Daily Briefing

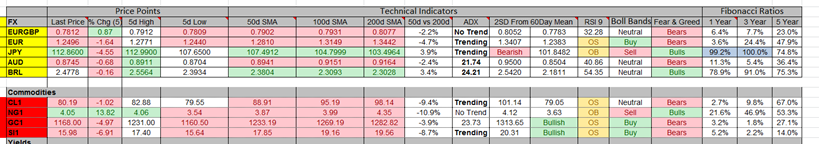

Currencies

- EUR/USD: The pair is trading below its downward trend line on a 240 minute time frame. The next support is at 1.2318 and the next resistance is at 1.2895.

- USD/JPY: The pair is trading above its upward trend line on a 240 minute time frame. The next support is at 109.18 and resistance at 114.28

- GBP/USD: The pair is trading in a rectangular pattern on a 240 minute time frame. The resistance is near the 1.6588 and the support is at 1.5907.

Indicators

Indices

- Asian Markets closed mostly mixed on the first trading day of the week. The Hang Seng index was the worst performing index during the session and it closed lower with a loss of 0.34%. The index is down nearly by 0.34% in the past 5 days.

- European stock markets are trading lower during the early hours of trading. The FTSE MIB index is the worst performing index during the session and it is trading lower with a loss of 0.38%. The index is up by almost 0.29% in the past 5 days.

- US Indices futures are trading flay ahead of ISM manufacturing data. Most indices closed higher on Friday and the NASDAQ index was the best performer with a gain of 1.42%.

TOP News

- The Australian building approvals m/m data fell short of the previous reading of 3.4%. The final reading was at -11.0%

- The Chinese HSBC manufacturing data matched the previous reading of 50.4.

- The Italian manufacturing PMI data came in at 49.0 while the forecast was at 50.6.

Things to Remember

- Stops are your biggest friends so make sure use them.

Market Sentiment

- Gold: The precious metal under tremendous selling pressure and most of the technical indicators are giving oversold signals. The support is at 1150 and the resistance is at 1200.

- Crude Oil: The black gold is consolidating near the $80 mark and the trading above the 50day and 100 day moving average on a 30 minute time frame. The next resistance is at 85 and the support is at 77

- VIX: Volatility index dropped nearly -3.37% on Friday.

News Agenda For Today

GBP 09:30 Manufacturing PMI

USD 15:00 ISM Manufacturing PMI

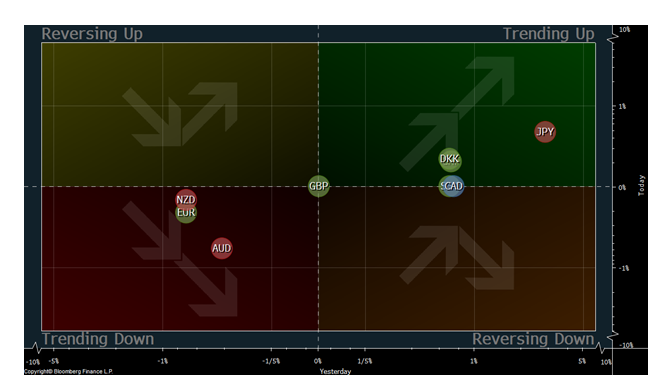

Trend

The JPY and DKK are trending up against the USD, while the EUR and AUD are trading lower against the USD on an intra-day basis.

Disclosure & Disclaimer: The above is for informational purposes only and NOT to be construed as specific trading advice. responsibility for trade decisions is solely with the reader.

by Naeem Aslam