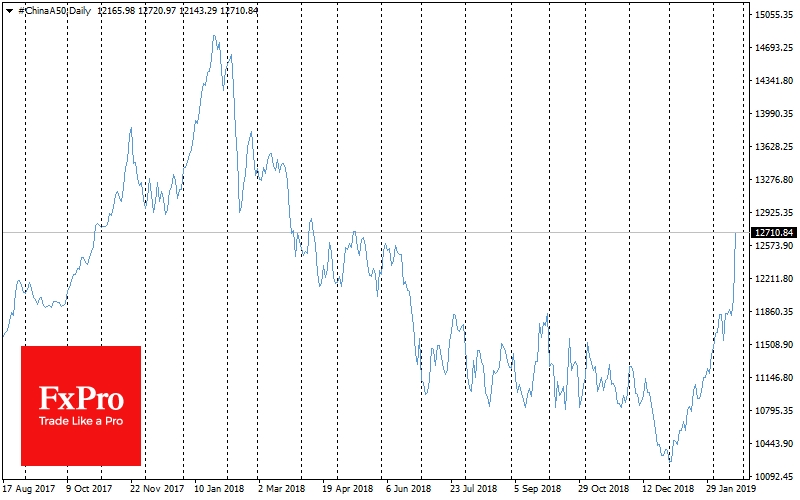

Rally In China

China's blue-chip index jumped more than 6% on Monday morning on news that Trump would postpone of the tariff’s introduction. The U.S. President at the weekend noted "significant progress" in trade negotiations, announcing an intention not to raise tariffs after March 1, deescalating market tensions about the deadline.

Chinese markets jumped up on the news, rising to the highest levels since June last year. The yuan strengthened against the dollar to its highest level since July 2018. Thus, the Chinese markets returned to the levels where they were before the news of the intention to introduce 25% tariffs.

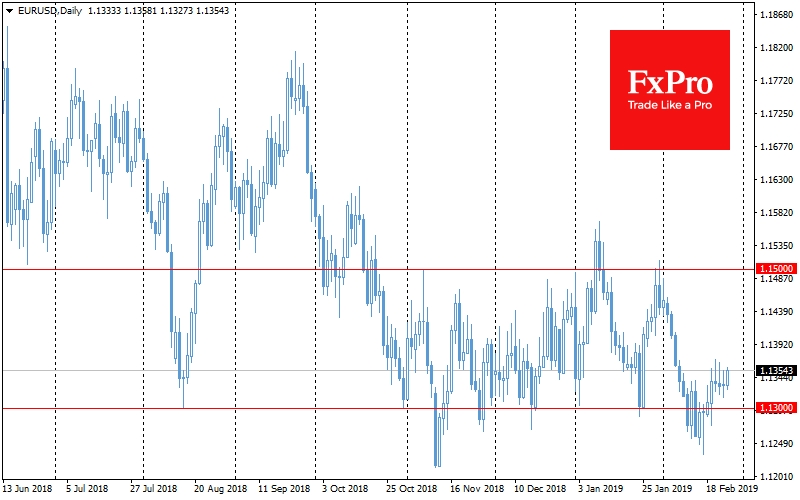

Not To The Benefit Of U.S. Stocks And Dollar

U.S. indices futures show a more restrained dynamics, adding 0.1% after rising by 0.8% on Friday. The S&P 500 and Dow Jones returned to the highs of December last year.

These stock markets sentiments can cause moderate pressure on the dollar, reducing the demand for it as a defensive asset in the short term. The last few weeks, after positive feedback on the negotiations, the dollar has been falling from local highs. This trend development can reduce the currency by another 0.7% -0.8%, returning the dollar index to the 200-day moving average and to the support line passing through local lows since September last year. This dynamic opens up possibilities for the EUR/USD return to the area above 1.1450 and the next testing of the 1.15 mark.

Real Progress?

Nevertheless, it is necessary to be wary of this positive news about the negotiations.

In our opinion, although President Trump is publicly pleased with the trade negotiations progress, he understands that by the end of this week, the parties are unlikely to be able to overcome their differences. The postponement of the deadline may be a sign of understanding that the final chord in the negotiations can't happen in the near future. At the moment, the markets have excluded from their expectations the most negative scenario, when Trump decided not to complicate the situation.

This decision was timely, as the latest data from the United States showed a significant growth rate cooling, which caused a negative market reaction. The risks around trade wars are now softened, leaving the markets one on one with domestic economic data, among which one should pay attention to estimates of GDP and consumer spending this week.