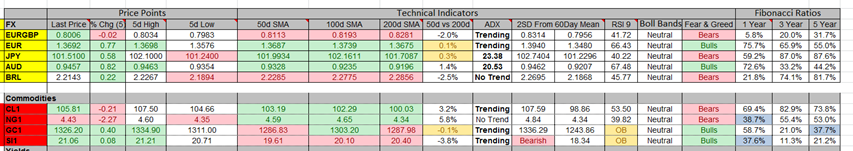

Currencies

- EUR/USD: The pair has broken our of its resistance zone 1.3682-1.3661 on a 60 minute time frame. The next support is at 1.3590 and the next resistance is at 1.3749.

- USD/JPY: The pair is trading below the downward trend line on a 60 minute time frame which represents a weakness for the price. The next support is at 100.96 and resistance at 102.17

- GBP/USD: The pair is trading in resistance zone of 1.7090-1.7112 on a 60 minute time frame. The resistance is near the 1.7183 and the support is at 1.6968.

Indices

- Asian Markets closed mostly higher by building further gains on top of yesterday. The Nikkei 225 was the best performing index during the session and it closed higher with a gain of 1.08%. The index is down nearly by 0.28% in the past 5 days.

- European stock markets are trading higher during the early hours of trading. The CAC index is the best performing index during the session and it is trading higher with a gain of 0.21%. The index is down by almost 1.65% in the past 5 days.

- US Indices futures are trading higher ahead of the housing data. Most indices closed mixed but mostly higher yesterday and the NASDAQ index was the best performer with a gain of 0.23%.

TOP News

- The Chinese manufacturing PMI data came in at 51 while the previous reading was at 50.8.However,the HSBC final manufacturing reading was slightly softer with the reading of 50.7.

- The Spanish manufacturing PMI data came in at 54.6 while the forecast was at 53.2

- The Italian Manufacturing PMI was on the softer side with the final reading of 52.6 when the forecast was for 53.5

- The German unemployment data also fell short of expectations with the reading of 9K while the forecast was for -9K.

Things to Remember

- Trade the trend for more profitable trades

Market Sentiment

- Gold: The precious metal is trading near the resistance zone of 1330 and the odds are that the metal may b able to break this resistance without too much struggle. The next resistance is at 1360 and the immediate support at 1310.

- Crude Oil: The black gold is trading in an upward trend on a 60 minute time frame. The major support is near the 104 and resistance at 107.50.

- VIX: Volatility index increased nearly 2.75% yesterday.

News Agenda For Today

08:30 GMT

GBP – Manufacturing PMI

14:00 GMT

USD – ISM Manufacturing PMI

Trend

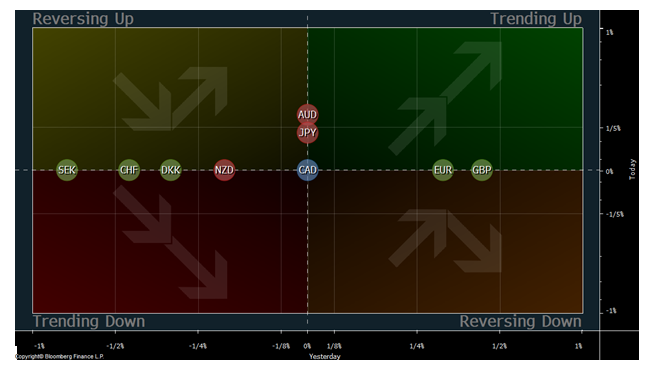

The SEK and EUR are trending up against the USD, while the DKK and GBP are trading lower against the USD on an intra-day basis.

Disclaimer: The above is for informational purposes only and not to be construed as specific trading advice. responsibility for trade decisions is solely with the reader.