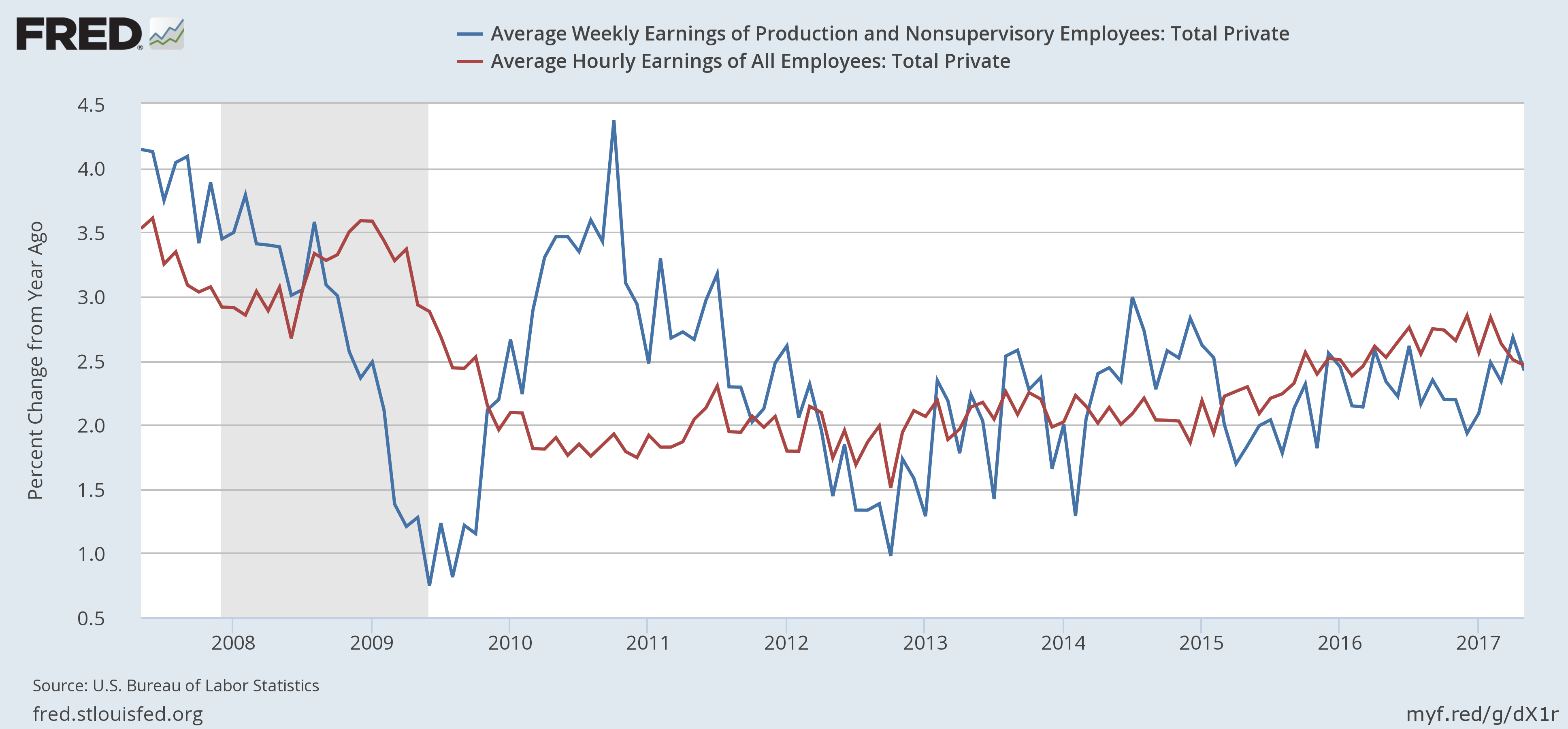

This week’s news was evenly divided between good and bad releases. Starting with the negative, there was Friday’s jobs report: the headline figure was a paltry 138,000. Adding to the bearishness was the 60,000 decline in previous month’s growth. There were other negative elements, starting with weak wage and hourly earnings growth:

