The S&P 500 and the Dow may be toiling to reclaim the glory of all-time record peaks. On the other hand, nearly 200 ETFs have already recovered 52-week highs, terminating the notion of a lengthy stock market correction. The list of winners includes some of the biggest names from 2013, including: (a) Powershares DJ Pharmaceuticals (PJP), (b) iShares Medical Devices (IHI) (c) First Trust Internet (FDN), (d) Guggenheim Global Solar Energy (TAN) and (e) PowerShares NASDAQ 100 (QQQ).

I have favored technology and health care for quite some time in client portfolios. Granted, I may be paying a premium for the privilege of ownership. Yet the less volatile drawdowns for tech and health care over the last twelve months reinforce the case for over-weighting them. In contrast, backing away from consumer-oriented sectors is more easily justifiable. Retail sales data as well as retailer earnings have been anemic. Employers barely hired in December or January. Meanwhile, homebuilder confidence suffered its largest one-month drop ever in February.

For all the discussion about the effect of Federal Reserve tapering on emerging market currencies — for all the worry surrounding stagnant growth in the euro-zone and sub-par growth in China — Japanese economic policy may trump everything. For one thing, if Japan’s leaders do not inspire confidence, those who have borrowed the country’s yen to invest in riskier assets (e.g., small European companies, US. biotech stars, etc.) would be forced to sell and pay back their loans. Not only would risky assets lose value, but the yen would appreciate and the export-dependent Japanese economy would suffer. Second, the world’s third largest economy has not been successful in generating wage inflation or appreciable increases in spending. If something does not change, additional declines in Japanese stocks could spill over into other developed world stocks.

At present, Japan may be at the epicenter of stock market volatility. Investors are growing impatient with the country’s weak economic data. Similarly, the yen’s perceived strength is indicative of future struggles in the exporting of goods. It follows that the only thing that may quiet the crowd would be a combination of yen depreciation and additional monetary stimulus. Note: More monetary stimulus would be adding to an existing asset purchase program that is 3x larger than the quantitative easing (QE) program of the United States when adjusted for GDP.

Perhaps fortunately, the Bank of Japan (BOJ) introduced several steps yesterday to encourage banks to lend. (Banks are sitting on monstrous reserves, whether it is a fear of lending or limited borrower demand or both.) The action heightened investor expectations for additional bond purchasing by the Bank of Japan in the future and sent the yen lower. In fact, February’s drop in the yen via funds like CurrencyShares Yen Trust (FXY) played a key role in minimizing January’s sell-off in U.S. and European stocks.

Critics suggest that the impact of doubling the scope of two separate lending initiatives will be inconsequential. What critics may be missing, however, is reaction by traders of the currency and of Japanese equities. Specifically, the Bank of Japan had not been expected to do anything at its recent gathering; instead, it announced two new efforts. The fact that the yen has continued to drop in February and that Japanese stocks rocketed on the announcement suggest that more aggressive stimulus by the BOJ is probable. In the short- and immediate-term, investors love monetary stimulus.

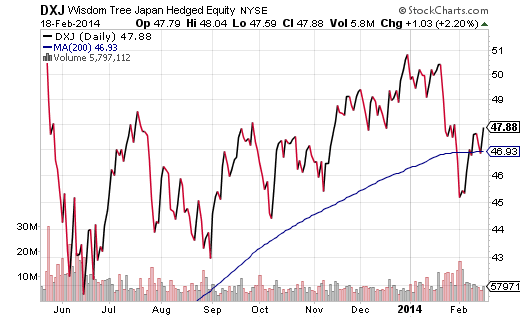

WisdomTree Hedged Japan Equity (DXJ) forfeited nearly 11.8% in value at its lowest ebb in 2014. DXJ has since popped 6.4% off of the bottom, providing support for the notion that central banks are quite adept at inflating asset prices. It is true that U.S. and European stocks completely decoupled from emerging market equities in 2013. In an era of unprecedented currency and interest rate manipulation, though, stock markets in the U.S. and Europe will not be able to divorce themselves from what happens in Japan. What happens in Japan matters to developed country stocks the world over.

It follows that faith in Japanese QE is every bit as important as the faith the investing community has placed in Yellen’s Fed and Carney’s Bank of England. The price direction (up/down) and fund flow (in/out) for WisdomTree Hedged Japan Equity (DXJ) may very well foreshadow how U.S. and European stocks will fare in the months ahead.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.