The market's initial reaction to the Federal Reserve statement and the press conference was that it was dovish: the 10-year yield slipped, and the dollar was sold to new lows.

In fact, the two countries that appear to be ahead of the curve among high-income countries, Canada and Norway, saw their currencies rally to new three-year highs. However, Asia and Europe have seen it the other way.

US yields have recovered and helped the dollar. Asia and European equities have shrugged off the nonplussed US response. Besides Japan, where the markets were closed for a local holiday, Asia Pacific equities advanced. South Korea's KOSPI was a notable exception.

In Europe, the Dow Jones STOXX 600 was approaching last week's high record high. US futures were also pointing to a strong opening, helped by a series of strong earnings from tech giants.

The US 10-year yield is near 1.66%. Recall that the yield peaked in late March near 1.77% before falling to around 1.52% this month. The yield has risen about 10 basis points this week. European yields are also firm, and German, French, Dutch, and Italian benchmark yields were recording new three-month highs today.

The greenback was broadly firmer, but only after yesterday's losses were extended in early Asia. The euro initially rose to $1.2150, and the dollar fell to about JPY108.45. On the other hand, emerging market currencies were trading better, led by the Indian rupee, which was rising for a fourth consecutive session amid talk of strong foreign demand for local shares, and the Chinese yuan rose to almost two-month highs. The JP Morgan Emerging Market Currency Index is up a little more than 1% this week.

Gold initially extended its gains but faltered near $1790 as US yields and dollar found traction. Oil was firm, and the June WTI contract was trading near yesterday's high, near $64.40. Recall that last week, and at the start of this week, it found support near $60.60.

Asia Pacific

Japan's markets were closed to celebrate Showa Day (Emperor). Tomorrow it reports unemployment (expected flat at 2.9%) and no change in the job-to-applicant ratio (1.09), Tokyo CPI headline unchanged at -0.2% and core rate may be flat from -0.1%), and March industrial production, which is expected to have slumped by 2% (after a 1.3% decline in February). The Ministry of Finance also reports the weekly portfolio flows and note Japanese investors have stepped up their foreign bond-buying in recent weeks.

Australia confirmed that it is experiencing a positive terms-of-trade shock. Its export price index is rising much faster than its import price index and more so than the market expected. In Q1, export prices jumped 11.2% (Bloomberg median forecast was for 9.0%) after a 5.5% gain in Q4 20. Import prices were also stronger than expected, rising by a marginal 0.2% (Bloomberg median forecast was for a decline of 1.6%) after a 1.0% decline in Q4 20.

Separately, Australia also reported that Chinese tariffs on its wine have a powerful impact. Australian exports of wine to China fell from A$325 mln in Q1 20 to A$12 mln in Q1 21. Lastly, comments by Australia's Treasurer, Josh Frydenberg, suggested an alignment with the central bank on wanting to drive the unemployment rate lower, which implies additional fiscal support in the May 11 budget.

The dollar has nearly recouped its losses against the yen in full as it probed the JPY109 area in the European morning. There is an option struck there for $1.3 bln that expires today. The JPY109.20 area is the (50%) retracement level of this month's decline. The key driver continues to appear to be US yields.

The Australian dollar made a marginal new high for the month, just shy of $0.7820, but again was rebuffed and was trading below $0.7780 in the European morning. Note that it was alternating between gains and losses since Apr. 15, but is extending its gains for the fourth consecutive week.

The Chinese yuan was trading higher today for its fourth consecutive advance. In fact, the yuan has fallen in only one session in the past three weeks. The greenback's low today around CNY6.4660 has not been seen since early March. The PBOC's dollar fixing continues to be in line with expectations. The offshore yuan (CNH) was trading a little firmer than the onshore yuan (CNY). Note that tomorrow, China reports its April PMI, which is expected to be a touch softer than March, and the Caixin manufacturing PMI, where a small uptick is anticipated.

Europe

Ahead of tomorrow's preliminary estimate of EMU's April inflation, Spain and German figures were available today. In Spain, upward pressure on prices is still evident. The harmonized measure jumped 1.1% on the month following March's 1.9% gain. This lifted the year-over-year pace to 1.9% from 1.2%.

Both readings were 0.2 percentage points above expectations. Most of the rise seemed to come from higher energy prices, while food prices looked softer. Core CPI (excluding energy and fresh food prices) rose 0.4%, and the year-over-year increase was steady at 0.3%.

German states have reported their April CPI figures, and the national harmonized report is due today. The year-over-year rate was still rising, helped by the return of the VAT and higher energy prices. The EU harmonized measure may edge higher from the 2.0% year-over-year pace reported in March.

Separately, German employment data was a bit softer than expected. Although the unemployment rate was steady at 6.0% in April, the number increased by 9k, disappointing market forecasts for a 10k decline.

