Forex News and Events

Turkish central bank should act

In the wake of the failed military coup in Turkey investors will be focused on today’s central bank MPC meeting. So far markets have reacted in an orderly fashion to unfolding events, yet, short-term risks remain, while longer-term questions will damage outlook and growth. The stability seen in Turkish assets, with 5-year CDS only inching up 20bp to 246 since Friday’s close, is indicative of a risk-on environment, rather than faith in Turkish resiliency. President Erdogan is expected to use these events to tighten his political grip.

Lingering political and social uncertainly is likely to result in a deterioration of economic fundamentals and threaten investment grade sovereign ratings. This comes at a time when Europe, Turkey's largest trading partner and primary source of tourism, is stifled by stagnation and Brexit repercussions.

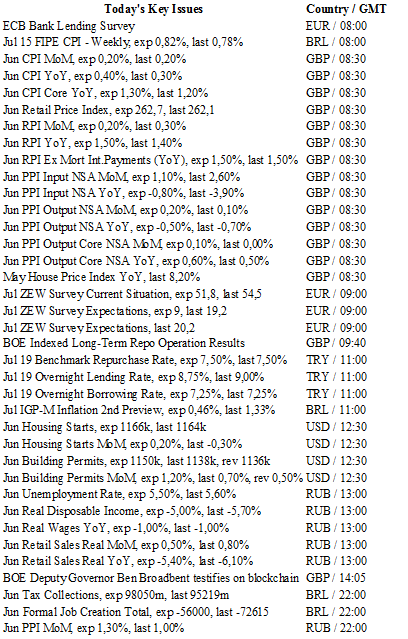

Given this backdrop we anticipate a deeper than consensus central bank action as policy makers attempt to get ahead of the curve (despite anxieties over renascent inflation pressure). We expect the CBT to ease the O/N lending rate 50bp to 8.5% (consensus 25bp to 8.75%), while keeping the benchmark and O/N borrowing unchanged at 7.50% & 7.25% respectively. The move is unlikely to have a lasting impact on USD/TRY trading on the 2.9800 handle. In the longer term, TRY looks significantly vulnerable, especially in the event that President Erdogan prolong tensions. Foreign currency loans remain a significant part of the banks’ balance sheet so further weakness could prompt funding concerns. Given the current environment, TRY is likely to underperform any EM rally, while investors will likely cut TRY positions quickly in a risk-off scenario.

US Stocks: Is the sky the limit?

The S&P 500 is trading at a record high, closing at 2166.89 points on Monday. While global uncertainties are important, it appears that US stocks may be overvalued. We remain cautious on the true assessment of the US economy. In fact we believe that US fundamentals are overestimated (in particular labour data). In other words, a stronger US stock market would clearly mean that the American economy is expanding. We are skeptical of this.

Our view is to look at the unlimited liquidity central banks may be willing to offer. Stock markets are no longer driven by fundamentals but by central bank policymakers and quantitative easing. Earlier last week, Ben Bernanke’s visit to Japan and rumours of BoJ helicopter money pushed the Nikkei higher, around 8% in three sessions, even though we know that Japan is struggling for sustainable economic expansion and fighting against deflation.

There is, and we have been saying this for some time, absolutely no monetary policy divergence. Investors understand that rates will remain low for some time. According to Fed Fund Futures, a US rate cut before the end of 2017 is now possible - yes, even if right now the probability seems extremely small. As we have written several times, the path to US rate hike is largely overestimated and should continue to underpin the stock market.

It is also true that the current S&P 500 P/E ratio (Share/ Earnings - incl. dividends) is not at its 2009 level. It is around 25. We recall that this indicator being way higher in 2009 at 123.73. Most earnings for Q2 declined and we should see the P/E ratio increasing again.

There is no reason why US stocks would decline right now as easing should continue. 2200 on the S&P 500 represents therefore a decent target on the 1-2 month term horizon. Yet, a risk off move or panic may trigger a sharp downside move on US stocks. The US election is the new market focus and a QE4 should be expected.

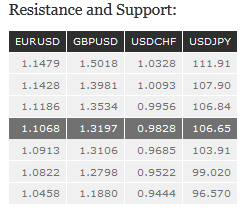

USD/JPY - Towards Resistance At 106.84.