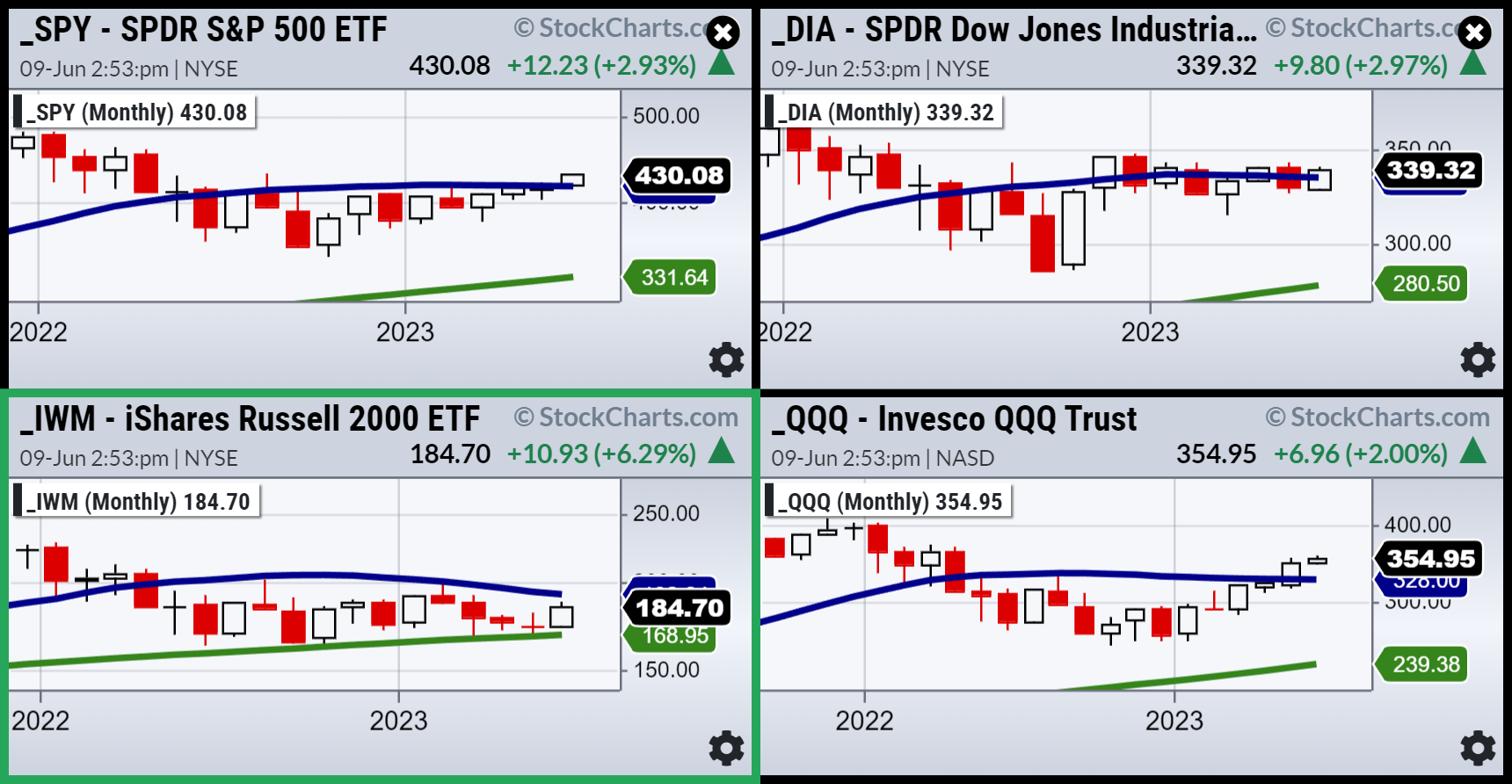

Looking at the monthly charts of the four major indexes, all but the Russell 2000 as we hit mid-June, trade above their 23-month moving average.

Thus far, this is in line with our prediction that by the time IWM hits (if it does hit) 190-200 and the SPY hits 440, the top will be in.

First, the Russell have to clear their HUGE resistance at 1900.

SPY has to take out the August 2022 highs, and NASDAQ, well overbought, has to get above 370.

Right now, with so much economic data coming up, we are finding it best not to be in a bullish or bearish camp. Rather, we like to think like a trader and not get too wedded to a bias.

Thus far, looking at some key ratios, we have stayed on the right side of the market. All signal risk on.

The SPY is doing better than gold and outperforming the long bonds. Junk bonds are doing better than long bonds.

Those ratios made it clear that the tech rally, long in the tooth, would attract retail money into the small caps, value stocks, retail sector, and some basic materials.

The first 5-6 months and this ongoing rally makes alot of sense.

As the market is forward thinking, investors saw the Fed slowing down rate hikes, inflation cooling, earnings better than expected, a mixed yet robust labor market, tech undervalued and perhaps the worst over for economic contraction.

The big question now is what about the next 6 months-what will the market think the forecast is?

Here are the upcoming reports to look forward to this week.

Of course, the biggie is the Fed.

Regardless, we still believe inflation round 2 is coming.

Recent weather threats (from storms to drought), Canadian fires, issues in the Panama Canal and the West Coast potential port strike could easily weaken the dollar and spike the commodities.

Plus, oil-and OPEC, folks are thinking lower oil prices in store, but we know the Saudis want to control supply.

As for the FED-our guess is they will pause for June. And they should.

But even if they raise .25%, can they control supply chain issues and a persistent lack of certain raw materials?

Another feature is that the Treasury is about to buy a trillion dollars of short-term bills, announced this week and then completed on the 12th.

The impact on fixed-income bond ETFs is what we are watching.

The Government needs to raise money and auctions are meant to get competitive pricing from buyers (retail and institutional). However, it all comes down to supply/demand.

ETF Summary

- S&P 500 (SPY) August 2022 high 431.73-and of course 420 now key

- Russell 2000 (IWM) 180-now must hold while still miles from its 23-month MA 193

- Dow (DIA) 23-month MA 337 pivotal support now

- Nasdaq (QQQ) Interesting inside day after yesterday’s drop. Makes 348.18 important for Fri. close

- Regional banks (KRE) 45.50 significant resistance. 44 mild support

- Semiconductors (SMH) Inside here after yesterday’s decline making Wednesday low important

- Transportation (IYT) 233.50 is significant resistance

- Biotechnology (IBB) 121-135 range

- Retail (XRT) 60 now support and 63 resistance