Dollar strengthens on strong data

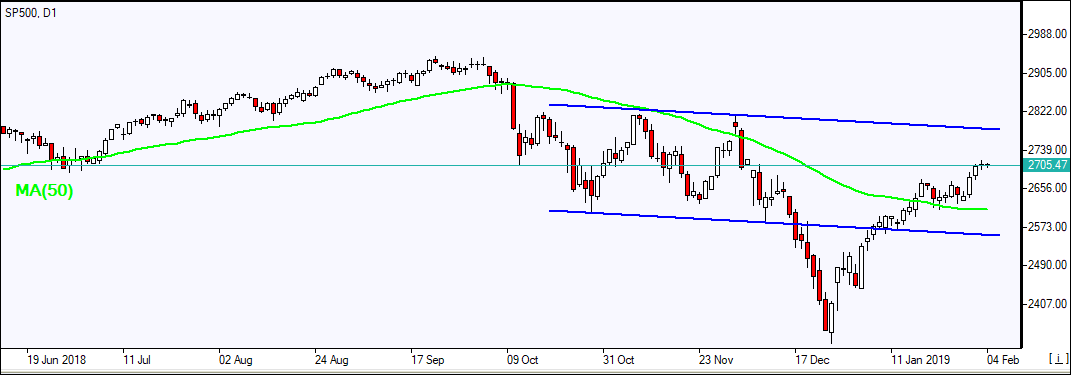

US stock market extended gains on Friday as the US economy created above-expected 304,000 new jobs in January. S&P 500 advanced 0.1% to 2706.53, closing 1.6% higher for the week. Dow Jones industrial rose 0.3% to 25063.89. The Nasdaq however lost 0.3% to 7263.87 weighed by Amazon’s 5.4% drop on weak earnings outlook. The dollar strengthening continued as ISM manufacturing index’s final reading for January came in at above expected 56.6. The live dollar index data show the ICE (NYSE:ICE) US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, inched up less than 0.1% to 95.55 and is higher currently. Futures on US stock indexes point to mixed openings today.

FTSE 100 still paces European indices gains

European stocks finished mostly higher on Friday. The EUR/USD turned higher while GBP/USD slid with both reversing currently. The Stoxx Europe 600 Index gained 0.3%. The DAX 30 added 0.7% to 11180.66. France’s CAC 40 gained 0.5% and UK’s FTSE 100 rose 0.7% to 7020.22.

Australian stocks lead Asian indices gains

Asian stock indices are mixed today in thin trading as many Asian markets head into Lunar New Year holidays.Nikkei rose 0.46% to 20883.77 with yen continuing its slide against the dollar. Mainland China markets are closed for the week for Lunar New Year celebrations, Hong Kong’s Hang Seng Index is 0.02% lower. Australia’s All Ordinaries Index rose 0.48% with the Australian dollar extending losses against the greenback as homebuilding permits fell sharply for the second month in a row in December.

Brent up

Brent futures prices are higher today supported by OPEC cuts and sanctions on Venezuela. Prices ended higher on Friday after Baker Hughes reported active oil rig count fell by 15 to 847 last week: Brent for April settlement jumped 3.1% to close at $62.75 a barrel Friday, gaining 1.8% for the week.