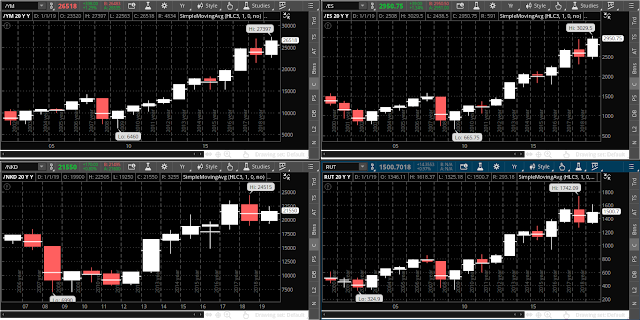

Each candle on the first chartgrid of the /ES, /YM and /NQ Emini Futures Indices and RUT Index represents a period of one year. (Note that I would have shown the /RTY Emini Futures, but it only had 3 years' of data, so I've shown the RUT instead).

The horizontal white line that cuts through each candle is a one-period moving average (H+L+C). Friday's closing price on the current year's candle is above this moving average. They are also above the moving average on both 2018 and 2017 candles.

However, in the case of the RUT, the price is only slightly above the highest moving average on those two candles, so it's important that it holds above the highest at 1476.42 if we're going to see higher prices from here.

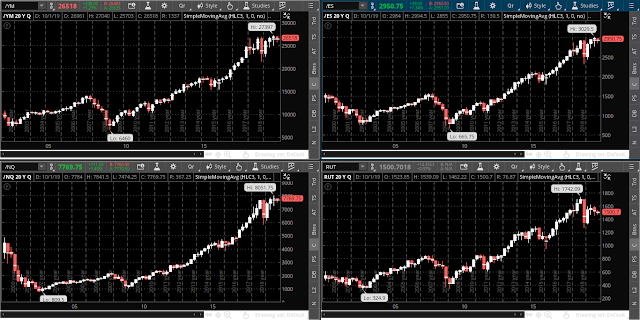

Each candle on the next chartgrid of the /ES, /YM and /NQ Emini Futures Indices and RUT Index represents a period of one quarter.

On a quarterly basis, and looking forward to the end of Q4, this H+L+C moving average for the Q3 candle is as follows:

So, these three support levels for the /YM, /ES, and /NQ will need to hold to confirm a sustainable push for higher levels through to year end from here.

In the case of the RUT, it will have to retake and hold above its resistance level to convince traders to buy with conviction until then.

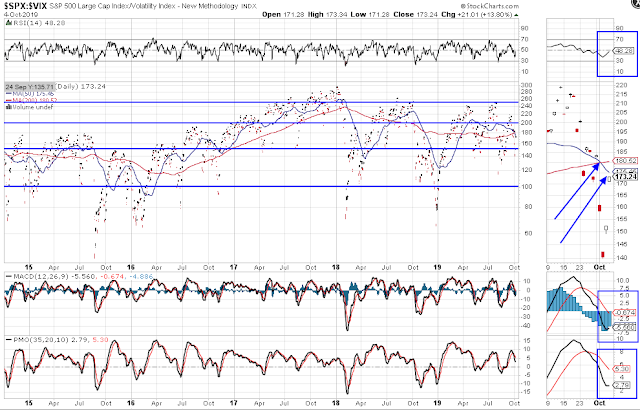

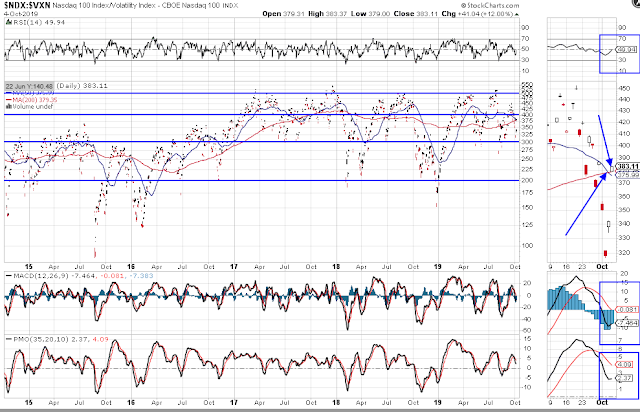

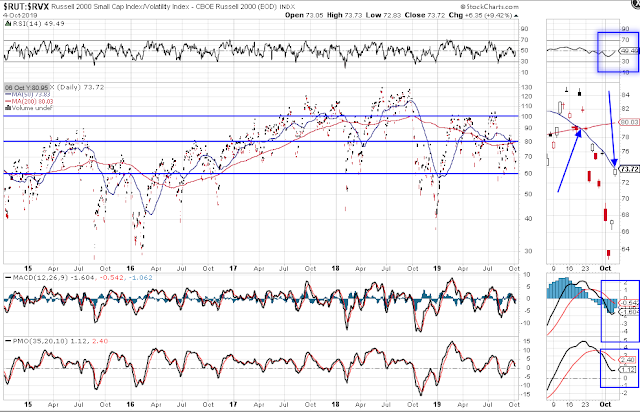

To gauge possible direction and volatility on a shorter daily timeframe, take a look at the following three ratio charts of SPX:VIX, NDX:VXN and RUT/RVX.

SPX:VIX ratio:

NDX:VXN ratio:

RUT:RVX ratio:

To support higher prices from Friday's close, watch for the:

- SPX:VIX and RUT:RVX to pop and hold above the Death Cross levels

Otherwise, we may see traders continue to take some profits to year end in a series of tepid rallies, producing, either, further chop in a sideways direction, or, serious profit taking occur on some kind of negative catalyst...pushing the SPX to a low of 2400, or lower, as I described in this recent post.

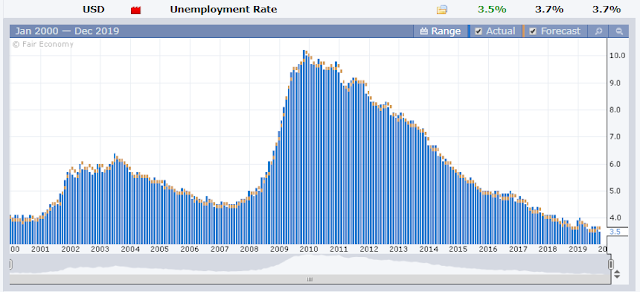

With the U.S. Unemployment Rate now at 3.5% (a low not see seen since 1969), it appears that there may be good reason that a strong economy may hold, at least, until the end of the year...and tip the odds in favor of a higher year-end close for these four U.S. Major Indices.

Bottom Line: Keep an eye on the above three timeframes, price levels (index and ratio) and technical indicators to gauge possible short/medium/long-term direction and volatility for Q4 of 2019.