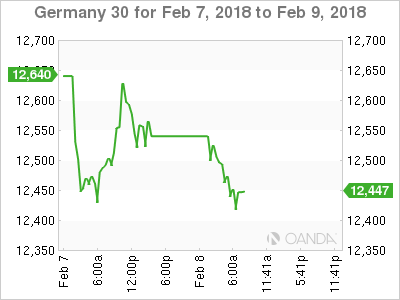

The DAX index has posted sharp losses in the Thursday session. Currently, the index is trading at 12,453.53, down 1.09% on the day. On the release front, Germany’s trade surplus narrowed to EUR 21.4 billion, just shy of the estimate of EUR 21.5 billion.

Global stock markets have shown strong volatility this week, and the DAX continues to see red. February has been awful, with the DAX shedding 5.9 percent. The week started with the Dow Jones posting its biggest one-day loss, and losses in US stock markets have pushed European markets lower. Earlier this week, the DAX dropped to its lowest level since early September. The catalyst for the current turbulence is investor concern that inflation could rise in the US, which in turn would trigger additional rate hikes from the Federal Reserve. This would make dollar-denominated assets more attractive and weigh on the European stock markets.

After months of political uncertainty, Germany appears on the verge of forming a new government. On Wednesday, the socialist SDP and Angela Merkel’s conservatives announced that they had finalized a coalition agreement. In the last government, the SDP was the junior partner of the conservatives, but this time around the SDP has extracted major concessions from Merkel, notably control of the powerful finance ministry. This will likely mark a shift in Germany’s eurozone policy, which had been marked by a conservative stance under former finance minister Wolfgang Schaeuble. The weaker members of the eurozone, such as Greece, will likely find a more sympathetic ear for financial help from the SDP than they did from Schaeuble. The coalition agreement still requires the consent of a majority of the 464,000 members of the SDP, but is expected to pass this final hurdle.

Economic Calendar

Thursday (February 8)

- 2:00 German Trade Balance. Estimate 21.5B. Actual 21.4B

- 3:45 German Buba President Weidmann Speaks

- 4:00 ECB Economic Bulletin

*All release times are GMT

*Key events are in bold

DAX, Thursday, February 8 at 6:15 EDT

Open: 12,490.50 High: 12,500.23 Low: 12,412.00 Close: 12,453.53