A lot of Trump trades have gained great favor over the past month. Twitter Inc (NYSE:TWTR) is one potential trade I am still waiting to pop.

Trump’s Twitter habit is of course well-known and probably legendary at this point. As a result, Twitter has become a household name more than ever across the social and media spectrum. “Twitter” is a strong brand name, and “tweeting” or a “tweet” might as well be the equivalent of must-see, breaking news. When it comes to theme-based trading, these attributes are typically enough to launch an associated skyward. Unfortunately for Twitter, its easily recognized brand also comes with a lot of baggage that has already weighed heavily on the stock.

Twitter is inching toward closing its last big gap down in October. Could Trump’s tweeting habit provide the next catalyst to capture investor imaginations?

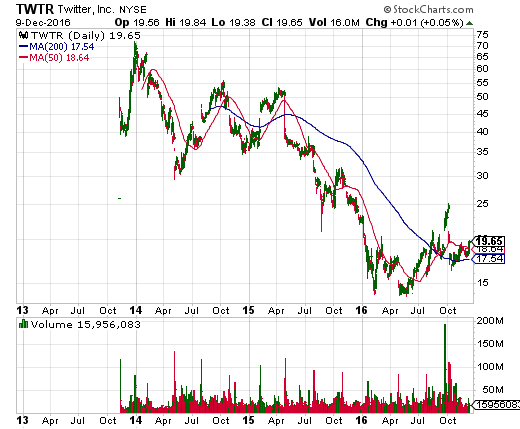

Twitter’s best days are definitely way in the past but a bottom may finally be at hand with this year’s successful test of all-time lows.

While TWTR is up 6.9% since the election, the stock generated most of that gain in the first day of post-election trading. TWTR even lost all of those gains over the course of the following two weeks. TWTR is now up 6.3% for December.

The first daily chart above shows that TWTR is on the edge of a breakout. Even if no follow-through occurs in December, I fully expect a friendly January with the relief from the pressure of end-of-year selling. Note that TWTR’s post-election gain is ahead of the S&P 500’s (via SPDR S&P 500 (NYSE:SPY)) 5.6% post-election gain and the NASDAQ’s (PowerShares QQQ Trust Series 1 (NASDAQ:QQQ)) 4.8% gain, but it is peanuts compared to the post-election gains in the likes of United States Steel Corporation (NYSE:X) of 72% or Goldman Sachs (NYSE:GS) of 33%.

I made a big mistake in failing to take profits on my short put when the M&A rumors were hot and heavy. That position is now back to roughly even. After the M&A excitement completely fizzled out, I stubbornly took out a fresh short position on a January 15 2018 put. That position allows me to buy TWTR for under $12.50 whereas the first one has a break-even at just under $20. My main outstanding question is whether Twitter will retain its cachet after inauguration…

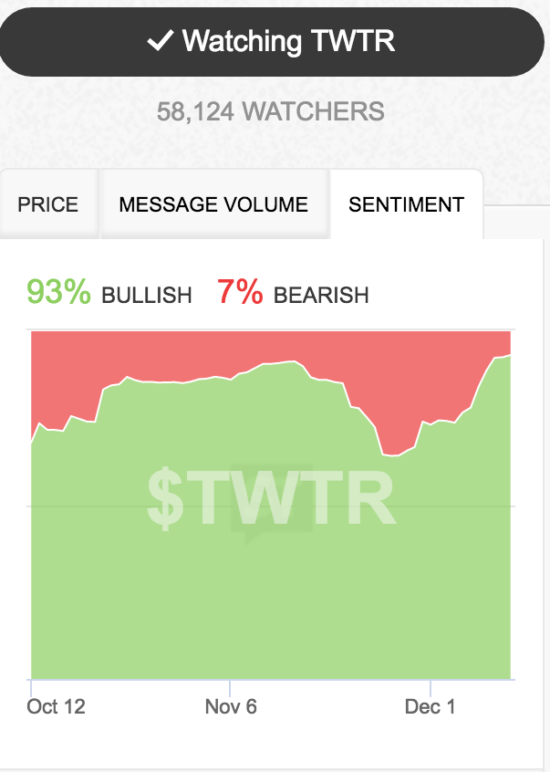

At least I am aligned with the good folks on StockTwits!

Be careful out there!

Full disclosure: short TWTR put options