The S&P 500 and Nasdaq 100 indices staged a solid intraday rebound yesterday, digesting the initial drop and closing the day higher. Along with the rebound in equities, a reversal to the downside is forming in the Dollar Index.

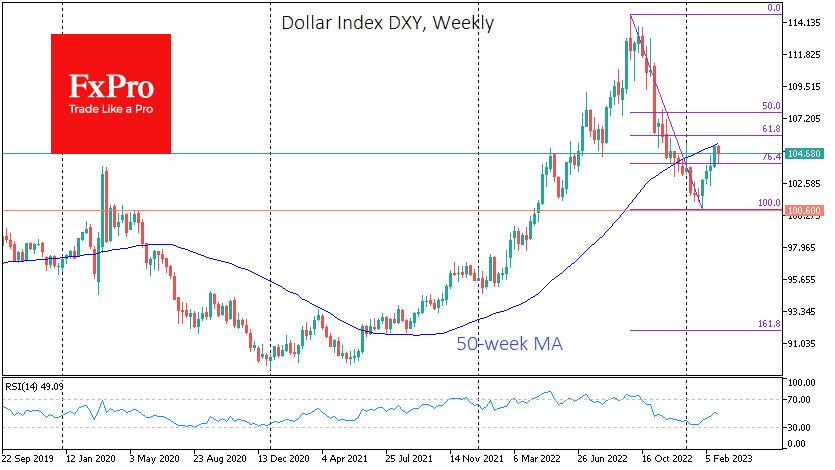

Technically, the dollar's rebound in February has cleared the oversold conditions accumulated during the decline since late September last year. The RSI on the daily timeframe touched the overbought territory and was turned down precisely a week ago, leaving room for further declines.

Strictly speaking, the pullback is below 61.8% of the initial decline that passes through the 106 level. Below that is the 200 SMA, but the USD bulls didn't have enough power to push the American currency into the area now, as in January. The 105 territory is interesting, as it has seen several reversals in the past.

A possible intermediate target for the US currency is 103.2, the 50-day average. Also, here, the DXY stopped rising in March 2020. It is very likely that the dollar will continue its slide at this level and will test the February lows of 100.6 before the end of April.

The view that the dollar is weakening against its major rivals fits well with historical examples. Often the Fed is the first to tighten monetary policy, triggering a wave of dollar strength. But a few months later, other central banks followed suit or moved ahead of the Fed.

Compared with January, the bond markets have priced in the Fed's expectations quite well. In turn, the ECB and the Bank of England continue to push up expectations in their markets. As in previous similar episodes, this reassessment of expectations by the Fed's "competitors" promises to be a driving force in the currency markets.

The picture in EUR/USD and GBP/USD is also bullish, as the pairs received strong support from buyers on dips to psychological and technical levels near 1.05 and 1.20, respectively.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

U.S. Dollar Likely Completed Corrective Bounce

Published 03/03/2023, 09:00 AM

U.S. Dollar Likely Completed Corrective Bounce

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.