QE has ended and growth is picking up along with the labor market. This now puts the spotlight on the Fed and their timing for interest rate rises.

GROWTH EXPECTATIONS:

GDP has been stellar throughout the previous quarter.The November reading for GDP q/q came in at a very strong 5.0% q/q (4.3% exp) figure which surprised the markets. As a result, many now believe that GDP figures could even pick up further, as quarterly data from the Christmas period is traditionally stronger. Coupled with positive labor figures, it’s likely we could see some minor revisions in GDP forecasts, which would be in the positive territory.

The Labor market has been another of the positives recently out of the USA, as non-farm payrolls produced a very strong reading for November of 321K, we saw a drop in the unemployment rate to 5.8% compared to 6.1% from the last quarterly report. The Federal Reserve (Fed) has been receptive to the changes in the labor market, and the unemployment rate is currently sitting at its 50 year average, so this bodes well for the US market as a whole.

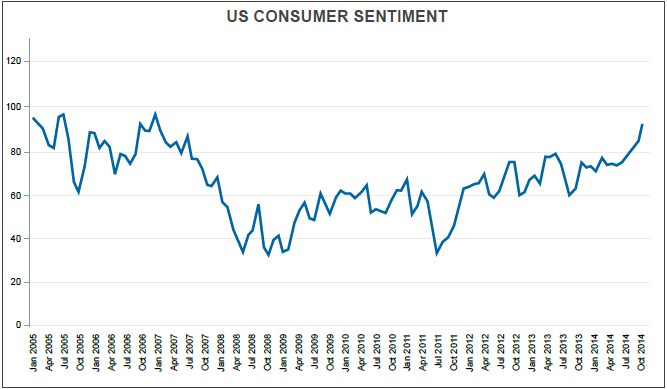

The University of Michigan Consumer Sentiment continues to also impress the market. Despite people worrying about various parts of the economy, the retail and consumer sector has so far been exceptional for the US economy. The December reading came in at 93.6; a reading not seen since 2006 pre-recession level. Retail sales also picked up sharply before Christmas, with strong readings of 0.3% m/m for October (0.2% exp) and 0.7% m/m (0.4% exp) in November.

MONETARY POLICY:

Tapering, the cornerstone of America’s Quantitative Easing (QE) program has finally ended in the previous quarter, and going forward, it’s unlikely we will see it reemerge any time soon given the current pick up in the American economy.

Inflation remains an ever present threat for the economy, however, with the recent drops in oil prices, the Fed has said “with lower energy prices and a stronger Dollar, it’s likely to keep inflation below target for some time”. This is no surprise for the market and we may see the expected interest rate rise delayed until the 2nd or 3rd quarter of2015 due to the dovish nature of Yellen.

Interest rates have sat at historic lows for some time and the market is no stranger to them now; in fact, it has enabled the housing market to recover significantly and overall business investment has increased. The rate of 0.25% is expected to be at least 0.50% by the year end and the market is now anticipating this to be at least after April. We believe, based on current forecasts and the low inflation rates expected, it may happen much later as the Fed has been quite Dovish on previous moves.

FX OUTLOOK:

US dollar strength has so far been one of the largest market movers, especially as the euro continues to struggle in forex markets. Our outlook remains bullish for the USD in the long term, as interest rate rises and an improving economy continue to produce on a positive outlook for the currency. A delay in interest rate rises could cause a pullback for the currency. Nevertheless,all signs point to further bullish movements during 2015 especially in the first quarter as market anticipation builds up.

EQUITY OUTLOOK:

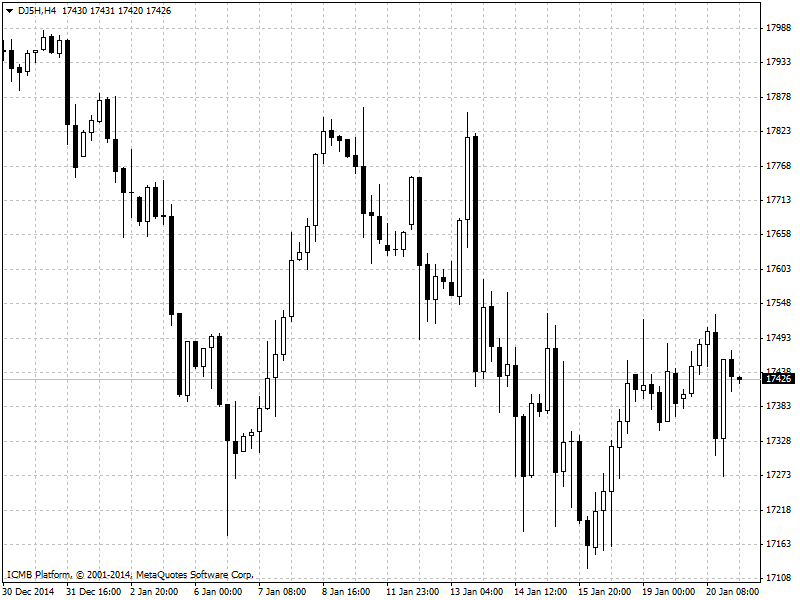

Equities have continued to do well. However, volatility was much more aggressive during the last quarter and the coming quarter could see some strong pullbacks on the charts. Looking forward, the bull market is still running its course, but with interest rate rises on the horizon, we could see a shift in capital from equity markets into other avenues. The S&P 500 has been the most volatile with large pull backs seen on a regular basis. The Dow Jones as well has seen solid movement but not to the same extent and traders will be more focused on S&P volatility for short term trends.