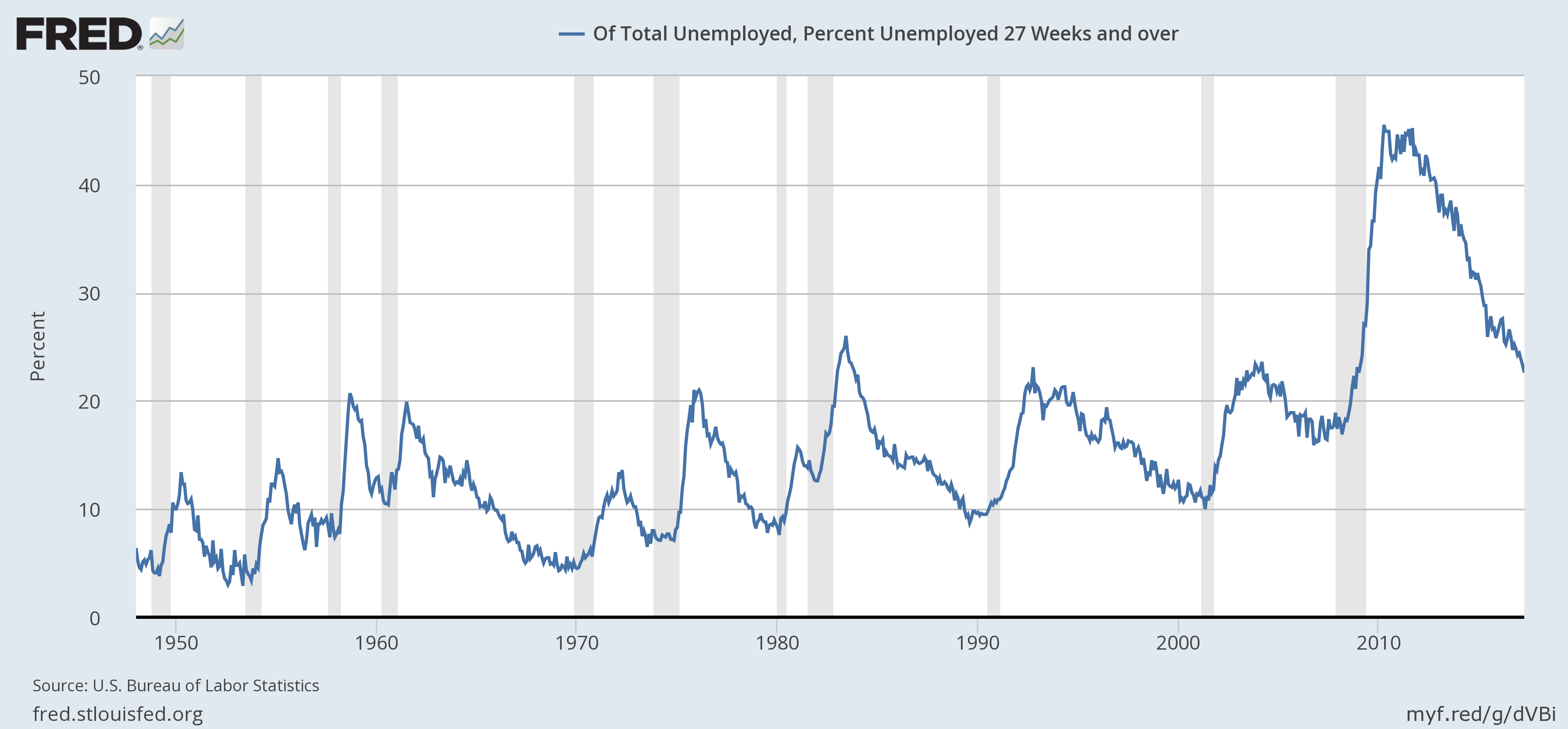

The percentage of people unemployed for 27 weeks or longer is still very high:

