Investing.com’s stocks of the week

Market Brief

As broadly expected, the ECB left its rates unchanged. The market, however, wasn’t expecting such a dovish message from Mario Draghi. ECB’s president emphasised downside risks to inflation, citing: “heightened uncertainty about emerging market economies’ growth prospects, volatility in financial and commodity markets, and geopolitical risks". "In this environment, euro area inflation dynamics also continue to be weaker than expected”. As a result, EUR crosses dropped sharply during the press conference as Draghi made clear that a reconsideration of the ECB’s monetary stance will be necessary at the next meeting in March. EUR/USD fell one figure and a half, down to 1.0778, while EUR/JPY plummeted to a 9-month low at 126.17.

Nevertheless, we have the feeling that the market took Draghi’s comments with a grain of salt this time, in an attempt to avoid repeating the mistakes of December 3. As a result, EUR crosses returned to their pre-ECB meeting level; however, the bias is now on the downside for the single currency, especially against the USD and the JPY. In addition, we wouldn’t be surprise to see a reversal of commodity currencies versus the euro once pressure on commodity prices has eases and financial markets stabilised. EUR/AUD has already dropped 2.40% since the press conference, a support can be found at 1.5341 (low from January 13) but once broken, the road will be wide open toward the next one lying at around 1.50.

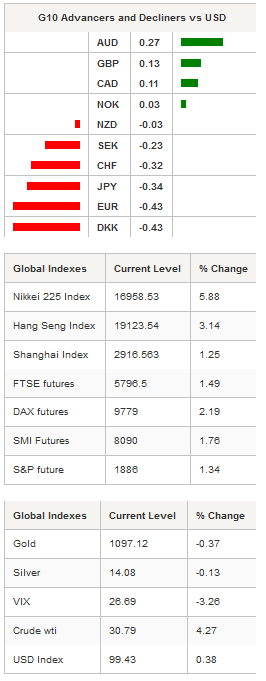

In Asia, regional equity indices are wearing green this morning as a wind of optimism is blowing across financial markets. Obviously, today’s recovery in crude oil prices is undoubtedly pushing equities higher. Futures on the West Texas Intermediate were up 4.27%, while ones on the Brent climbed 5.0%, both back above $30 a barrel. In Japan, the Nikkei 225 gained 5.88%, while in Hong Kong, the Hang Seng was up 3.14%. In mainland China, the rally is less pronounced with the Shanghai and Shenzhen Composite rising 1.25% and 1.46% respectively. In Europe, futures are pointing to a higher open with the FTSE 250 up 1.49%, the DAX +2.19%, the CAC 40 +1.76% and the SMI +1.76%.

In the FX market, the USD is broadly in demand this morning as safe-haven currencies and the euro go south. As explained above, Mario Draghi’s dovishness should have a limited effect on the single currency as traders want to avoid over-pricing a potential extension/increase of the QE. Most EUR crosses will therefore remain in a volatile range, with asymmetrical risk to the downside, until D-day on March 10.

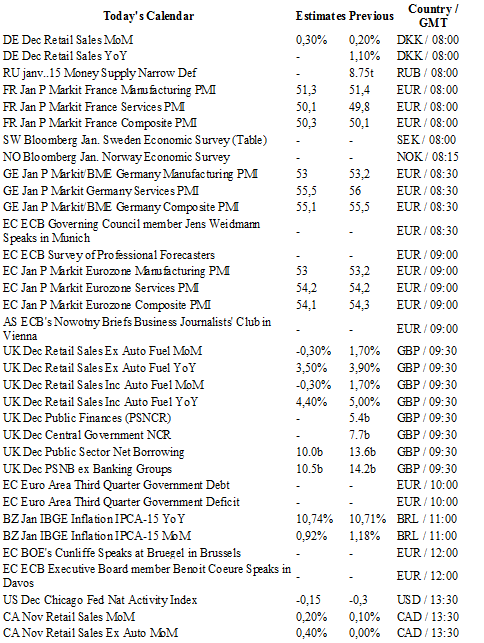

Today traders will be watching Markit manufacturing PMI from France, Germany the Eurozone and the US; retail sales from Germany, Canada and the UK; mid-month inflation report from Brazil; CPI report from Canada; existing home sales and Leading index from the US.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0833

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5242

R 1: 1.4969

CURRENT: 1.4237

S 1: 1.3657

S 2: 1.3503

USD/JPY

R 2: 125.86

R 1: 123.76

CURRENT: 118.07

S 1: 115.57

S 2: 105.23

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 1.0101

S 1: 0.9786

S 2: 0.9476