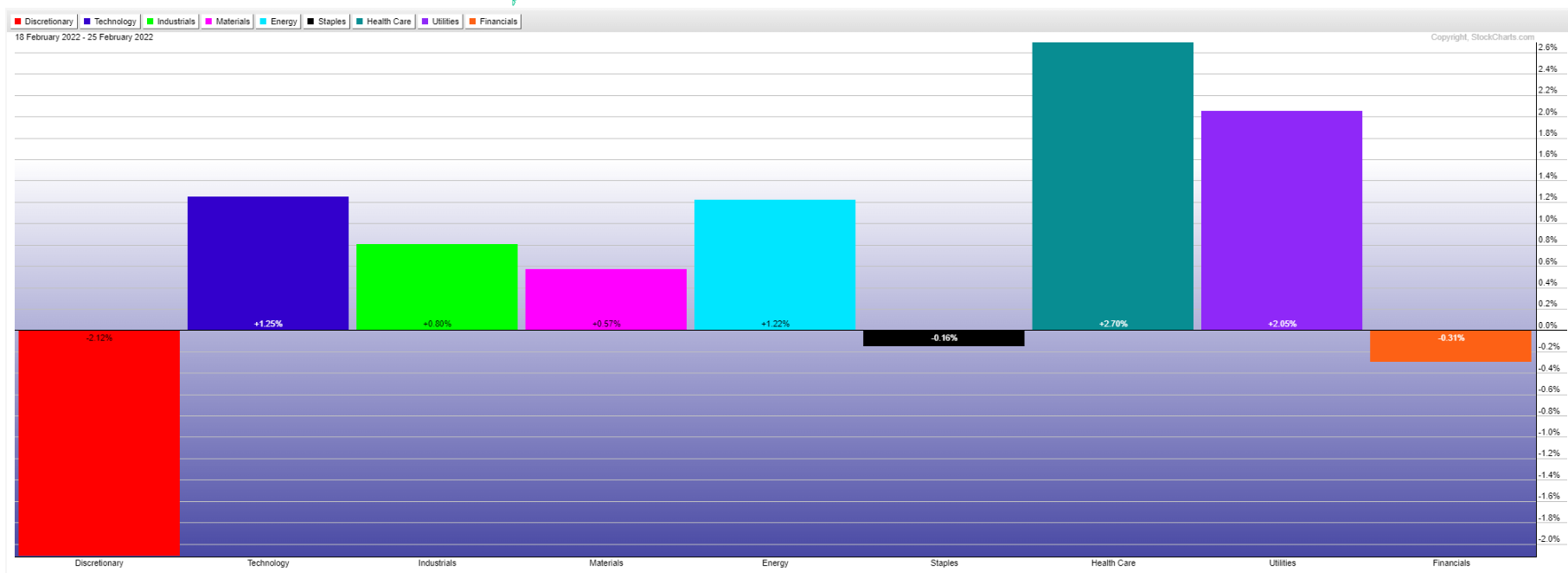

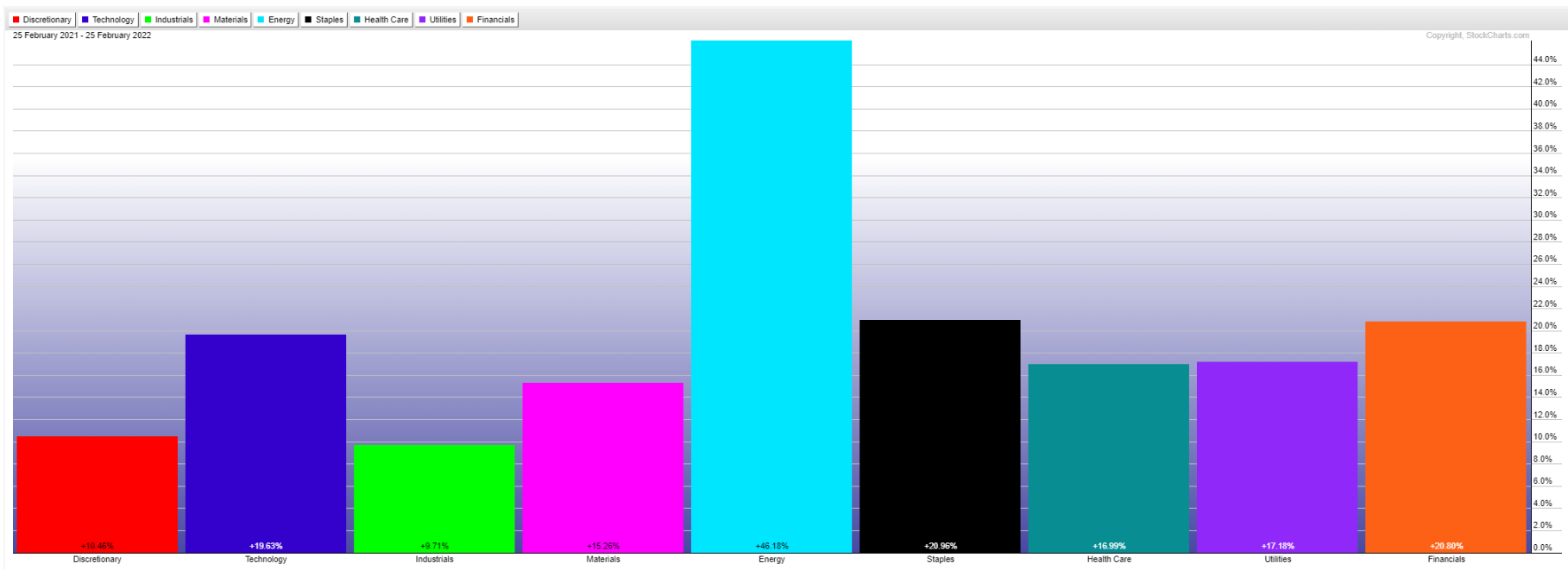

The following graphs of the U.S. Major Sectors show that, for the most part, investing has remained defensive for a one-year period, with Energy taking the leading role.

My latest post of late February 25 on WTI Crude Oil described price targets in certain scenarios.

