-

Powell’s testimony dents the dollar

-

US CPI data could deepen the wounds

-

Pound gains as BoE’s Pill dampens August cut bets

-

Wall Street at new highs, gold gains as well

Dollar Softens Ahead of CPI Data

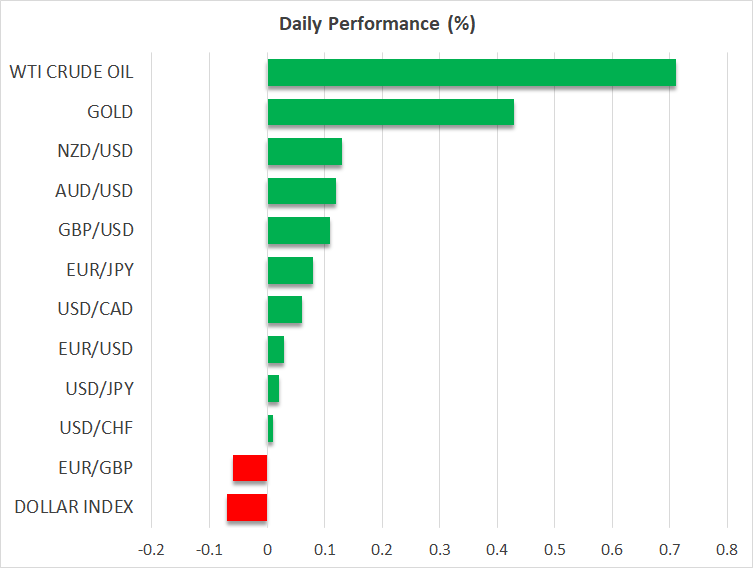

The US dollar drifted south against most of its major peers on Wednesday, gaining some ground only against the yen, the franc, and the kiwi. What may have allowed dollar traders to maintain their short positions was Powell’s testimony before the House Financial Services Committee. When asked if he felt that the bar to lowering rates had been cleared, he said that he has some confidence in that, though he is not ready to confirm it, adding that the risks to the job market are more or less aligned with the risks of high inflation.

Powell’s remarks were interpreted as keeping the door wide open to two rate cuts this year. According to Fed funds futures, the market remained convinced that there is around an 80% chance for a first 25bps reduction in September, while they are penciling in another one in December.

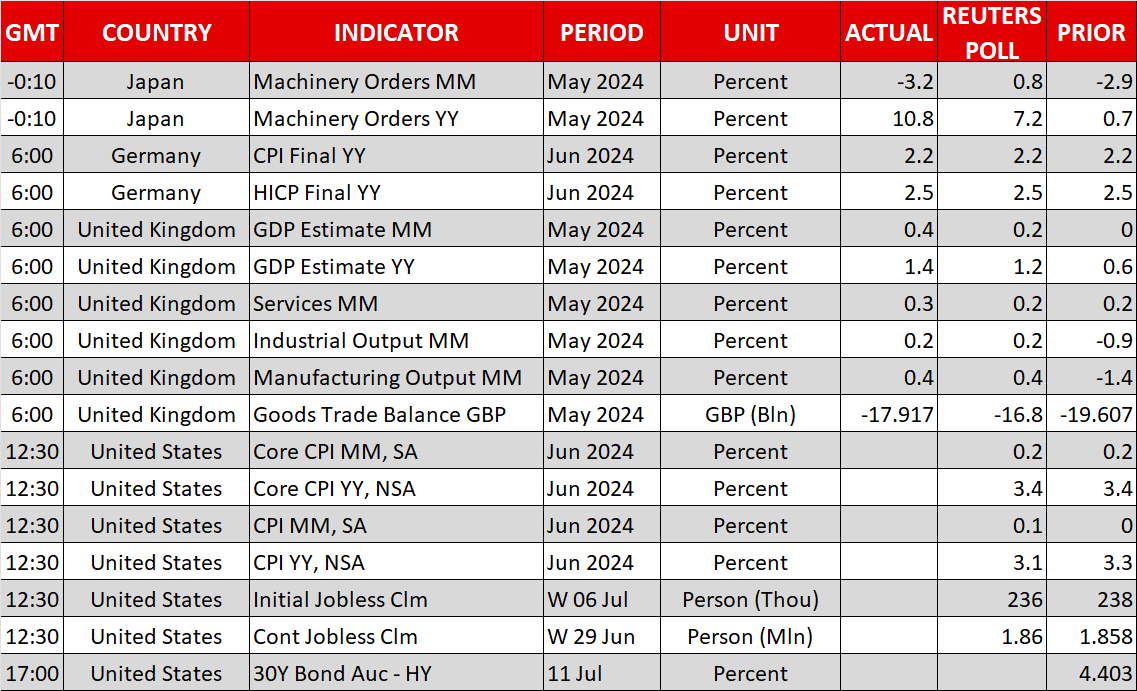

Today, the spotlight is likely to turn to the US CPI data for June. The headline YoY rate is expected to have slid to 3.1% from 3.3%, but the core one is anticipated to have held steady at 3.4%. That said, bearing in mind that the price subindices of both the ISM PMI surveys declined, the risks may be tilted to the downside. A further slowdown may seal the deal for a first reduction in September and thereby add more pressure on the US dollar.

BoE’s Chief Economist Lifts Sterling

The pound was yesterday’s main gainer as remarks by BoE Chief Economist Huw Pill poured cold water on expectations of an August rate cut. Pill said that services and wage inflation remain uncomfortably high despite headline inflation hitting the BoE’s target of 2% in May, adding that June’s prints are unlikely to change the picture.

This prompted investors to scale back their BoE rate cut bets, now seeing a 50% chance for an August reduction, down from around 60% before Pill’s comments. Combined with a weaker dollar, this helped Cable climb above the key resistance zone of 1.2820.

The kiwi was the main loser, feeling the hit of a dovish shift by the RBNZ, while the yen kept tumbling despite market participants assigning a nearly 60% probability for another 10bps hike by the BoJ at the end of the month.

Yet, Japanese authorities have remained relatively silent about the possibility of a fresh intervention. Perhaps they believe such an action this time is not worth it following the minimal impact that resulted from the latest episodes, as even with the BoJ raising interest rates, a slow pace of hikes, and the rate differentials with the US could still allow ‘carry’ trading.

Wall Street Celebrates Prospect of Rate Cuts

All three of Wall Street’s main indices gained more than 1% each yesterday, with the S&P 500 and Nasdaq hitting fresh record highs. It seems that anything supporting two rate cuts by the Fed this year is music to the ears of equity investors, and thus, should the CPI figures today point to further easing of inflation, market participants may be more than happy to increase their risk exposure.

Gold has also joined the party, with the CPIs having the potential to trigger a break above the key resistance zone of $2,388. Expectations of lower rates in the US and elevated central bank purchasing are likely to keep the precious metal’s picture positive.