Market Brief

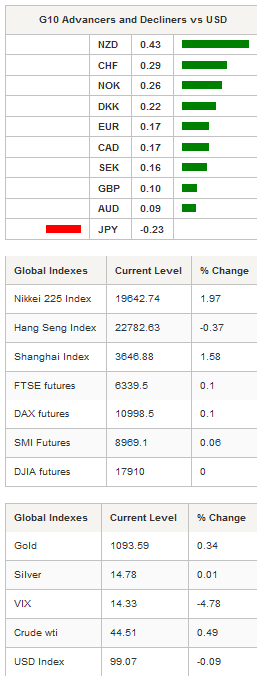

USD domination in the G10, after Friday's strong US payroll report, faded slightly in the Asian session. However, the USD was marginally higher against EM FX Asia as US 10-year yields rose to 2.332%. EM Asia bond yields moved higher across the board as expectations for Fed lift-off in December has forced investors selling. Friday's surprise US October non-farm payroll data, which printed at 271k and strong 2.5% y/y wage increase, reflects a healthy and broad-based economic expansion. Rates market are now pricing in 68% probability of a 25bp Fed rate hike in December. Asia regional equities indices were mixed as the Nikkei and Shanghai composite rose 1.96% and 1.52% respectively while the Hang Seng fell -0.14%. Friday's impressive rally in USD/JPY supported Nikkei buying today. In a win for Japanese Prime Minister Shinzo Abe, regular wages increased 0.4% in September while labor cash earnings, which include overtime and special payments, increased by 0.6%y/y against 0.5% expected. This was the seventh consecutive rise as Abe has been pressing business to raise salaries (part of third arrow). From Australia, ANZ job advertisements rose 0.4%m/m in October, slowing significantly from downwardly revised 3.8% increase in September. Finally in India, National Democratic Alliance (NDA), led by Prime Minister Modi faced a setback as state elections in Bihar saw the party taken only 58 of 243 seats.

Mildly hawkish comments from President of the Federal Reserve Bank of San Francisco John Williams indicates that the USD bullishness should continue. Feds Williams indicated that at least one measure of full employment has been reached. Walliams said on Saturday, “on one hand, the US economy continues to grow and is closing in on full employment. On the other, in large part due to developments abroad, inflation has remained lower than we’d like.” CFTC IMM data indicates that Speculative position saw increase in USD longs to the highest level since mid-August (EUR net shorts rose and GBP longs were cut).

In China, data showed that monthly trade balance widened to $61.6bn, the highest level on record. October exports contracted -6.9% y/y against -3.2% expected. Imports were also weaker, dropping -18.8% y/y against -15.2% expected. In addition, the persistently weak commodity prices continued to take their toll, as commodity imports contributed 8.1% to the whole -18.8% fall. The weak commodity imports indicates that Australia hopes of renewed appetite would support growth looks premature. AUD/USD recovery rally to 0.7066 has already run into significant supply and likely retests intraday lows at 0.7017. The current backdrop keeps us negative on commodity currencies. Elsewhere, China foreign reserves unexpectedly improved to $3525.5bn in October from $3514.1bn in September. While no clarification came from the PBoC, it's likely that the rise was due to valuations adjustments.

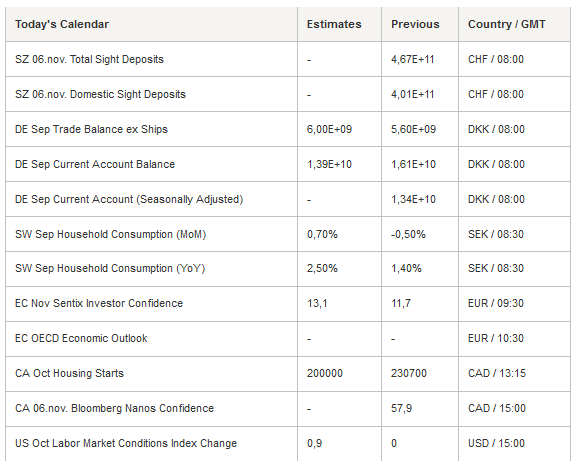

Today’s light economic calendar will see ECB Yves Mersch speaks, Boston Fed President Rosengren speaks and Mexico CPI.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1079

CURRENT: 1.0883

S 1: 1.0809

S 2: 1.0458

GBP/USD

R 2: 1.5659

R 1: 1.5508

CURRENT: 1.5175

S 1: 1.5108

S 2: 1.5089

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 121.86

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.0240

R 1: 1.0129

CURRENT: 0.9948

S 1: 0.9739

S 2: 0.9476