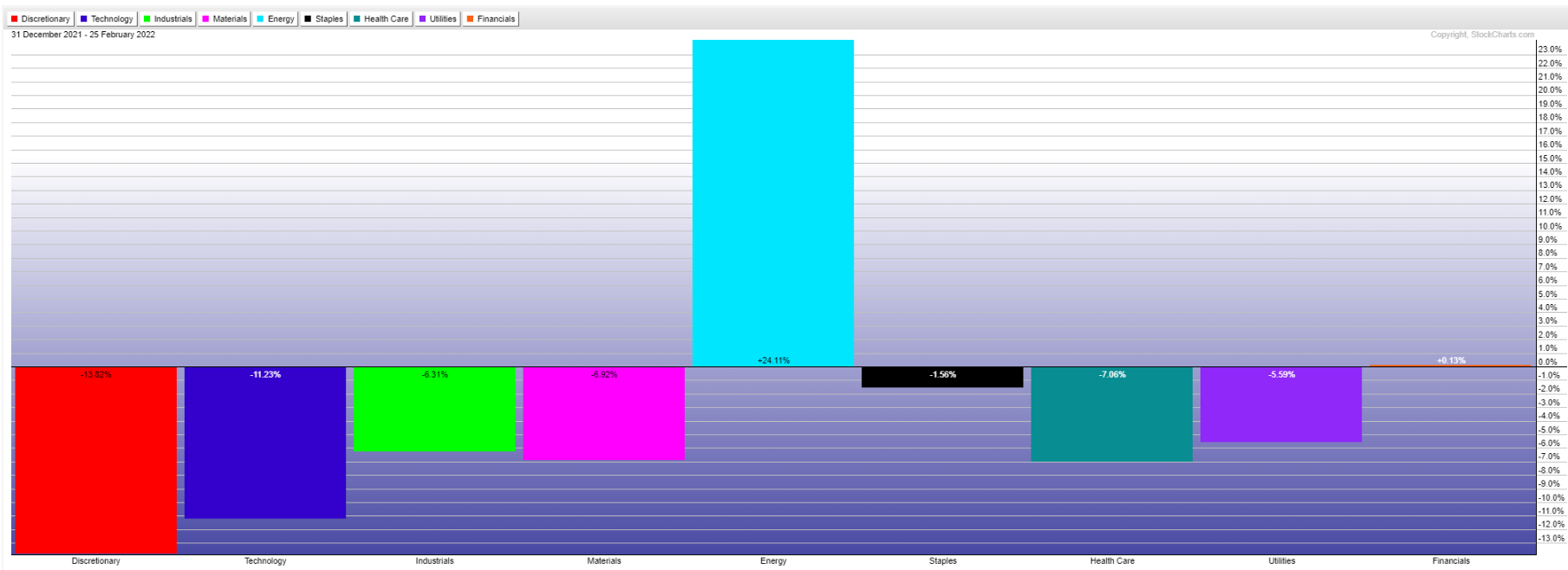

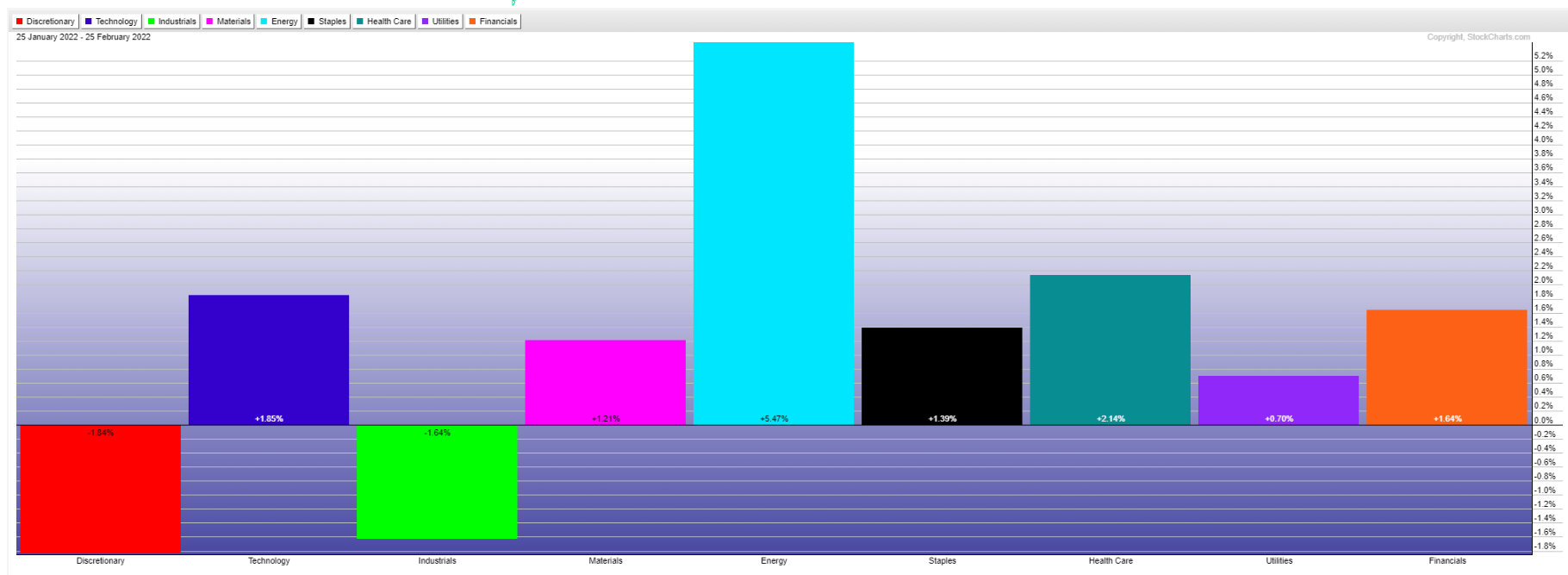

There has been some mild interest in Technology, Industrials, Materials, and Financials during February.

However, until we see sustained major buying flow into the Discretionary Sector, I think that any further advance on the S&P 500 Index (SPX) will be sporadic, whippy, tepid, and chaotic (see my post of February 22 and important UPDATE of February 23 for target prices and clues on market direction)...and that markets will remain, primarily, defensive.

We may have to wait until the Fed meets on March 16 to determine what their immediate and longer-term monetary policy will look like on interest rates in order to gauge which Sectors will gain or lose momentum in the short and medium term.

So, keep an eye on which Sectors are gathering strength on weekly graphs until then...and thereafter...as another trend/strength tool (here).

U.S. Major Sectors One Year

U.S. Major Sectors Year-To-Date

U.S. Major Sectors February

U.S. Major Sectors One Week