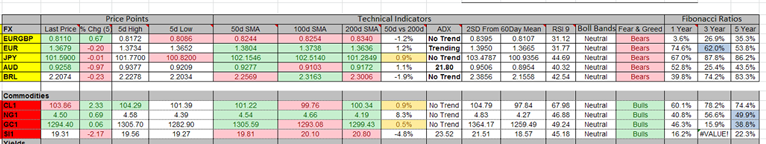

Currencies

- EUR/USD: The pair is still trading in a downward wedge pattern on a 60 minute frame. The next support is at 1.3580 and the next resistance is at 1.3742.

- USD/JPY: The pair has broken the neck line of the reverse head and shoulder pattern on a 60 minute time. The next support is at 100.80 and resistance at 102.11.

- GBP/USD: The pair is has formed a massive reverse head and shoulder pattern as well on a 60 minute time frame. The resistance is near the 1.6964 and the support is at 1.6798.

Indicators

Indices

- Asian Markets closed sharply higher on the final trading day of the week. The Nikkei 225 index was the best performer index during the session and it closed higher with a gain of 0.87%. The index is up nearly 2.30% in the past 5 days.

- European stock markets are trading higher during the early hours of trading. The DAX index is the best performing index during the session and it is trading higher with a gain of 0.24%. The index is up by almost 0.78% in the past 5 days.

- US Indices futures are trading higher ahead of the new home sales data. Most indices closed higher on yesterday and the NASDAQ Composite index was the best performer with a gain of 0.55%.

TOP News

- Standard and Poor has raised the Spain’s credit rating to BBB

- The German final GDP data matched the forecast of 0.8%. The previous reading was also the same.

- The UK’s price expectations are at record high.

Things to Remember

- Stops are your biggest friends so make sure use them.

Market Sentiment

- Gold: The precious metal is moving in a side way pattern on a 1 hour time frame. The resistance remains at 1320 and the support is at 1280.

- Crude Oil: The black gold is trading above its upward trend line on 1 hour time frame and the bias remains to the upside as long as the price stays above this line. The next support is at 100 and the resistance at 105.

- Volatility S&P 500: Volatility index ganied nearly 1.01% yesterday.

News Agenda For Today

08:00 GMT

EUR – German Ifo Business Climate

12:30 GMT

CAD – Core CPI m/m

14:00 GMT

USD – New Home Sales

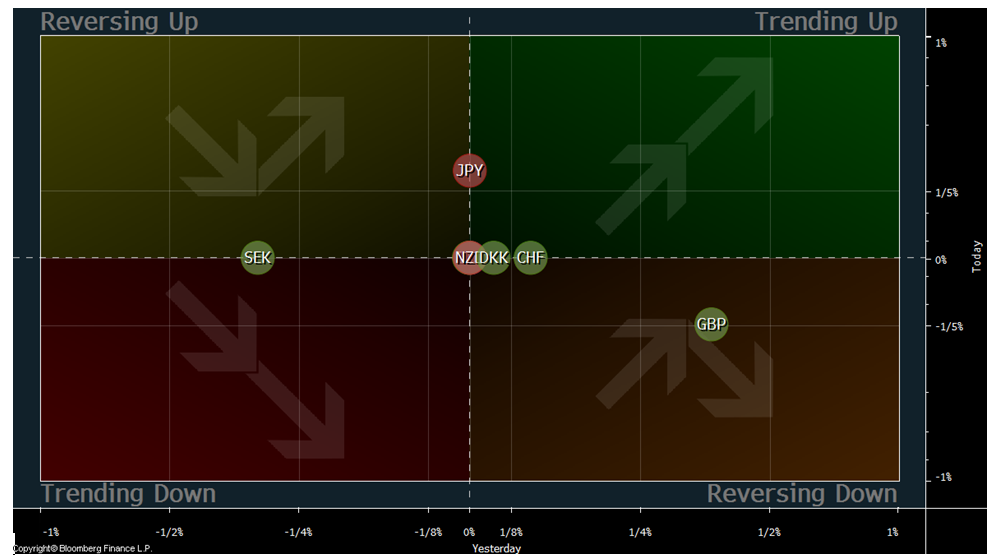

Trend

The SEK and CHF are trending up against the USD, while the EUR and NZD are trading lower against the USD on an intra-day basis.

Disclosure & Disclaimer:

The above is for informational purposes only and NOT to be construed as specific trading advice. responsibility for trade decisions is solely with the reader. by Naeem Aslam