Summary:

-

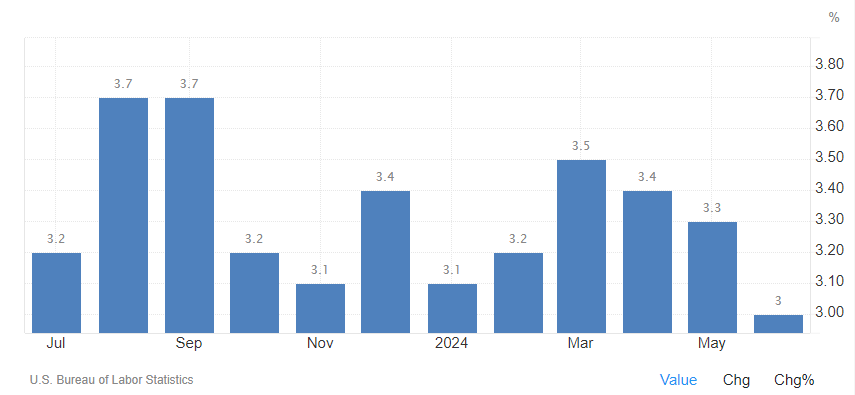

Market expectations for July’s US CPI data release are centered around a 0.2% month-over-month increase and a 3% year-over-year increase.

-

Different CPI outcomes will have varying effects on the markets with each potential outcome broken down.

-

The US Dollar Index (DXY) is currently testing support at 102.40 and faces immediate resistance at 103.00.

-

Will the Inflation print solidify a September rate cut?

Today’s release of the US CPI data has a consensus expectation of a 0.2% month-over-month increase for July, which is likely to cement a rate cut by the Federal Reserve in September.

Source: TradingEconomics (click to enlarge)

Approaching the inflation readings in April and May, markets were considerably more anxious due to the March spike to 3.5%.

However, the dynamics have shifted following a series of weakening data from the US, along with encouraging signs from the June inflation print, which reached 3%, a one-year low.

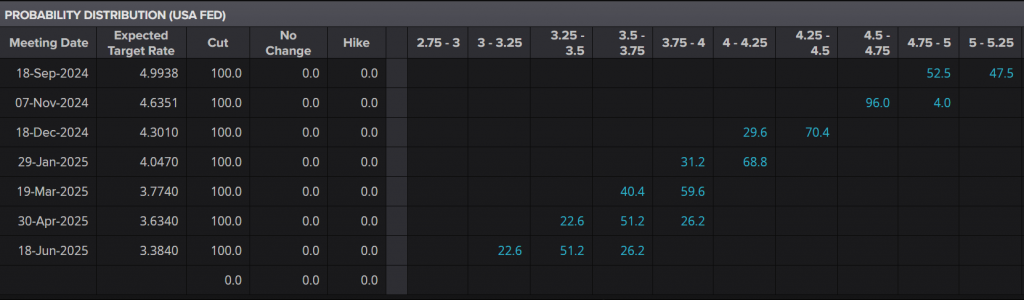

In response to this softening data, market participants have started to aggressively price in rate cuts from the Federal Reserve as recession concerns emerge.

Source: LSEG (click to enlarge)

There have been positives with the recent PPI data which showed a year-on-year increase of 2.2%—a notable decline from the previous month’s 2.6%. Similarly, the core PPI number dropped to 2.4% from 3% the prior month, with the month-over-month increase remaining modest at 0.1%.

These figures suggest that inflationary pressures are beginning to subside, offering another ray of hope to both consumers and policymakers.

Potential Scenarios from the CPI Release

With today’s CPI release, market participants are keen to understand the current economic climate and prospective trends.

Numerous factors continue to influence US and global inflation trends, such as labor market concerns, supply chain disruptions, geopolitical events, and energy prices. Several scenarios could unfold, with the most anticipated being a consensus print of 0.2% month-over-month and 3% year-over-year.

Let’s explore the potential market impacts based on different scenarios.

Inflation Above Expectations: Should the CPI data reveal higher-than-expected inflation, is possibly the worst outcome. High inflation combined with a decelerating economy could result in another risk-off event and a move towards safer assets.

This scenario could lead to increased volatility in financial markets, with equities and indices such as the S&P 500 and Nasdaq 100 potentially experiencing downward pressure.

Inflation Meets Expectations: If the inflation figures align with market expectations, it may provide a sense of stability and reassurance around September rate cuts. This outcome would suggest that current monetary policies are effectively managing inflation, likely resulting in a neutral to positive market reaction.

Inflation Below Expectations: Lower-than-expected inflation data could bolster the case for a more dovish stance from the Federal Reserve and could spark a renewed selloff in the US dollar. This scenario might lead to a rally in equity markets as investors gain confidence and market sentiment continues to improve.

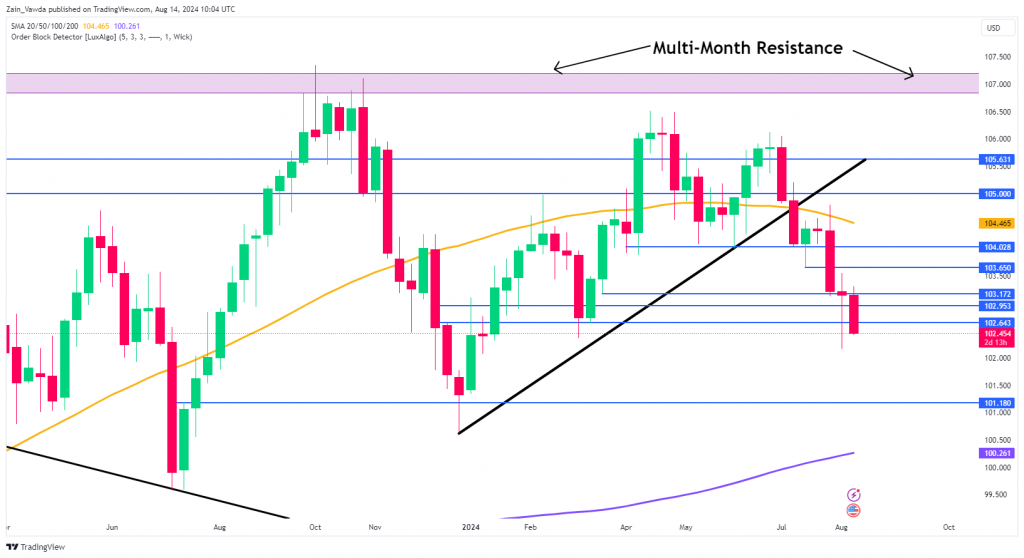

Technical Analysis of Dollar

From a technical perspective, the DXY is declining this morning, testing the support level at 102.40. Although it showed strong recovery last week, it has been under pressure this week. US PPI data has further weakened the dollar, pushing the DXY closer to the December 2023 lows around 101.00.

The DXY is at a critical juncture as markets brace for potential rate cuts in the second half of the year, making it vulnerable to a possible retest of the psychological 100.00 level.

Any recovery from this point will face immediate resistance at 103.00, followed by 103.17 and 103.65.

Source: TradingView.com (click to enlarge)

Support

-

102.40

-

101.20

-

100.26 (200-day MA)

Resistance

-

103.00

-

103.65

-

104.00