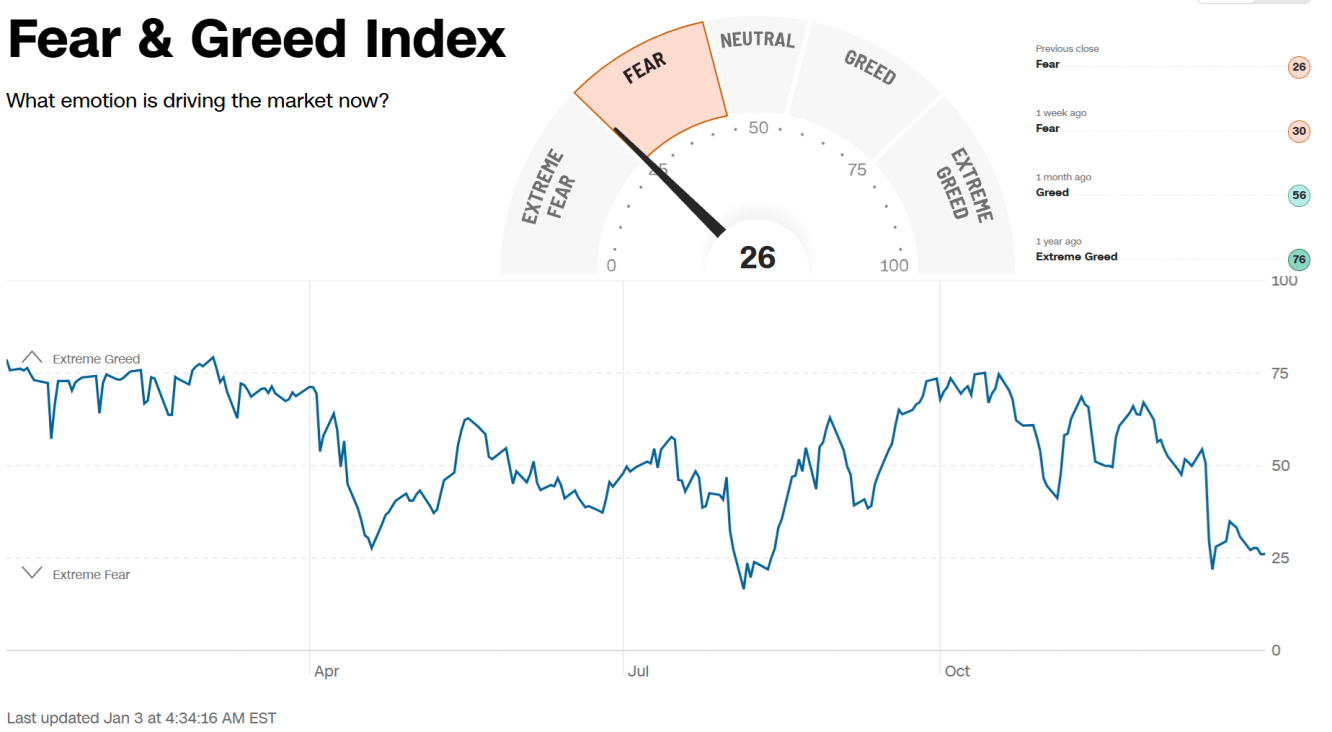

The US stock market is starting the year in a state of fear bordering on extreme fear - the opposite of a year ago when the market was balanced between 'greed' and 'extreme greed'. That's the conclusion we can draw from the CNN Business Sentiment Index.

A significant pressure on markets in December was the reversal in Fed rhetoric, with Powell's speeches and official FOMC comments shifting towards fewer rate cuts. As a result, the probability of a rate cut at the end of January has fallen to around 10%. Markets are now pricing in a 50-point rate cut to the 3.75-4.00% range as the central scenario for year-end.

The Fed's hawkish tone is the main reason the S&P 500 is 3.5% below its December peak. While the low levels of the fear and greed index attracted buyers last year, we remain cautious about the markets.

Stock market dynamics in the first few days are often seen as spoilers for the whole year (the famous first five-day rule). As a result, the start of the year carries a high emotional charge that can highly influence traders' behaviour.

The short-term technical picture is also worrying as the S&P 500 failed in its attempt to break above its 50-day moving average in the first trading session on the 2nd. The Nasdaq 100 failed to break above its own, and the Dow Jones fell back to its December lows, almost 6% off its historical highs.

With this start to the year, we are likely to see a test of the 200-day moving average soon, which defines the long-term trend. For the S&P 500, it is now at 5575. In August, the market's decline was halted as it approached it, and then it was helped by the Fed's reversal of easing - the opposite of what we are seeing now.

However, the situation could be corrected this time around if we see an impressive growth reversal in the next few days. This would restore confidence in the bullish outlook for the new year despite a less dovish Fed and fading economic growth momentum.

The FxPro Analyst Team