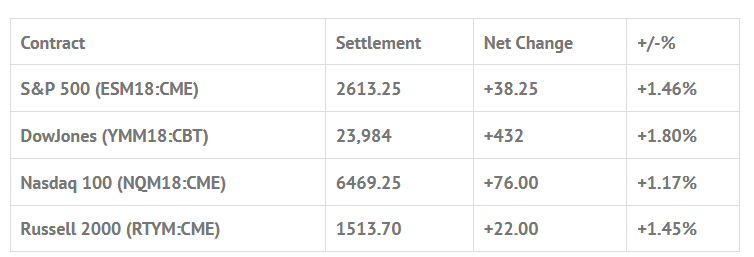

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 8 out of 11 markets closed lower: Shanghai Comp -0.15%, Hang Seng -2.19%, Nikkei +0.13%

- In Europe 12 out of 12 markets are trading lower: CAC -0.93%, DAX -1.37%, FTSE -0.61%

- Fair Value: S&P -0.73, NASDAQ +10.98, Dow -33.51

- Total Volume: 2.1mil ESM, and 1.3k SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, ADP Employment Report 8:15 AM ET, James Bullard Speaks 9:45 AM ET, PMI Services Index 9:45 AM ET, Factory Orders 10:00 AM ET, ISM Non-Mfg Index 10:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, and Loretta Mester Speaks at 11:00 AM ET.

S&P 500 Futures: #ES, #YM, #NQ Breath As FAANG Takes A Rest Day

After Monday’s big selloff, both Japan and China stocks fell. The Stoxx 600 was down -0.50%, as technology stocks continued to be a drag on markets around the globe. On Globex the S&P 500 futures range was 2577.75 to 2596.00, with 245,000 contracts traded.

The first print in the S&P 500 futures off Tuesdays 8:30 CT open was 2593.00. From there, the ES pulled back down to 2587.75, and then rallied up to 2597.50 at 9:49, before selling off down its early low at 2573.50. After the selloff, the futures rallied all the way up to 2606.25, a 32.5 handle rally. The ES went on to make a series of lower highs, and then sold back off down to 2584.00. It then made a few higher lows, and traded back up to 2599.50 going into 12:30 CT. Not long after that, the futures got hit by a sell program that pushed the ES back down to 2579.50 area. Total volume at 2:00 was 1.6 million contracts traded.

The next move was a 39.25 handle rally up to 2618.75. After a pullback down to 2606.00, the ES popped up to 2617.50, and then dropped down to 2603.00 as the MiM went to sell $900 million. On the 2:45 cash imbalance reveal, the ES traded 2607.75, then traded 2610.50 on the 3:00 cash close, and went on to settle at 2613.50 on the 3:15 futures close, up +30.75 handle or +1.19%.

In the end, I am not sure what caused the big late day rally. What I do know is, the FAANG stocks took a breather. Facebook (NASDAQ:FB) closed up $0.52 cents, or +0.34%, Apple (NASDAQ:AAPL) closed up $1.68, or +1.1%, Amazon (NASDAQ:AMZN) closed up $21.40, or +1.56%, Netflix (NASDAQ:NFLX) closed up $3.93, or +1.41% and Google (NASDAQ:GOOGL) settled up $6.41 or +0.64%, despite another Tweet by President Trump that said, “I am right about Amazon costing the United States Post Office massive amounts of money for being their Delivery Boy. Amazon should pay these costs (plus) and not have them bourne by the American Taxpayer. Many billions of dollars. P.O. leaders don’t have a clue (or do they?)!”

Trump hit the Twitter waves again this morning saying, “We are not in a trade war with China, that war was lost many years ago by the foolish, or incompetent, people who represented the U.S. Now we have a Trade Deficit of $500 Billion a year, with Intellectual Property Theft of another $300 Billion. We cannot let this continue!”

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.