Investors can borrow a currency with low interest rates or zero interest rates and buy risk assets (e.g., stocks, bonds, commodities, currencies, etc.) in a currency with a higher interest rate. For example, a hedge fund might decide to borrow the low-yielding Japanese yen to buy New Zealand stocks that trade in the higher-yielding New Zealand dollar. This is often referred to as a “carry trade.” Similarly, when the U.S. Federal Reserve made it possible for the world to borrow U.S. dollars at record low interest rates at the tail end of 2008, carry trade speculators began pouring money into emerging market assets. The result? Funds like Vanguard Emerging Markets (VWO) rocketed at twice the pace of the SPDR Trust S&P 500 (SPY).

Perhaps unfortunately, most emerging markets depend on cheap labor to boost exports; most are not yet capable of relying on their middle-class consumers to fuel economic growth. It follows that central banks in many of those emerging countries viewed their rapid currency appreciation as a threat to their well-being, and chose to cut rates alongside the rest of the world. The globally coordinated activity has often been referred to by the moniker, “the currency wars.”

Fast forward to 2011. Whereas the lower rates had benefited consumerism in the developed world, unnecessarily low rates in emerging economies eventually served to deter foreign investment. Why borrow the yen or the dollar to invest in the emergers when the lower-than-necessary rates are adversely affecting their currencies? And when the U.S. Fed finally shifted its monetary policy from ultra-accommodative to a slightly less accommodating stance (a.k.a. “tapering”) at the tail end of 2013, emerging market currencies rapidly depreciated in value. The adverse effect on non-dollar-denominated emerging market stocks can be seen in the performance discrepancy between VWO and SPY.

Not surprisingly, investors have been abandoning emerging markets faster than fans of the Denver Broncos hid football paraphernalia in junk drawers. Roughly $11 billion left emerging market stock ETFs in January 2014 alone. Yet developed market stock ETFs in the U.S. have not been immune either, as $13 billion left U.S. stocks in January as well. Some of the selling is related to profit-taking. Some can be tied to bleaker-than-anticipated U.S. economic data. Yet a whole lot of the activity may be attributable to repatriation of the Japanese yen (a.k.a. “reverse carry trade”).

Remember, if investors borrow from a lower-yielding currency like the yen, they have to pay the money back in yen. A stable or weakening yen makes the carry trade desirable. On the flip side, if the yen is appreciating as a safer haven in relation to emerging market currencies, or even the U.S. dollar, carry traders reverse course; that is, they sell their stocks and other risk assets to quickly pay back their loans, as a strengthening yen makes the carry trade undesirable.

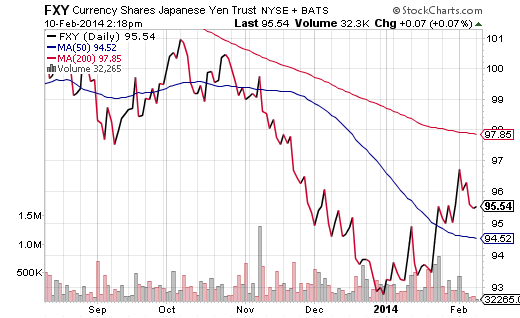

Fortunately, ETF enthusiasts can track several Currency ETFs to determine the level of risk that they are comfortable with. For instance, one should keep an eye on the Japanese Yen Trust (FXY). While its recent jump above a short-term, 50-day moving average is not a serious blow to U.S. equities, a move above a 200-day trendline might be.

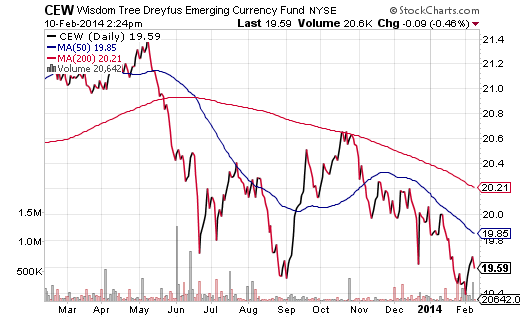

By the same token, when the Fed first hinted at tapering its bond buying back in May of 2013, emerging market currencies plummeted. So did a wide variety of interest-rate sensitive assets. Yet here in 2014, Wisdom Tree Emerging Market Currency Fund (CEW) hit a new 52-week low at the end of January. Further erosion of CEW would signal more concern about a currency crisis overwhelming the governments of countries like Turkey, Argentina and Brazil.

Tracking currency ETFs cannot tell a stock investor everything he/she needs to know about probable market outcomes. Nevertheless, if you have been trying to determine whether to raise or lower your exposure to equities, a quick glance at funds like FXY and CEW may aid in the decision-making process.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.