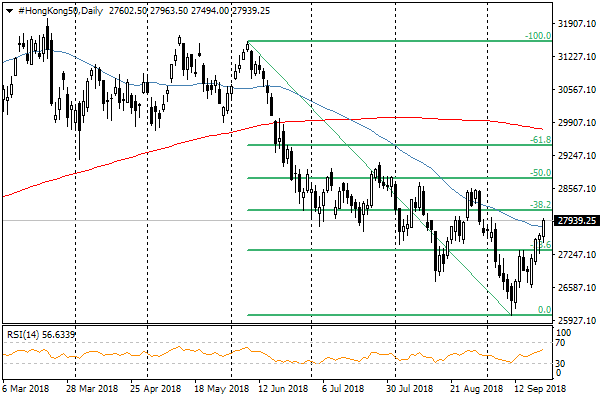

Financial markets enjoy a risk-on sentiment. S&P 500 Index has updated its historical highs, adding 0.8% on Thursday. On Friday morning, the futures on the index maintain a positive dynamic. Hong Kong’s Hang Seng adds 0.5% this morning, restoring losses of the first half of September and touching the 50-day average. The fixation above this mark on week closing could become an additional positive factor.

To a large extent, the weakening of the American currency has supported the markets. The Dollar Index lost on Thursday 0.7%, becoming one of the key drivers of market growth. An important milestone in the weakening of the US currency was the overcoming of important support levels. The EUR/USD pair growth intensified after overcoming the resistance area at 1.1700-1.1730. At the moment, the pair is trading at 1.1790, near three months highs.

The recovery of the demand for risks causes the weakening of the yen. EUR/JPY went up to the highest levels in five months. USD/JPY rose to 112.80, despite the global dollar’s decline.

At the same time, it is necessary to remain cautious about further prospects of the market growth. Asian indices mostly show a rebound after an extreme oversold earlier this month. The S&P 500 Index is approaching the overbought levels.

The main formal reason behind the current rally, less stringent tariffs on imports from the US and China than it was expected, seems to be a very unreliable cause of growth. There is still no meaningful data that reflects the real impact on the economy. This data will be received only in the following weeks and months.

Alexander Kuptsikevich, the FxPro Analyst