Here are the latest developments in global markets:

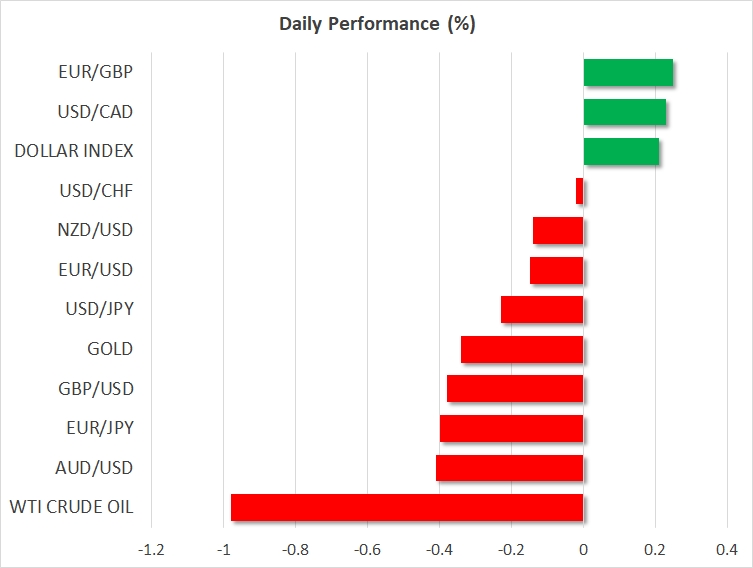

· FOREX: The US dollar continued to stage a recovery during Tuesday’s Asian session against most majors with the exception of the yen. The latter currency was bid as it performed its traditional role of safe-haven. The dollar index was around 1% higher from its 3-year low hit on Thursday. Rising bond yields were said to bolster the greenback.

· STOCKS: Stocks were correcting following their stellar run of the previous weeks. The Dow closed two-thirds of a percent lower on Monday and futures were signaling a negative open for Tuesday as well. The Nikkei closed down 1.4% today and other Asian indices were also under pressure. A selloff in Apple shares (NASDAQ:AAPL) on Monday and the rise in bond yields were cited as the main reasons for the pullback.

· COMMODITIES: Gold fell at the same time as the US dollar recovered and yields rose. Gold fell to a 1 ½-week low of $1333 per ounce. The bounce in the dollar also pushed crude oil lower, with the US benchmark falling below $65 to $64.85. Fears about rising US production also seem to be holding back further gains by crude oil for now.

Major movers: Yen does best after stock sell-off; dollar off lows

The Japanese yen managed to strengthen during Tuesday’s trading as it attracted some safe-haven related flows. The yen’s gains were more pronounced versus the pound and to a lesser extent against the euro, whereas the Japanese currency managed to post small gains versus the greenback as the dollar recovered on the back of higher Treasury yields. In terms of Japanese data, except for retail sales, employment and household spending numbers came in on the disappointing side.

10-Year Treasury yields climbed near their highest in four years at 2.72%, as long-term interest rates in the US have risen on the back of expected Fed rate hikes, fiscal deficits and strong growth prospects for the world’s largest economy. Interestingly, German 10-year Bund yields have also risen to around 2 ½ -year highs by touching 0.70% on Monday as the ECB is increasingly expected to wind down its QE program in the coming months.

The Aussie was one of the biggest losers versus the greenback – perhaps because of risk aversion and because the Australian currency was one of the best performers of 2018 and therefore would need to correct the most. The pound was in a similar position following previous strong performance as pound/dollar broke below 1.40 on the back of dollar strength and worries that UK’s Brexit-related woes would return because of unstable politics.

Finally, oil was down by around 1% but it remained close to three-year high levels.

