Looking at the Wednesday session, we believe that the United Kingdom releasing its GDP numbers will be the highlight of economic announcements. True, there is a Core Durable Goods Orders number coming out of the United States, but it is also the day before Thanksgiving, so it’s very unlikely that the markets move with any significant. With that being said, we believe that the FTSE and the GBP/USD markets might be the ones to watch for the Wednesday session.

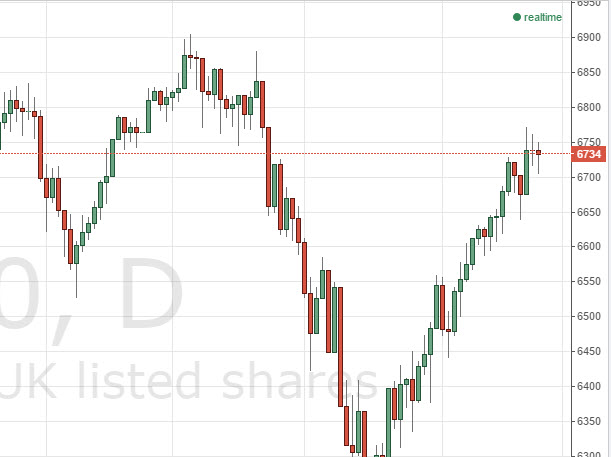

We believe that the FTSE struggling in the general vicinity that we are at right now probably leads us a little bit lower and into call buying opportunities. We believe that the market will eventually go to the 6900 level, and perhaps even higher given enough time. We like the FTSE, as the British pound has been weakening over the longer term so it does of course help exports.

The GBP/USD pair should continue to offer put buying opportunities, as we believe that there is a significant amount of resistance between here and the 1.60 handle, which essentially is where we would consider the trend to change. We like sending this market down to the 1.55 handle, and perhaps even as low as the 1.50 level.

The S&P 500, the NASDAQ, and the Dow Jones Industrial Average will all be very quiet. We just have a hard time thinking that traders are going to want to put on large position to write before the holiday. With that, we believe that any pullback should be looked at as potential value for next week, as we believe in the validity of the uptrend in all three of those markets. Ultimately, we still favor the US and the US dollar, so we are bullish and hope for a little bit of a pullback but will essentially leave it alone at this point.