

R 1: 1.2771

CURRENT: 1.2565

S 1: 1.2520

S 2: 1.2500

GBP/USD

R 2: 1.6212

R 1: 1.6185

CURRENT: 1.5987

S 1: 1.5966

S 2: 1.5920

USD/JPY

R 2: 112.00

R 1: 111.50

CURRENT: 111.30

S 1: 108.80

S 2: 108.27

USD/CHF

R 2: 0.9670

R 1: 0.9648

CURRENT: 0.9597

S 1: 0.9441

S 2: 0.9400