Day ahead: Eurozone GDP, German inflation and US consumer confidence on the agenda

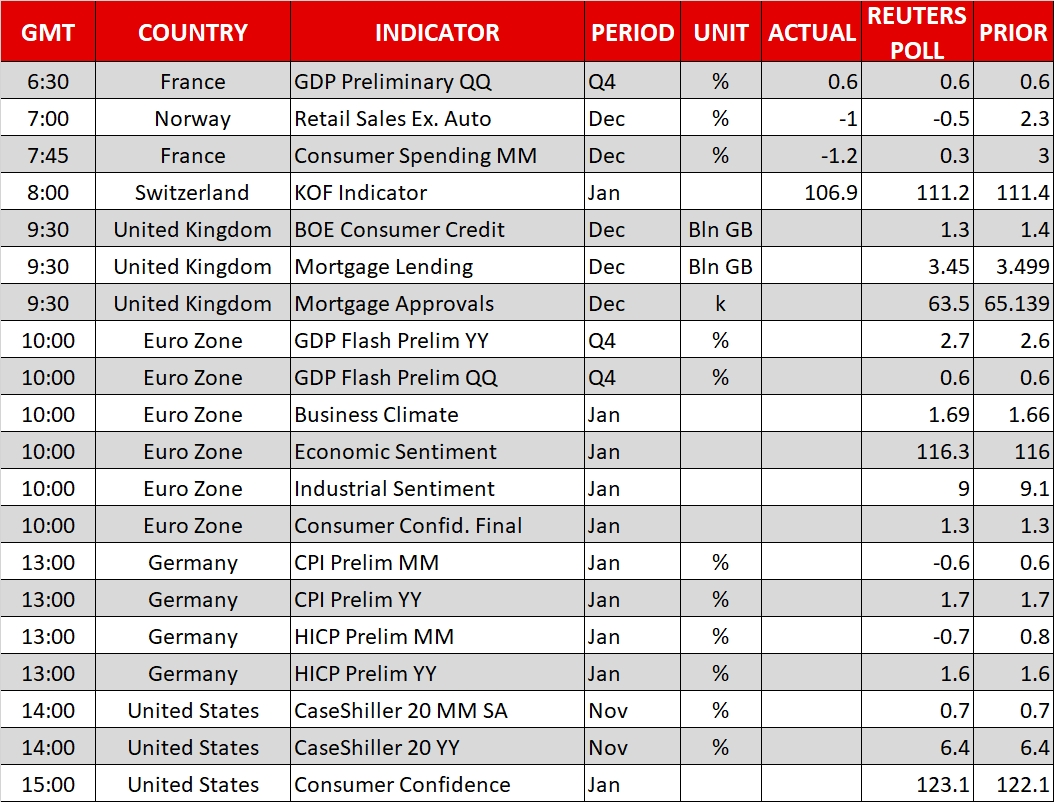

UK data on consumer credit and mortgage lending & approvals will be made public at 0930 GMT.

At 1000 GMT, the eurozone will see the release of numerous surveys gauging business and consumer sentiment, including the final reading of consumer confidence for the month of January released by the European Commission’s Directorate General for Economic and Financial Affairs. Consumer confidence is expected to be confirmed at 1.3, its highest since 2000.

Eurozone Q4 2017 flash GDP figures will also be released at 1000 GMT and are expected to attract investor interest, with a surprise potentially leading to positioning on euro pairs. Quarter-on-quarter, growth is expected to stand at 0.6%, the same as in the preceding two quarters which is considered a solid rate of expansion, while on an annualized basis, it is anticipated to come in at 2.7%, this being a multi-year high.

One day before the eurozone’s preliminary estimate of January CPI goes public, Germany, the eurozone’s, and Europe’s, largest economy will see the release of its respective inflation figures for the month of January at 1300 GMT.

Out of the US, the CaseShiller indices gauging house prices for the month of November are due at 1400 GMT, while the Conference Board’s consumer confidence index for January will be released at 1500 GMT – the relevant index is expected to rise, albeit not by much, after declining in December. It should also be mentioned that the Federal Reserve will commence its two-day meeting on monetary policy later on Tuesday, with a policy decision due on Wednesday; this will be Janet Yellen’s last meeting as Fed chief with Jerome Powell subsequently taking over. Some analysts are anticipating a “hawkish hold” of rates at current levels, with a signaling for a hike during the March meeting.

Bank of England Governor Mark Carney will be speaking before the House of Lords Economic Affairs Committee at 1530 GMT.

API data on US crude oil stocks will be made public at 2135 GMT.

