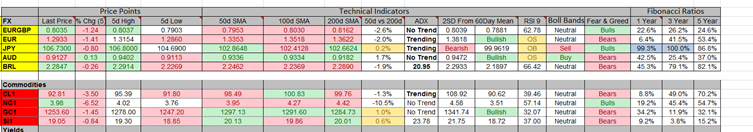

Currencies

- EUR/USD: The pair is trading below its downward trend line on a 60 minute time frame. The next support is at 1.2811 and the next resistance is at 1.3113.

- USD/JPY: The pair is trading above its upward trend line on a 60 minute time frame. The next support is at 103.89 and resistance at 107.12

- GBP/USD: The pair is trading in its support zone on a 60 minute time frame. The resistance is near the 1.6560 and the support is at 1.5907.

Indices

- Asian Markets closed mostly lower by erasing some of their gains from yesterday. The Hang Seng index was the worst performing index during the session and it closed lower with a loss of 1.93%. The index is up nearly by 0.82% in the past 5 days.

- European stock markets are trading lower during the early hours of trading. The Ibex index is the worst performing index during the session and it is trading lower with a loss of 1.15%. The index is up by almost 0.29% in the past 5 days.

- US Indices futures are trading higher ahead of the crude oil data. Most indices closed lower yesterday and the NASDAQ index was the worst performer with a loss of 0.88%.

TOP News

- The French final non farm payrolls data matched the previous reading od 0.1%. The forecast number was also 0.1%

- The French Industrial production m/m data came in at 0.2% while the previous reading was at -1.2%

- Apple Inc (NASDAQ:AAPL) announced iPhone 6 and Apple Watch yesterday.

Things to Remember

- Stops are your biggest friends so make sure use them.

Market Sentiment

- Gold: The precious metal is trading below its downward trend line on 60 minute time frame and the near term support is at 1240 while the resistance is at 1300.

- Crude Oil: The black gold is under tremendous selling pressure and the support of $90 is in focus. The resistance is at 98.

- VIX: Volatility index gained nearly 4.72% yesterday.

NEWS Agenda For Today

14:30 GMT: USD – Crude Oil Inventories

21:00 GMT: NZD – Official Cash Rate

Trend

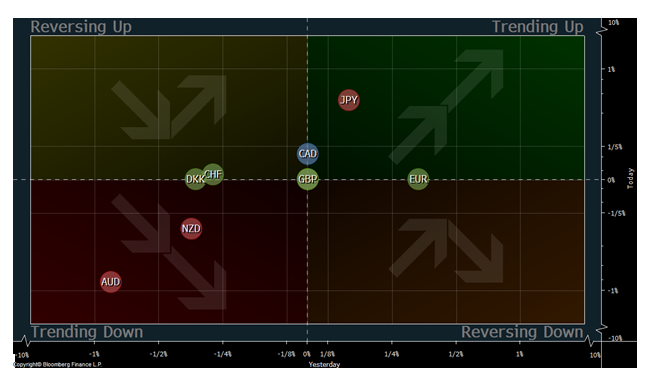

The CAD and JPY are trending up against the USD, while the AUD and NZD are trading lower against the USD on an intra-day basis.

Disclaimer: The above is for informational purposes only and NOT to be construed as specific trading advice. responsibility for trade decisions is solely with the reader.