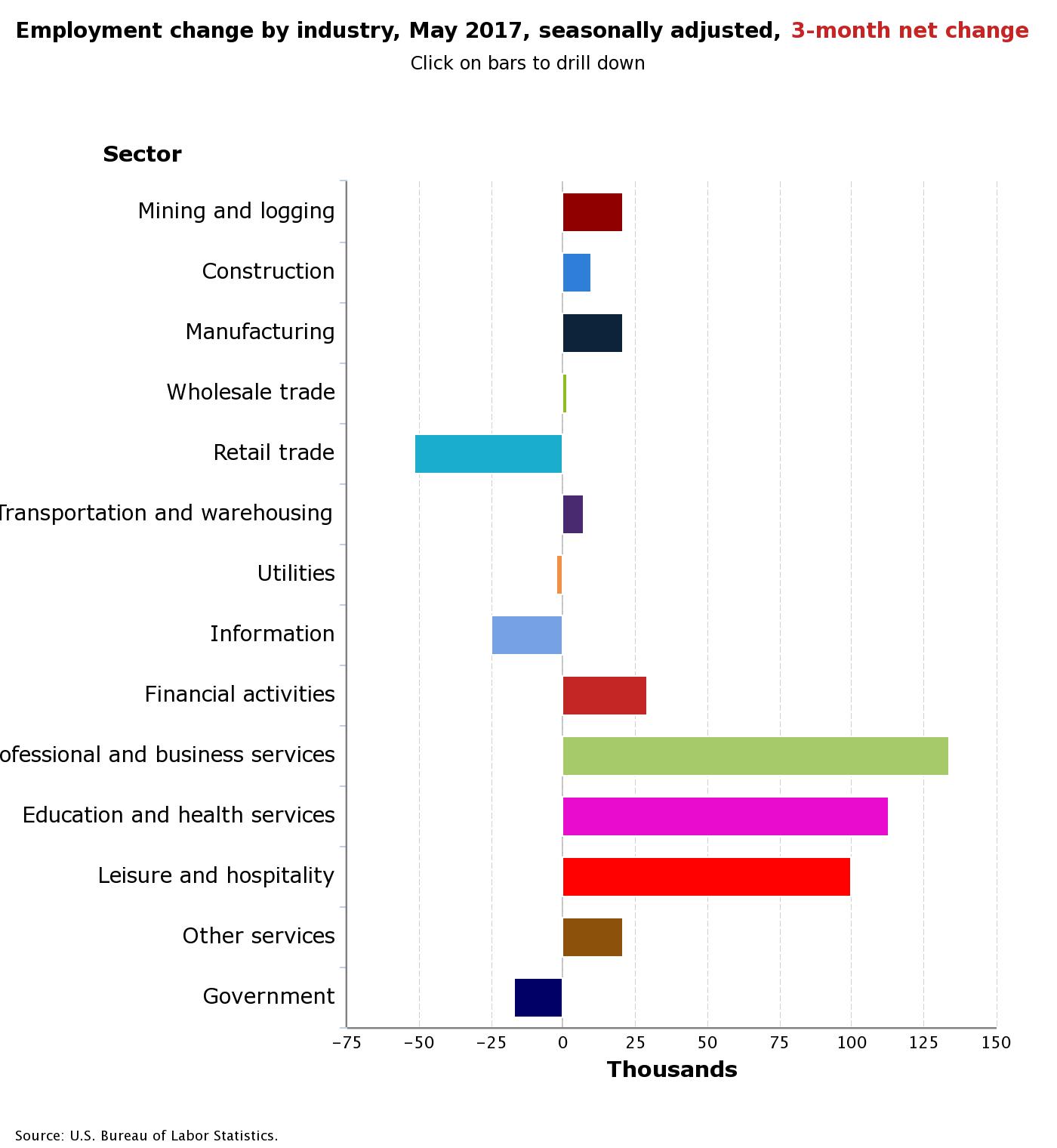

Retail employment is limping along:

