- Dollar retreats, but Powell keeps Fed pause chance elevated.

- Euro traders ‘buy the fact’ after French no-confidence vote.

- Bitcoin breaks $100,000, Wall Street tests uncharted territory.

Powell Reiterates Cautiousness on Interest Rate Cuts

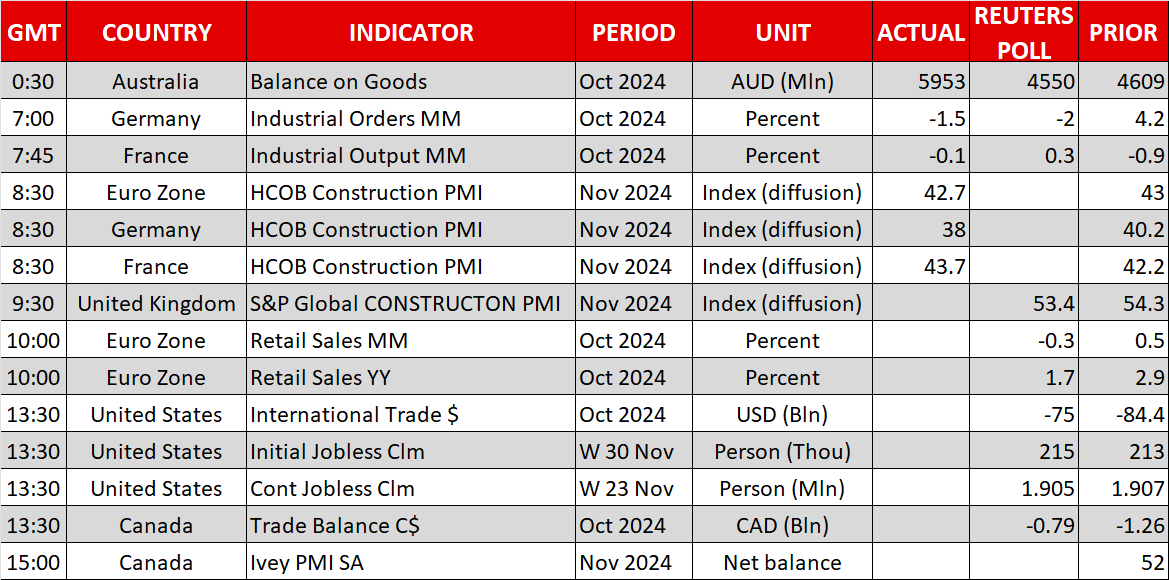

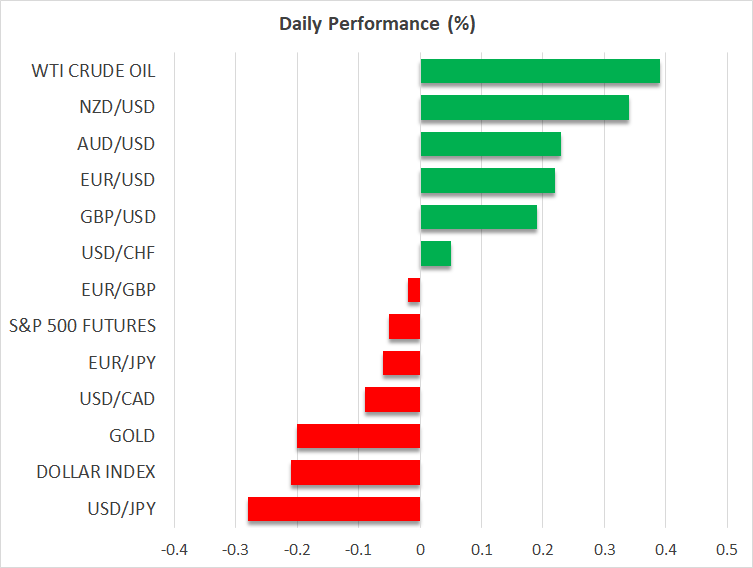

The US dollar is pulling back against all its major peers on Thursday, perhaps as traders are adopting a cautious stance ahead of tomorrow’s nonfarm payrolls report, especially after the ADP report revealed that the private sector gained less jobs than expected.0

Just after the ADP data, the final S&P Global composite PMI was revised slightly lower, while the ISM non-manufacturing PMI missed its forecast by a large margin. The data increased the probability of a rate cut by the Fed in December to 78%, but on Thursday that chance is back down, at 72%.

Perhaps this is owed to Fed Chair Powell, who reiterated the view that a slower pace of interest rate cuts may be appropriate moving forward as the US economy seems to be stronger than what the Bank had expected in September. That’s probably also why the probability of a pause in January remained elevated at 62%.

With that in mind, investors are likely to lock their gaze on tomorrow's NFP data, but they may also sift through on Thursday's initial jobless claims for last week. Expectations are for a small increase, which could increase cautiousness about a potentially softer-than-expected set of employment data tomorrow, and thereby allow the US dollar to correct a bit lower.

However, it would still be too early to start discussing a bearish reversal as a positive surprise tomorrow, could well encourage the US Dollar bulls to recharge. After all, the ADP has historically proven to be a poor predictor of the NFP number.

Euro Gains, but French Political Crisis Deepens

In the Eurozone, the euro (EUR/USD) moved slightly higher after French lawmakers backed a no-confidence motion against Prime Minister Michel Barnier and his government, with a majority of 331 votes.

Although President Macron is aiming to install a new interim prime minister, Barnier’s removal is deepening the political crisis in the Eurozone's second-largest economy. This is likely to result in more headaches for euro traders, who may have just closed some of their short positions yesterday on a “buy the fact” strategy.

In terms of monetary policy, ECB President Lagarde said that the ECB will continue lowering interest rates, but she refrained from committing to any rate-path pace. The Bank’s next policy gathering is next Thursday, and traders are assigning an 85% chance for a 25bps rate cut, with the remaining 15% pointing to a bigger 50bps reduction.

In Japan, market participants scaled back somewhat their BoJ hike bets and from around 15bps at the upcoming gathering on December 19, they are now penciling in only 9. Yet, the Japanese yen remains on the front foot against its US counterpart today.

Bitcoin and Wall Street Rally as Trump Appoints Atkins

Bitcoin stole the show once again, climbing above $100,000 for the first time on Thursday and hitting a fresh record high of $103,619 after US President-elect Donald Trump said he would nominate Paul Atkins as the CEO of the Securities and Exchange Commission.

Atkins is a former top SEC official who has advocated for de-regulation of cryptocurrencies, and thus, his nomination may be explaining the rally on Wall Street as well, despite Powell repeating his cautious stance on interest rate cuts.

On his Truth Social platform, Trump noted that Atkins believes in the promise of robust, innovative capital markets, allowing high-growth tech stocks to drive US equity indices to fresh record highs. Both the Dow Jones and the S&P 500 gained more than 0.60%, while the tech-heavy Nasdaq rallied 1.30%.