Glum economic data derailed U.S. stocks in January. A mammoth “miss” for manufacturing activity, an unsettling decline in mortgage applications as well as an appalling “net-new-jobs” number were some of the high-profile culprits. At long last, it seemed as if the market might treat bad news as a reason to recoil.

Here in February, though, disappointing data have only strengthened the resolve of buy-the-dip investors. Job growth deceleration from a 3-month rolling average of 190,000 down to 150,000 sent U.S. stocks surging a week ago. Fed chair Janet Yellen ignited additional stock sparks by emphasizing that tapering of the central bank’s electronic money creation is not on a pre-set course. Meanwhile, the sharp drop in retail sales in December and January sent benchmarks higher as well; presumably, economic weakness implies the Federal Reserve may have to maintain or even raise the dollar amount of its emergency level bond-buying beyond 2014.

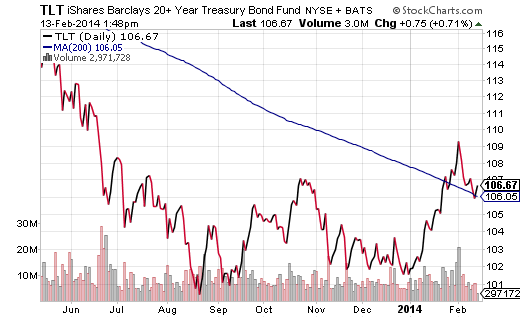

Are U.S. stocks still the place to be, then? Yes and no. The popular question assumes that fund flow will concentrate in U.S. equities at the expense of other asset classes. At the same time, “risk-off” assets like iShares 20+ Year Treasury (TLT), SPDR Gold Trust (GLD) and CurrencyShares Japanese Yen Trust (FXY) are some of 2014’s best performers.

At the very least, investors who diversify across a wide-range of asset classes may finally enjoy the fruits of their diversification labor. In 2013, diversifying left many ETF enthusiasts with a bad case of performance envy, as U.S. stocks reigned supreme.

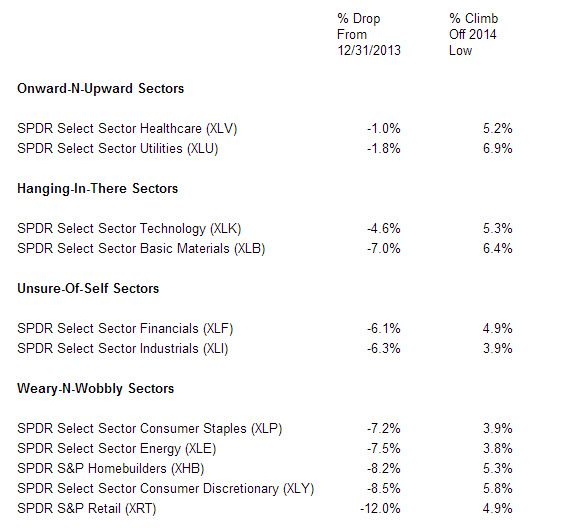

There are signs of weariness in stocks tied to the U.S. consumer, however. Healthcare (XLV), Utilities (XLU) and Technology (XLK) have been pulling most of the weight for the ever-popular S&P 500. In contrast, S&P 500 stocks in economic segments such as retail, consumer staples, consumer discretionary and homebuilding have a lot more recovery work ahead.

From my vantage point, there are two key takeaways from the first six weeks of 2014. First and foremost, diversification is back. For those who had given up on bonds and insisted that rates had only one direction to go (i.e., “up”), I encourage you to reread “Against the Herd: Lower Rates Rather Than Higher Rates In 2014.” Similarly, those who had abandoned commodities might want to keep an eye on PowerShares DB Commodity (DBC) for a potential breakout above a long-term, 200-day trendline.

Second, in the absence of confirmation by Janet Yellen’s Fed that they will suspend a tapering increment or even increase bond buying from current levels (i.e., $65 billion), I favor late-cycle sector stars like Healthcare (XLV) as well as less volatile funds like iShares USA Minimum Volatility (USMV). Like the Seattle Seahawks demonstrated in the Superbowl, defense is often the premier key to attaining the ultimate prize.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.