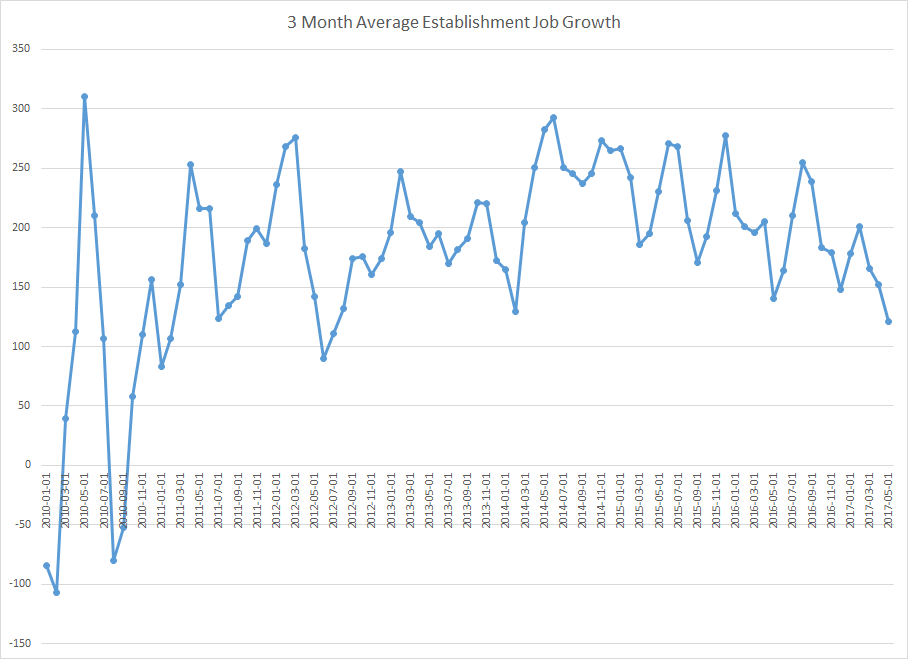

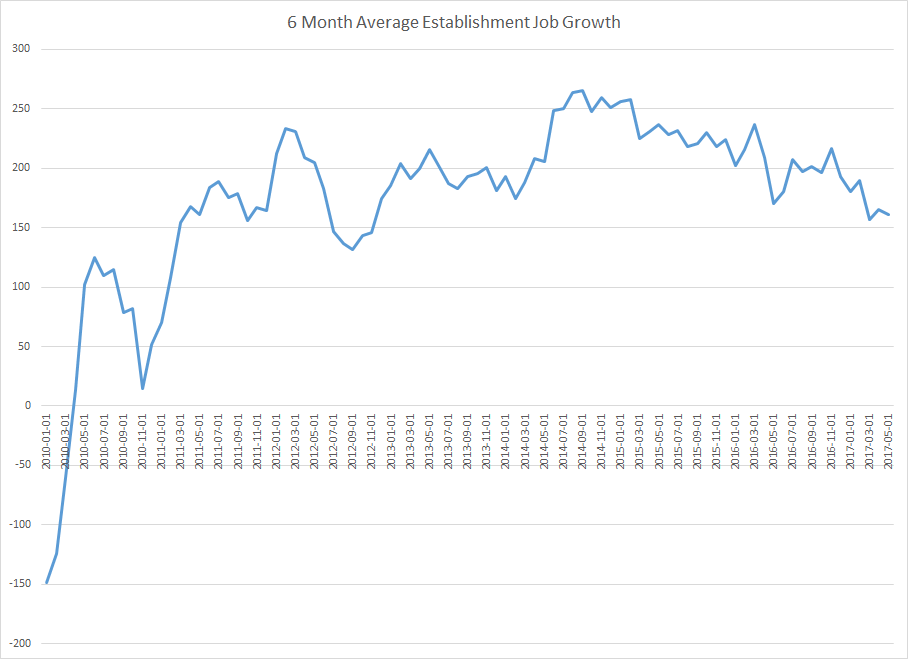

Finally, the 3 and 6 month moving averages of establishment job growth are all declining:

Secondly, auto sales are still weaker than levels over the last 6-12 months; they declined to a 16.6 million level.

But there were several positive news items, beginning with Tuesday’s report on personal spending. This was very positive, especially in light of weaker first quarter numbers. PCEs increased 2.6% Y/Y; durable goods spending was 7% higher; non-durable goods purchases rose 1.9% and service spending increased 2.1%. The PCE price deflator was slightly lower; the overall measure declined .2 to 1.7% and the core number was .1 lower, falling to 1.5%. Because consumer spending is responsible for 70% of U.S. growth, this report points to a far stronger 2Q GDP number.

