Looking at the Thursday session, there’s very little in the way of economic announcements to move the marketplace, with perhaps the Bank of Canada governor speaking been the most dangerous one, but that should be limited to the Canadian dollar itself. Ultimately, we believe that the Retail Sales number out of the United Kingdom is probably the biggest member, with perhaps the FTSE been primed to move during the session.

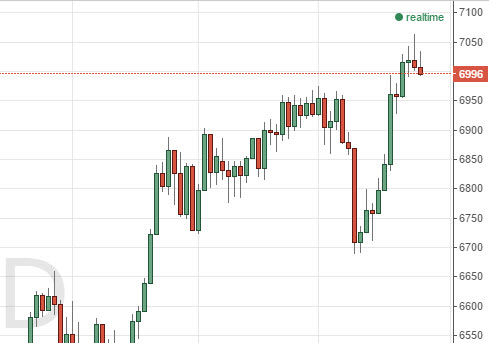

Looking at the FTSE, you can see that we tried to rally during the course of the session on Wednesday, but turned back around to form a shooting star. Because of this we believe that the market will drop a little bit from here, but probably find support somewhere closer to the 6950 level. With that being the case, we are more than willing to buy calls on supportive candles, or a break out to a fresh, new high.

The EUR/USD pair as you can see tried to rally again during the session on Wednesday, but keeps running into trouble at the 1.10 level. That being the case, the market looks as if you can buy puts every time he a close and therefore short-term opportunities. We do not believe that the EUR/USD pair is going to break out to the upside for any significant amount of time, so we remain fairly bearish.

The S&P 500 continues to be a bit soft at the moment, but we believe that ultimately the S&P 500 will continue to go much higher, offering call buying opportunities on supportive candles going forward. We believe that the S&P 500 will continue to be a market that breaks out to the upside, and as a result we remain bullish over the longer term.