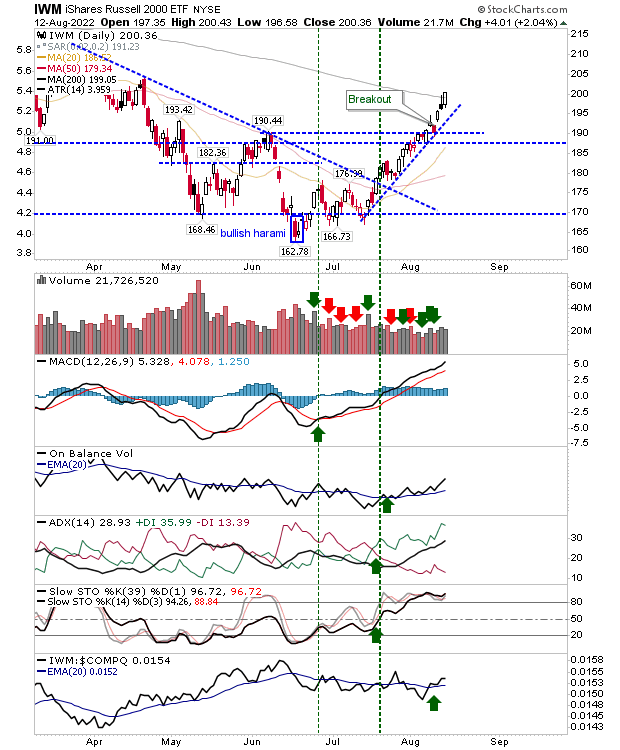

Friday was a solid day for indices with the Russell 2000 (IWM) doing enough to push through its 200-day MA despite Thursday's bearish candlestick.

Small Cap trading volume remained seasonally light, but Friday's buying was enough to retain the uptick in On-Balance-Volume and the relative performance advantage over both the S&P 500 and Nasdaq. Technicals are net positive as a result. Aside from the lack of a meaningful pullback (test of support), this is solid action for the index.

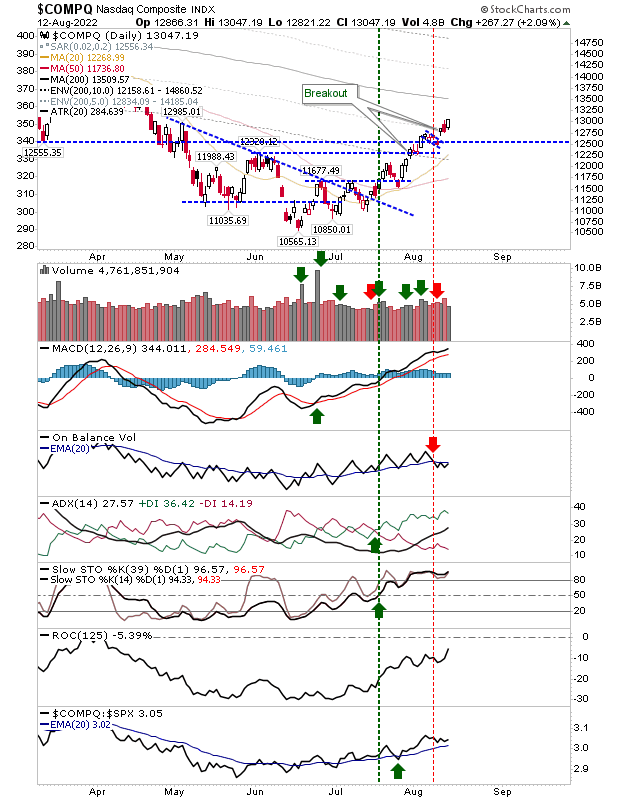

The Nasdaq also closed above the high of Thursday's bearish candlestick, but if there is a concern it's that On-Balance-Volume has been on a 'sell' trigger since the upside breakout from the small 'bull flag'. Something to keep on for this week, although other indicators are positive. The index remains on track to test its 200-day MA, and if it can repeat what happened in the Russell 2000 it won't prove to be a barrier.

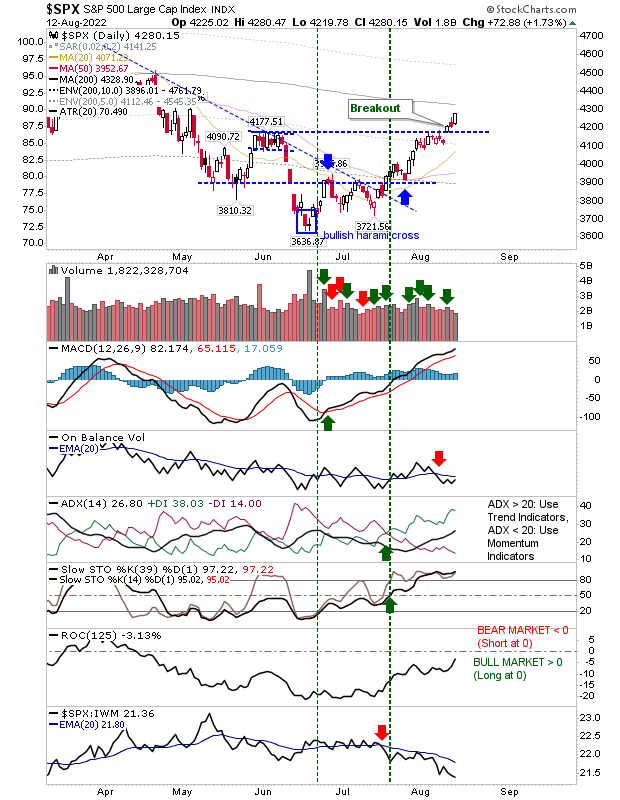

The S&P has been a laggard index given the weak relative underperformance to both the Russell 2000 and Nasdaq. The index is also working off a 'sell' trigger in On-Balance-Volume. If there is a chance for the index to regain its mojo it will be from a break through its 200-day MA. Despite weak On-Balance-Volume, individual buying days for August have skewed more in favor of buyers.

Indices have banked a good deal of wiggle room to protect June lows. Shorts will want to see undercuts of the May/June swing highs, but every day that passes makes the possibility of this happening even less as wannabe-buyers will be more likely to act on this test than shorts.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.