Finally, the ISM manufacturing report increased .1% to 54.9. New orders and employment increased. While production decreased, it’s still a very health 57.1. And the anecdotal comments were very encouraging:

- "Sales have picked up compared to the last two months. Customer demand has increased." (Plastics and Rubber Products)

- "Economy is still strong, but [the] political climate can change things very quickly." (Transportation Equipment)

- "Global price increases for commodities." (Electrical Equipment, Appliances and Components)

- "Business (sales/production) is steady. Pricing pressures on raw materials. Skilled labor in short supply." (Furniture and Related Products)

- "Agricultural demand very strong." (Chemical Products)

- "Our business is definitely paying attention to developments with the Canadian lumber tariff announcement. The final outcome could change our fiber pricing." (Paper Products)

- "OEM longer lead parts possibly longer lead time due to more orders." (Nonmetallic Mineral Products)

- "Business conditions are steady, and with competition increasing, it's making negotiations even more intense to reduce costs." (Machinery)

- "Business is booming, and getting direct employees is increasingly difficult." (Fabricated Metal Products)

- "Difficult to find qualified labor for factory positions." (Food, Beverage and Tobacco Products)

Economic Conclusion: This was a split weak, with the overall tone leaning bullish thanks to the strong PCE and ISM reports. But the job report’s headline and internal weakness is slightly concerning. On one hand, this could simply be a one-off report. Or, it could be that at this stage of the recovery, job growth is by definition a bit weaker – a point argued by several Fed presidents. But the downward trend in the 3 and 6 month average pace of establishment job growth is concerning, as it the continued weak wage growth. After nearly 7 years of job growth, it does seem that the job market should be a bit farther along.

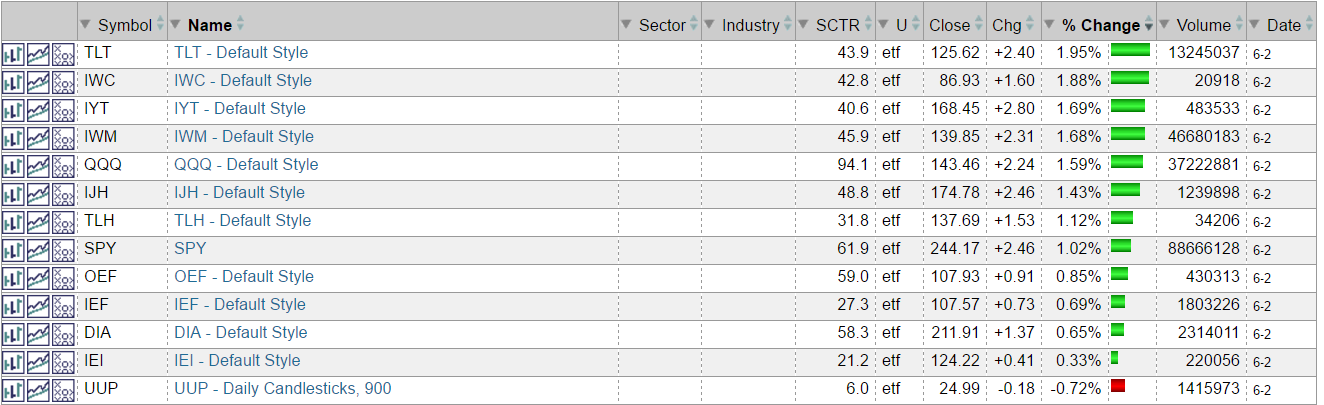

Market Overview: This was a good week for the markets, but there’s a catch:

Not only did the SPDR S&P 500 (NYSE:SPY) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) rally to new, all-time highs, but the treasury markets also advanced. The long-end of the curve (the iShares 20+ Year Treasury Bond (NASDAQ:TLT)) was up nearly 2% -- a big move for the fixed income market. And the belly of the curve – the iShares 3-7 Year Treasury Bond (NYSE:IEI) and iShares 7-10 Year Treasury Bond (NYSE:IEF) – also moved higher. Perhaps more importantly, all three ETFs also had important bullish moves: each rallied through important resistance levels:

In essence, we’re getting very mixed signals. The equity market is saying the economy will continue to expand but the treasury market is saying the economy is slowing. There is evidence in this week’s news to support both camps. The strong increase in PCEs and solid readings from the ISM report support an equity rally while the weak employment report was the primary reason for the treasury rally.