President Donald Trump will deliver his first State of the Union Address at 21:00 EST (02:00 GMT Wednesday 31st January) tonight from Capitol Hill. Any reference made to the economy, trade or the US dollar could result in volatility in markets. The consensus deems it likely that the speech will have a direct impact on the dollar, as it includes a budget message and an economic report of the nation.

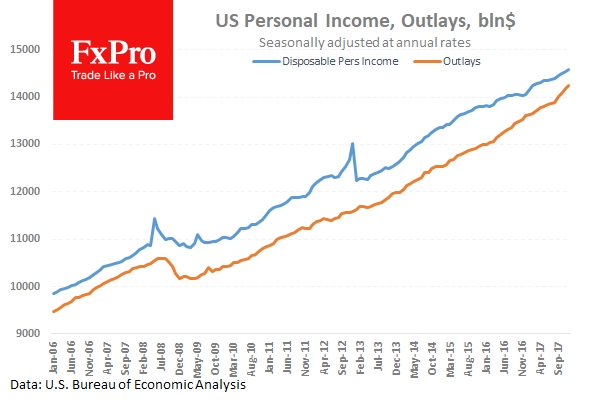

US Personal Consumption Expenditures – Price Index (YoY) (Dec) was 1.7% v an expected 1.9%, from 1.8% previously. Core Personal Consumption Expenditures – Price Index (MoM) (Dec) came in at 0.2%, from 0.1% previously. Personal Consumption Expenditures – Price Index (MoM) (Dec) was 0.1% v an expected 0.0%, from 0.2% previously. Personal Income (MoM) (Dec) was 0.4% v an expected 0.3%, from 0.3% previously. Personal Spending (Dec) was as expected at 0.4%, from 0.6% previously, which was revised up to 0.8%. Core Personal Consumption Expenditures – Price Index (YoY) (Dec) was as expected, remaining unchanged at 1.5%. USD/CAD moved higher from 1.23331 to 1.23453 as a result of this data.

US Dallas Fed Manufacturing Business Index (Jan) was 33.4 against an expected number of 14.6, from 29.7 previously. EUR/USD traded down from 1.23739 to a low of 1.23367 following the data release.

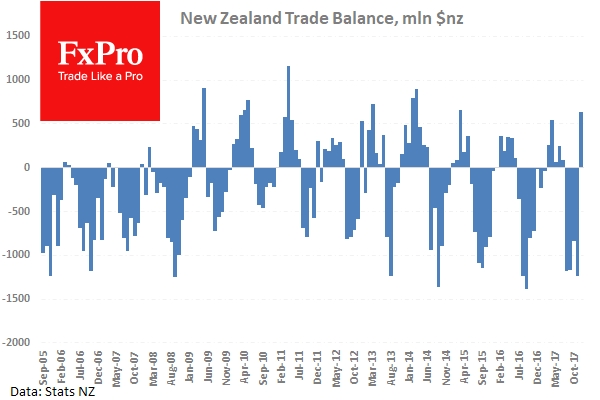

New Zealand Trade Balance (MoM) (Dec) numbers were released at $640M against an expected $-125M. The prior number was $-1,193M but was revised down to $-1,233M. Imports (Dec) were $4.91B from $5.82B previously, which was revised up to $5.84B. Trade Balance (YoY) (Dec) was $-2.840B from $-3.444B previously, which was revised down to $-3.480B. Exports (Dec) were $5.55B from $4.63B previously, which was revised down to $4.61B. NZD/USD moved higher from 0.73242 to 0.73357.