The earnings season remains under way with pharma giant Pfizer (NYSE:PFE) being among companies releasing quarterly earnings on Tuesday.

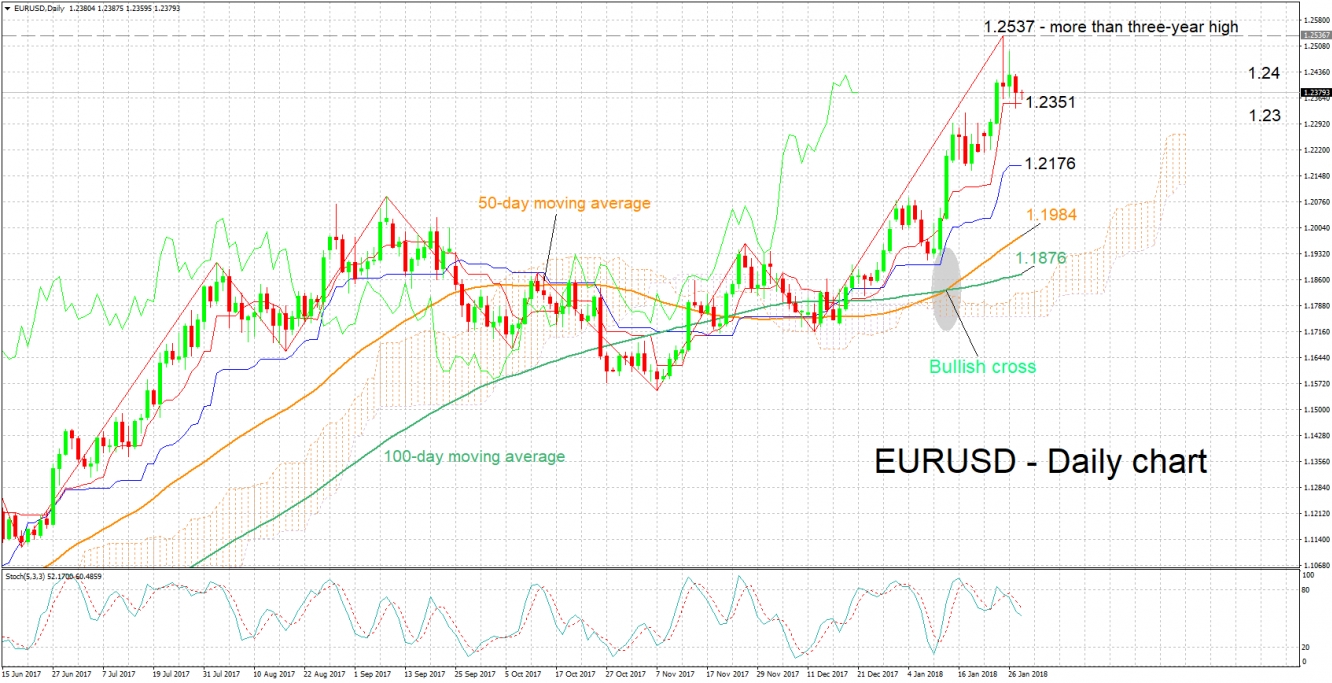

Technical Analysis: EUR/USD weakening positive momentum

EUR/USD has declined from 1.2537, the highest since late 2014 hit on Thursday, presently falling below the 1.24 handle. The positively aligned Tenkan- and Kijun-sen lines continue to project a bullish picture in the short-term. However, the two lines have started moving sideways, this potentially being an indication of weakening positive momentum. The stochastics are also giving a bearish signal in the very short-term as the %K line has crossed below the slow %D line and both lines are moving lower.

Should eurozone data due during morning European trading hours surprise to the upside, the positive momentum might be refueled with the area around last week’s more than three-year high of 1.2537 – including the 1.25 mark – coming into view as potential resistance. Before that, the range around the 1.24 handle might act as a psychological barrier to price advancing.

A disappointment on the data front on the other hand, is likely to exert selling pressure on the pair. The area around the Tenkan-sen at 1.2351 could offer support in this case, with steeper declines shifting the focus to the 1.23 level - a point of potential psychological significance - for additional support. Notice that the price is at the moment not far above the current level of the Tenkan-sen.