- Trump confirms 25% tariffs on Canada and Mexico, ups China tariffs by 10%

- Dollar jumps higher despite growing Fed rate cut bets and lower yields

- Aussie and kiwi lead FX losses, gold sinks again

- Equity selloff deepens as Nvidia shares plunge

Trade War Takes Dangerous Turn

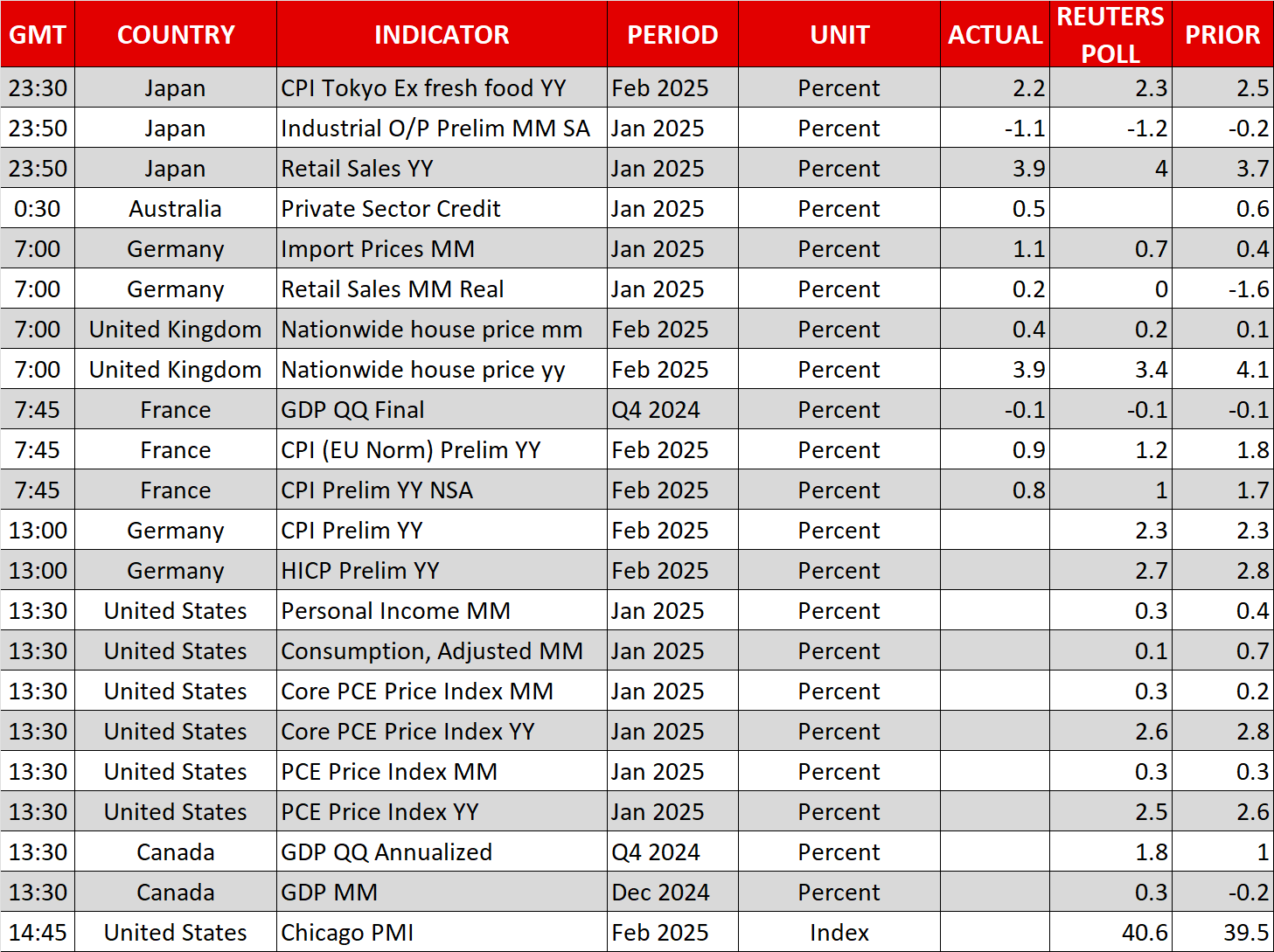

Another day at the White House and another tariff announcement by President Trump, as the trade war has just taken a dangerous turn. After much speculation about whether the delayed tariffs on Canada and Mexico will go ahead or not, Trump appeared to confirm on Thursday that the 25% levies will be implemented as planned on March 4. He also announced an additional 10% tariff on Chinese imports, taking the total to 20%.