With new border checks between Northern Ireland and the rest of Britain and civil unrest by loyalists, it should not be surprising that the head of the Democratic Unionist Party in Northern Ireland, Arlene Foster, will step down. There has been talk about this for some time.

Foster was on the wrong side of some social issues compared to many in her party, which may help account for the timing of yesterday's announcement. The UK holds local elections next week, and while Scotland and Wales local parliament is included, the Northern Irish local government election is not until May 2022.

Stronger business confidence in the euro area failed to do much for the euro. It had extended its recovery off the Mar. 31 low near $1.17 to reach its best level since Feb. 26 today ($1.2150) before sellers re-emerged.

The $1.21 area represents a (61.8%) retracement of the euro's decline since the January high (~$1.2350). Note that there is an option for 1.5 bln euro struck there ($1.2100) that expires tomorrow when the EMU reports its initial estimate for Q1 GDP. Support has been built in recent days around $1.2060. On the upside, the $1.22 area is the next hurdle.

Sterling poked briefly above $1.3975 for the first time in seven sessions, but it too has consolidated in the European morning. Last week's high was just shy of $1.4010, but sterling has not closed above $1.40 since late February. The market does not appear to have given up and may have another go at it today.

America

Literally and figuratively, there was little new from the Federal Reserve. Except for a handful of sentences, the statement was identical with the March statement, which itself was mostly a duplicate of the January statement. Fed Chair Jerome Powell's press conference did not cover new ground or reveal new insight into the central banks' reaction function.

The part of the statement that did change was the review of economic developments. The Fed did marginally upgrade its assessment. The sectors hardest hit by the public health crisis remain weak "but have shown improvement." Also, in January and March, the Fed warned of "considerable risks." Now it says, "risks remain."

Assuming the economy performs as expected, a further upgrade is likely at the next meeting in June, which also sees updated forecasts. Powell recognized that with the vaccine success, the economy can return to normal later this year. The combination of the easy monetary and fiscal policy, the wealth effect from rising house and equity prices (and assets more generally), and pent-up demand (think services as well as goods), coupled with the vaccine rollout, is fueling a growth spurt.

Still, Powell again repeated the Fed's assessment that it will still take "some time" to meet the threshold of "substantial further progress. While the growth surge will not last more than a few quarters, many expect that the threshold will be met, allowing the Fed to taper before year-end.

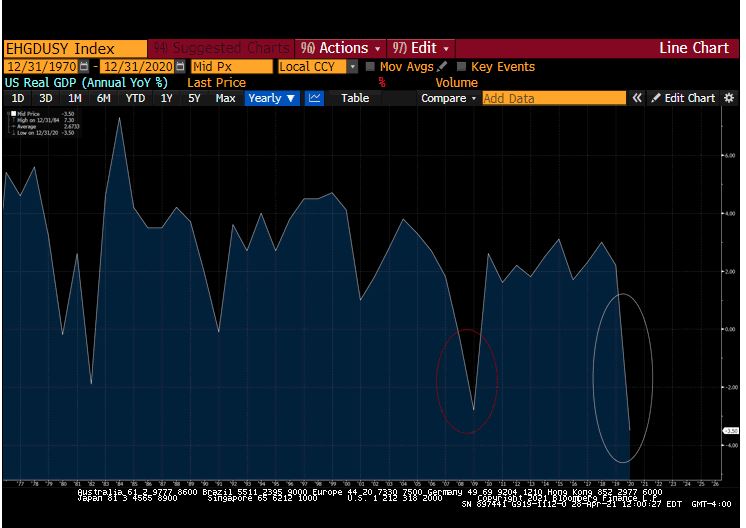

The chart at the top of the page is the year-over-year US GDP. With today's report, we should see the "V" shape emerge and continue to be drawn out of the next few quarters. This does not negate the "K-recovery," which is about the distributive gains rather the aggregate gains.

Most important data, besides the volatile durable goods orders, were above the median Bloomberg forecast. That means that economists (or their models) do not appreciate the strength of the economy. It might translate into today's report, where the median forecast has drifted lower in recent days to 6.6%.

The US also reports weekly jobless claims, which are expected to have fallen for the third consecutive week. At the end of next week, the monthly employment report is due, and the early call is for around another 900k increase in nonfarm payrolls.

Canada and Mexico's economic calendars are light today. Tomorrow Canada reports February GDP and Mexico reports Q1 GDP. The US dollar extended yesterday's drop and fell a little below CAD1.2290 but spent the European morning straddling CAD1.2300. The 2018 low was set near CAD1.2250, and that may be the next technical target. The 2017 low closer to CAD1.2060.

The divergence between the Bank of Canada's tapering and the Fed's "not even talking about talking about tapering" captures the sentiment.

The dollar had moved above its 20-day moving average (~MXN20.05) against the Mexican pesoyesterday for the first time since late March, but the dovish Fed saw the greenback tumble to around MXN19.86. It was consolidating today in the lower part of yesterday's range. Here too, the direction of US rates seems key.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.