Market Brief

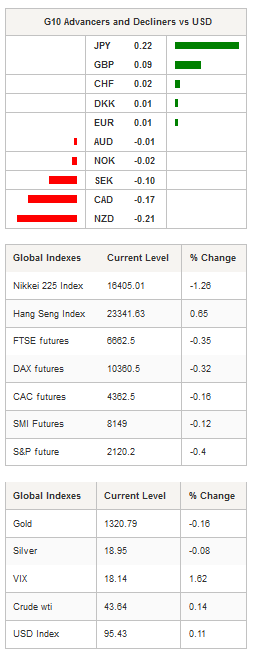

It was a quiet session in the FX market as investors impatiently await the upcoming BoJ and Fed meeting. The single currency was little changed against the dollar and traded range-bound between 1.1239 and 1.1251. The Japanese yen was the best performer amongst the G10 complex as it advanced 0.22% against the greenback, with USD/JPY easing at 102.21 after moving as low as 101.95 overnight.

In spite of the fact that the Federal Reserve should stay on the sidelines at next week's FOMC meeting, which would prevent the USD to extend gains, the bias should remain on the upside in USD/JPY as investors seem reluctant to load on long JPY positions and would rather continue to seek higher returns. On the upside, a resistance can be found at 104.32 (high from 104.32), while on the downside a support lies at 101.21 (low from September 7th).

The New Zealand dollar was the worst performing currency amongst the G10 complex as it fell 0.21% against the US dollar, down to 0.7265 amid worse than expected GDP figures and faltering business confidence. Data showed that the Kiwi economy grew 0.9%q/q (seasonally adjusted) in the second quarter, missing estimates of 1.1%, while the first quarter’s figure was revised to 0.9% from 0.7%.

All in all, the growth figures are rather encouraging, as it shows that the economy continued to adjust effectively to the strong Kiwi and weak global demand environment. However, we cannot rule out another rate cut from the RBNZ as inflationary pressures, and more specifically, inflation expectations remain desperately low. The possibility of another easing move means the RBNZ should maintain the pressure on the Kiwi or at least it should prevent it to appreciate strongly.

From a technical point of view, NZD/USD has tumbled and the long-term 0.7335 resistance implied by the 38.2% Fibonacci level (on 2009-2014 rally). In the short-term, the pair has successfully broken the bottom line of its uptrend channel, suggesting that the bullish momentum is coming to an end.

In the equity market, Asian returns were mixed on Thursday. Japanese equities moved further into negative territory with the Nikkei and the Topix index down 1.26% and 1.04% respectively. Chinese markets were closed for the Autumn Festival. In Hong Kong, the Hang Seng was up 0.65%. In Europe, equity futures were broadly trading in negative territory, suggesting to a lower open.

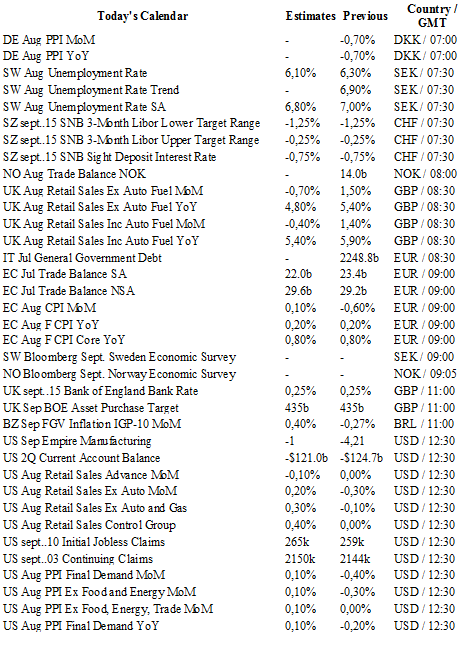

Today, traders will be watching the unemployment rate from Sweden; interest rate decision from Switzerland; retail sales from the US and the UK; Empire manufacturing, initial jobless; PPI, Philadelphia business outlook and industrial production from the US.

Currency Tech

EUR/USD

R 2: 1.1616

R 1: 1.1428

CURRENT: 1.1226

S 1: 1.1046

S 2: 1.0913

GBP/USD

R 2: 1.5018

R 1: 1.3534

CURRENT: 1.3230

S 1: 1.3024

S 2: 1.2851

USD/JPY

R 2: 107.90

R 1: 104.32

CURRENT: 102.43

S 1: 99.02

S 2: 96.57

USD/CHF

R 2: 0.9956

R 1: 0.9885

CURRENT: 0.9761

S 1: 0.9522

S 2: 0.9444