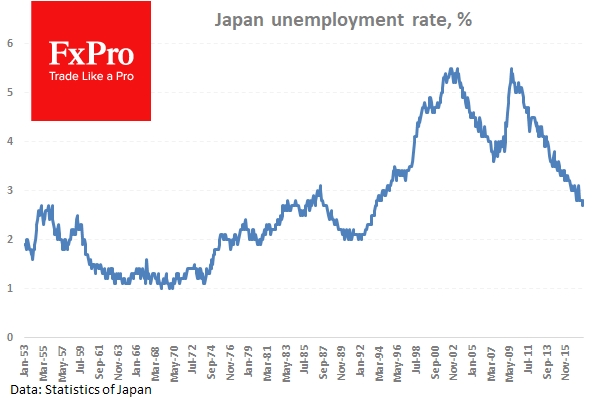

Japanese Jobs/Applications Ratio (Dec) was 1.59 v an expected 1.57, from 1.56 previously. Unemployment Rate (Dec) was 2.8% v an expected 2.7%, from 2.7% previously. Overall Household Spending (YoY) (Dec) was -0.1% against an expected 1.7%, from 1.7% prior. Large Retailers' Sales (Dec) was 1.1% against an expected -0.6%, from 1.4% prior. Retail Trade s.a. (MoM) (Dec) was 0.9% against an expected 0.1%, from 1.9% prior, which was revised down to 1.8%. Retail Trade (YoY) (Dec) was 3.6% against an expected 1.8%, from 2.2% previously, which has been revised down to 2.1%.

EUR/USD is down -0.24% overnight, trading around 1.23552.

USD/JPY is down -0.17% in early trading at around 108.773.

GBP/USD is down 0.38% to trade around 1.40205.

USD/CAD is up 0.21%, trading around 1.23636.

Gold is down -0.38% in early trading at around $1,334.80.

WTI is down -1.02% this morning, trading around $64.82.

Major data releases for today:

At 09:30 GMT, UK Consumer Credit (Dec) is expected to be £1.3B from £1.4B previously. Mortgage Approvals (Dec) is expected at 63.500K from 65.139K prior. GBP crosses could be affected by this data.

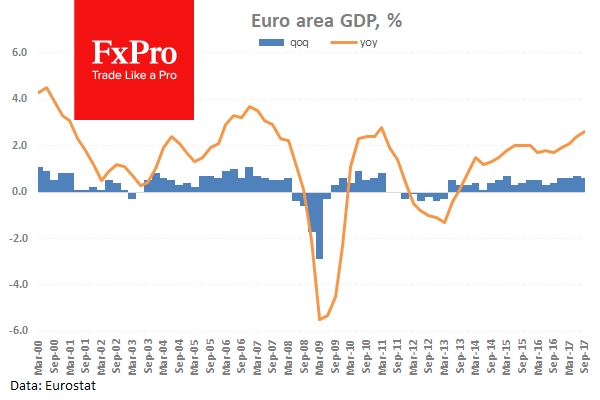

At 10:00 GMT, eurozone Gross Domestic Product s.a. (QoQ) (Q4) is expected to be unchanged at 0.6%. Gross Domestic Product s.a. (YoY) (Q4) is expected to be 2.7% from 2.6% previously. Services Sentiment (Jan) is expected to be 18.6 from 18.4 previously. Consumer Confidence (Jan) is expected to be unchanged at 1.3. Industrial Confidence (Jan) is expected to be 9.0 from 9.1 previously. Economic Sentiment Indicator (Jan) is expected to be 116.3 from 116.0 previously. Business Climate (Jan) is expected to come in at 1.69 from 1.66 prior. EUR pairs may be moved by this release, especially the GDP data.

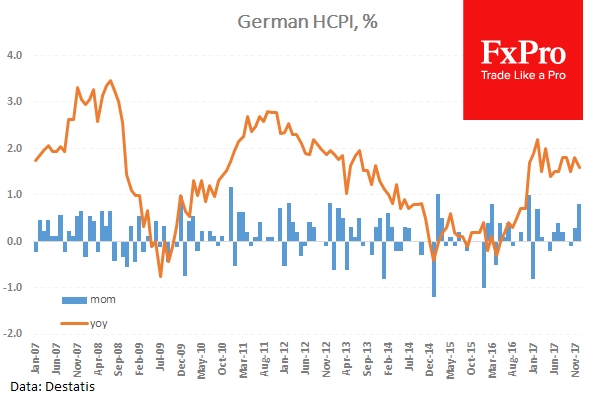

At 13:00 GMT, German Harmonised Index of Consumer Prices (YoY) (Jan) is expected to come in unchanged at 1.6%.

At 14:00 GMT, US S&P/Case-Shiller Home Price Indices (YoY) (Nov) is expected to be unchanged at 6.4%.

At 15:30 GMT, Bank of England Governor Mark Carney will testify before the House of Lords Economic Affairs Committee in London. GBP crosses may experience volatility during this time.

At 02:00 GMT, Wednesday 31st January, we will see the US State of the Union address by President Trump.