During the Friday session, there is almost nothing that we think is going to move the markets. There is Producer Price Index numbers coming out of the United States, but beyond that, we think that the day should be fairly quiet. Ultimately though, that should have an effect on the US start markets only.

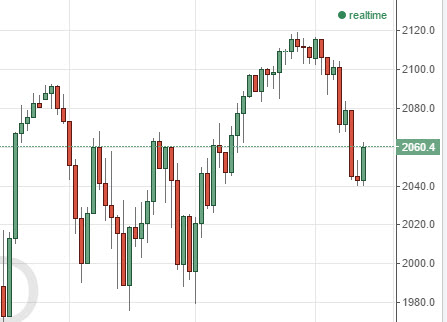

With that being said, the S&P 500 broke out to the upside during the session on Thursday, clearing the top of the shooting star from the Wednesday session. Because of this, it appears that the S&P 500 is going to continue to be very bullish, and therefore we only buy calls in this market. You short-term pullbacks as potential entry point, as the market should then offer value.

The silver markets continue to struggle in general, and we believe that they are essentially going to stay between the $15.00 level, and the $15.50 level, as the markets really don’t know what to do. This is an area where we could see an extensive amount of support, so ultimately, we believe that the buyers will come out on top.

The DAX pull back slightly during the session on Thursday, but with the way it’s been going lately, a little bit of a pullback all the way to the €11,600 level would be considered healthy. Look for short-term pullbacks as potential buying opportunities in a very strong marketplace, and what we believe will be the best performing stock index in the European Union.