Economist Hyman Minksy argued that when a private sector accumulates too much debt, an economic system buckles. Supporters of his theories point to the catastrophic effect that sub-prime mortgages had on the 2007-2009 U.S. economy. Detractors simply highlight the 2010-2011 eurozone crisis. In essence, the excessive borrowing and spending by beleaguered European nations nearly destroyed the region’s financial structure and still cripples economic growth to this day.

Personally, I feel that Dr. Minsky’s larger contribution to understanding why an economy self-destructs is rooted in psychology. He wrote, “the more stable things appear, the more dangerous the ultimate outcome will be, because people start to assume everything will be all right and end up doing stupid things.” Minsky may have been addressing why borrowers go overboard. However, he could just as easily have been talking about why an individual or entity would pay a price-to-earnings valuation of 90.

Enter Uber — the San Francisco-based online vehicle dispatcher. I have the application on my iPhone. I love using the car-for-hire company to get from one place to another. And yet, I would not dream of paying high double-digit P/Es or triple-digit P/Es for the right to own shares of Twitter (NYSE:TWTR), Tesla (NASDAQ:TSLA), Netflix (NASDAQ:NFLX), Facebook (NASDAQ:FB) or Uber.

Those who remember the dot-com mania in the 1990s have seen the speculative silliness before. Transformative ideas become businesses. Users become passionate investors who pay any price to partake. Mindless participation continues to inflate a balloon for years until, eventually, a variety of forces supersede greed, and a bubble bursts.

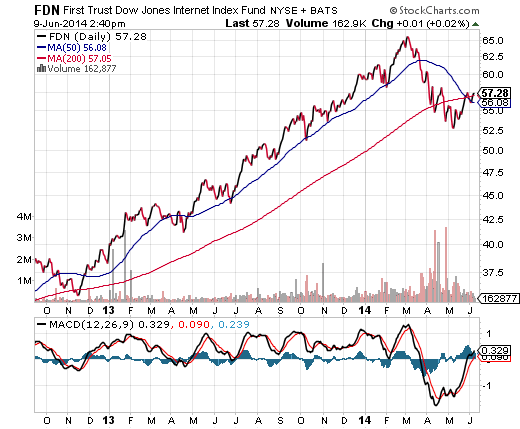

“New tech” may already have started the process of crashing. Take a look at the chart patterns of funds like PowerShares NASDAQ Internet (NASDAQ:PNQI), Global X Social Media (NASDAQ:SOCL) or First Trust Dow Jones Internet (NYSE:FDN). Did they begin breaking down in March, reaching bearish loss levels before rebounding handsomely in May? They have. Similarly, when the NASDAQ pierced bearish 20% losses in March and April of 2000, the tech-laden benchmark managed to recover ground from May to September of that year. The real carnage came shortly thereafter.

So is the entire U.S. stock market in danger of imploding? Thomson Reuters and Morgan Stanley Research found that 40% of technology companies currently carry lofty price-to-sales (P/S) valuations above 5x. In contrast, between 1997 and 1999, 80% of technology corporations traded above 5x. It follows that overpriced “new tech/Internet” stock shares could crash, but their collective impact on the entire marketplace would not be as large.

Of course, the fictional character Forrest Gump reminded us all that we are what we do. “Stupid is as stupid does.” One can be an intelligent person on paper, but if the smart person does a dumb thing, his/her behavior is no less idiotic than if a simpleton had done it.

Is the investment crowd currently acting in an imbecilic manner? Perhaps. Yet stupidity may take a number of years before it is disciplined. Forrest Gump appeared in the theaters in 1994. Two-and-a-half years later in late 1996, Alan Greenspan suggested that irrational exuberance might be unduly escalating asset values. Yet it was not until March of 2000 that the smart money punished dot-com dopiness.

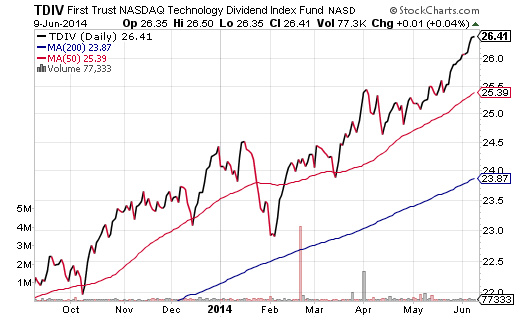

Ironically, “old tech” is still fairly valued. The trailing 12-month P/E for First Trust Internet approximates 36, while the trailing 12-month P/E for First Trust Technology Dividend (NASDAQ:TDIV) is closer to 15.5. The S&P 500? 18.5. Favoring old school technology corporations that reward shareholders via dividend increases and buybacks — companies like Apple (NASDAQ:AAPL), Cisco (NASDAQ:CSCO), Microsoft (NASDAQ:MSFT), Oracle (NYSE:ORCL) and Qualcomm (NASDAQ:QCOM) — is one way to partially insure against behaving foolishly.

There are other forms of insurance as well. Stop-limit loss orders, hedges, put options — intelligent investors take steps to protect accounts against severe wealth destruction. After all, inexpensive assets can always get dramatically cheaper and global panics can make the most rational decisions seem dumb.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.