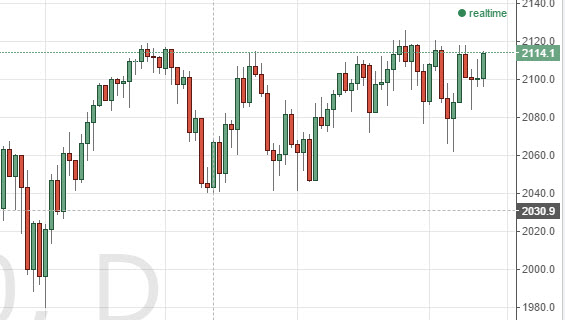

The US releases its Industrial Production numbers today and as a result we believe that the market will be focused on the US stock markets in general. With that being said, the S&P 500 continues to press against the 2120 handle, and as soon as we get above there we feel that the market continues to go much, much higher. We also believe that buying calls on pullbacks will continue to offer profits for traders who are willing to be patient enough for those setups to appear.

Silver markets broke above the 17.50 level during the session on Thursday, and now appear ready to go much higher. We believe that the 18.50 level is going to be the target going forward, and that short-term pullbacks continue to offer buying opportunities as the US dollar itself starts to get weaker, which of course is good for precious metals in general.

The DAX had a fairly positive day, and now we feel that the market will eventually go much higher and that perhaps the selling is over. We look at short-term pullbacks as call buying opportunities as the DAX tends to outperform most of Europe anyway, it is considered to be the “safer” alternative to other stock markets on the continent.