I last wrote about WTI Crude Oil in my post of Sept. 12, 2021.

I identified price targets of $80.00 and $100.00, provided it broke and held above $70.00.

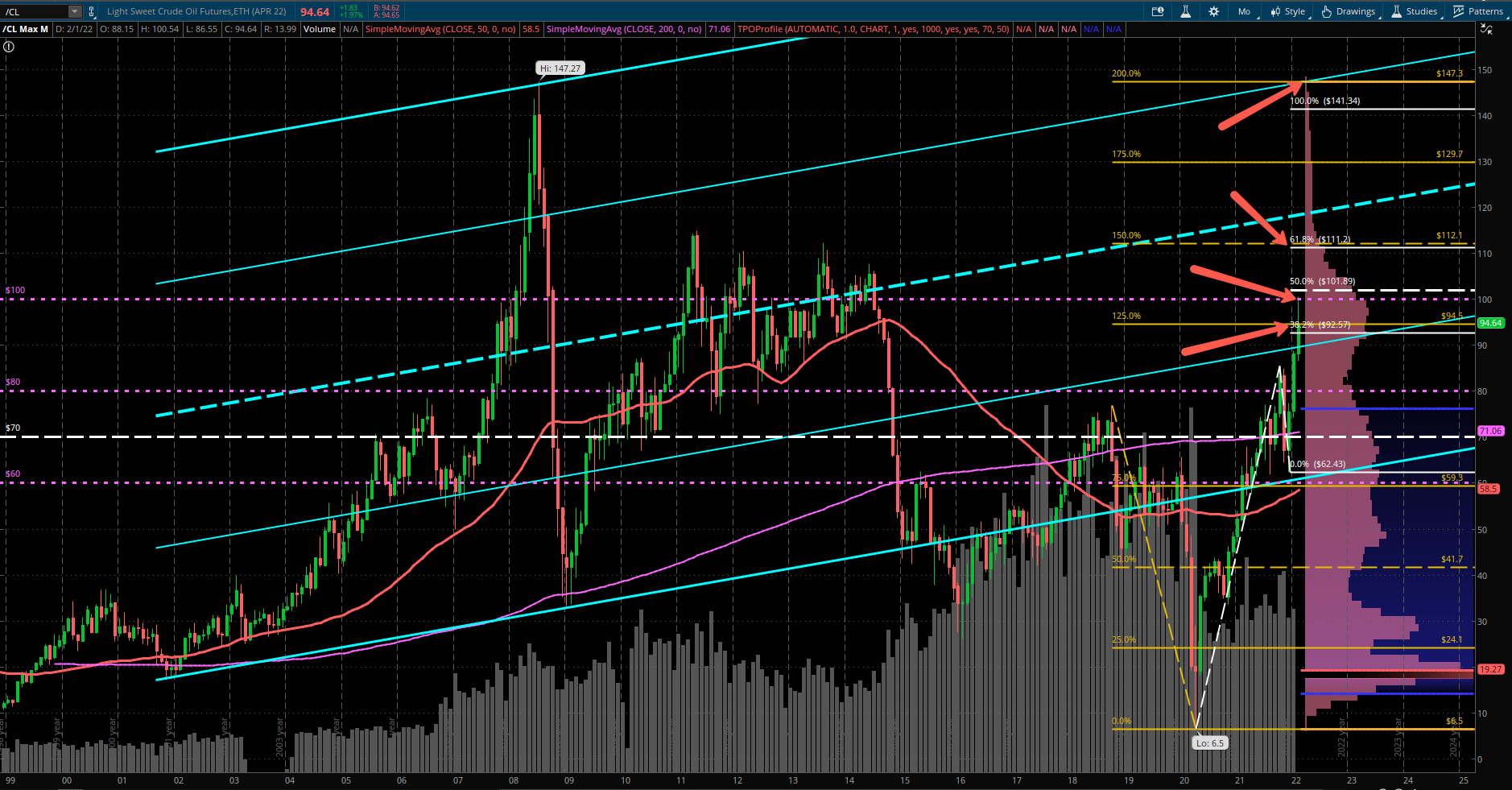

Following Russia's declaration of war and invasion last night of Ukraine, Oil hit $100.54 yesterday, before falling back to close at $94.75...which is around a convergence point (lower red arrow) of a 40% Fibonacci Extension level with a 125% External Quadrant level, and is just above the bottom 1/4 of a long-term rising channel, as shown on the following monthly chart.

There is little price resistance above $100.00, as shown on the pink TPO Profile along the right-hand side of the chart.

Price targets are identified by the other three red arrows, which are also convergence points on the Fibonacci Extension with the External Quadrant. The highest red arrow also happens to converge with the upper 1/4 of the rising channel.

If price can remain above $90.00, it has a good chance of continuing its rally to these three targets, namely, $100.00, then $111.00-$112.00, and then, ultimately, retesting its prior all-time high of $147.27.

Otherwise, a drop and hold below $90.00 could see a retest of $80.00, then $70.00, or lower.

At the moment, the "path of least resistance" is up.