Market Brief

It was a busy weekend in Turkey. After losing the majority at the parliament in June, the AKP has reclaimed its position, by securing more than 49% of the votes cast (predictions). Both the Peoples’ Democratic Party and the Nationalist Movement Party have lost ground, down 21 and 38 seats (predictions) respectively. The market cheered the news with the TRY rising more than 3.50% against the US dollar as investors interpret this clear victory as a step toward more stability in the region. USD/TRY fell as low as 2.7580 before stabilising at around 2.7850. Turkish shares rose more than 5%.

In Tokyo, USD/JPY traded range-bound between 120.25 and 120.80. On the medium-term, the pair remains within its 2-month range of 118-121.60. On the downside, the closest support lies at 119.62 (low from October 22nd), while on the upside, the 121.75 resistance continues to hold since August 28th).

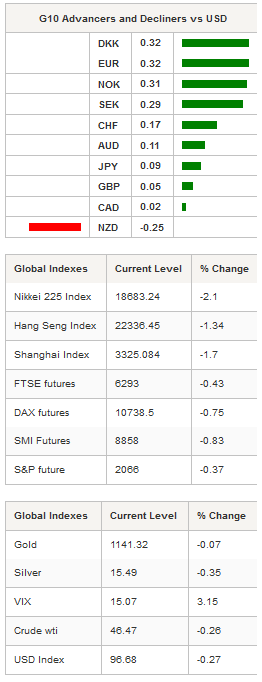

On the equity front, the disappointing data from China is weighing heavily on equities across the board. October official manufacturing PMI stayed unchanged at 49.8, falling short of the 50 reading expected by the market. In spite of a small improvement of the Caixin PMI, which rose to 48.3 (versus 47.6 consensus) from 47.2 in September, the mark is still below the 50 threshold, meaning that the manufacturing sector contracted over the period. The Shanghai and the Shenzhen Composite are down 2% and 1.70% respectively, while in Tokyo the Nikkei fell 2.10% as the final reading of the manufacturing PMI for October was revised down to 52.4 from 52.5.

In South Korea, the KOSPI index rose 0.28%. October trade balance printed at $6.7bn versus $7.1bn median forecast, while the previous figure was revised slightly lower to $8.919bn. In addition, South Korea’s manufacturing PMI fell further in October, reaching 49.1 compared to 49.2 in the previous month. USD/KRW didn’t react much to the headlines, suggesting that the market considers those figures as acceptable given the current weakness of the manufacturing sector across Asian countries.

In Australia, AIG performance of manufacturing index fell to 50.2 from 52.1 in September. TD securities inflation slid to 1.8%y/y from 1.9%y/y in September, while building approval climbed 2.2%m/m, beating an expected 1% and previous month revised figure of -9.5%. Finally, the commodity index continues to fall sharply in October, contracting 19.8%y/y after a drop of 21% in September. AUD/USD erased early session losses and is now testing the resistance lying at 0.7139 (Fibo. 50% on September-October rally).

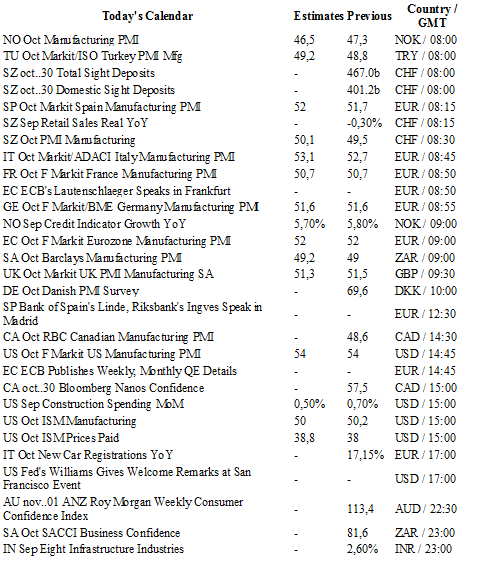

Today traders will be watching manufacturing PMI from Norway, Turkey, Spain, Italy, France, Germany, euro zone, South Africa, UK, Canada and the US; construction spending and ISM price paid from the US.

Currency Tech

EUR/USD

R 2: 1.1495

R 1: 1.1387

CURRENT: 1.1036

S 1: 1.0809

S 2: 1.0458

GBP/USD

R 2: 1.5819

R 1: 1.5659

CURRENT: 1.5431

S 1: 1.5202

S 2: 1.5089

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 120.49

S 1: 118.07

S 2: 116.18

USD/CHF

R 2: 1.0240

R 1: 1.0129

CURRENT: 0.9862

S 1: 0.9476

S 2: 0.9384