Markets had been hoping that Canada and Mexico would be granted another extension, but it seems that the Trump administration isn’t happy with how the negotiations have been going. Stopping the flow of fentanyl appears to be the main sticking point, including in the talks with China.

It’s still possible, though, that this is another bluff by President Trump and that there will be a last-minute deal before Tuesday when the tariffs will go into effect. But investors are not taking any chances this time and risk assets have taken a major knock.

China Tariff Deadline Clashes With ‘Two Sessions’

Canada and Mexico are unlikely to retaliate before the deadline, but the bigger question is how China will respond. Chinese leaders are busy preparing for next week’s National People’s Congress where legislators meet to set policies for the year, including the economic agenda.

These ‘Two Sessions’ as they’re called could be significant for the markets as there could be some announcements on fiscal stimulus or measures to boost domestic consumption. It may also distract China’s leaders from retaliating with immediate countermeasures to Trump’s tariffs.

Nvidia Adds to Stock Market Selloff

But the market reaction has certainly been a lot stronger this time, with equities in Asia and Europe today following Wall Street’s lead yesterday by diving deep into the red.

The Nasdaq fell the most (-2.8%), followed by the S&P 500 (-1.6%). China’s main indices are down by almost 2%, but the losses in Europe are so far more modest.

AI giant NVIDIA (NASDAQ:NVDA) was the worst performer, as the stock plummeted by 8.5% after its earnings release on worries that the recent trend of triple-digit growth in revenue is not sustainable, with profit margins also taking a hit from higher production costs and possibly from tariffs as well.

Dollar Up as Aussie and Kiwi Slump

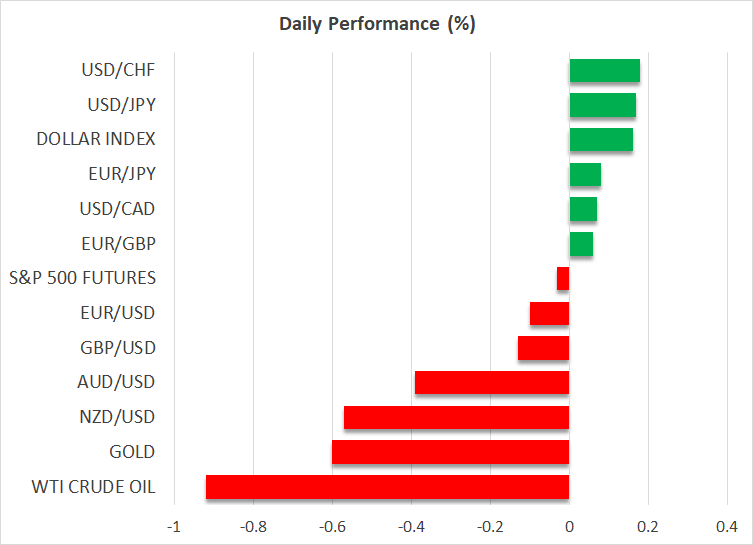

In FX markets, the US dollar resumed its role as the preferred safe haven during this tariff-related turmoil, climbing higher against a basket of currencies to reach a two-week high.

The Australian and New Zealand dollars have taken most of the brunt from this week’s tariff-led selloff as, apart from the general risk-off mood, investors see Trump as less likely to back down against Chinese restrictions in the event of a deal than with America’s other trading partners that are considered to be allies. Both Australia and New Zealand rely heavily on exports to China.

Pound Hopes for UK-US Trade Deal

Unsurprisingly, the Canadian dollar is the third worst performer among the majors, while the euro and pound have suffered only mild losses.

In a meeting with UK Prime Minister Starmer at the White House on Thursday, Trump appeared to backtrack on some of his harsher views on Ukraine, indirectly raising hopes that there is room for negotiation with the proposed levies against the EU. But for sterling, in particular, the good news is that Trump has opened the door to a UK-US trade deal where tariffs “wouldn’t be necessary”.

Gold and Bitcoin Continue Bleeding

The stronger dollar, meanwhile, continues to cause pain for gold, which doesn’t seem to be benefiting at all from this week’s safety flows. The precious metal came close to breaching the $2,850 level earlier today.

Bitcoin also remains in freefall, with its weekly losses exceeding 16%.

US Data Eyed Amid Rising Fed Rate Cut Bets

Barring any fresh tariff developments, the focus now is on the PCE inflation data due out of the US at 13:30 GMT. US Treasuries have been in demand this week, pushing the 10-year yield down to 4.245%.

Investors seem to be focusing more on the impact of tariffs on growth rather than inflation and are now pricing in a more than 40% probability of a third Fed rate cut this year.

Yet, these expectations don’t match the rhetoric from the Fed, with Philadelphia Fed President Patrick Harker yesterday suggesting that policy could move in “either direction”.