(Tuesday Market Close) Wall Street welcomed back an old friend on Tuesday: Volatility.

The market’s most closely watched fear indicator, the VIX, spike back above 20 after a couple weeks when it appeared to be on winter break. As VIX climbed and the major stock market indices retreated amid fears of world economic slowing and a possible hitch in China/U.S. trade talks, investors got a reminder that turbulent times could be far from over.

Tuesday’s action could also serve as a reminder that most of the worries contributing to December’s sell-off haven’t really gone away. It’s true that the Fed is less of a primary concern and more of a secondary concern after signaling what appears to be a somewhat hands-off stance, at least for the moment. Other than that, however, there’s still the China situation, the global economy, Brexit, and the government shutdown. These are all things investors need to grapple with, making the next six months perhaps as important for the economy as we’ve seen in a long time.

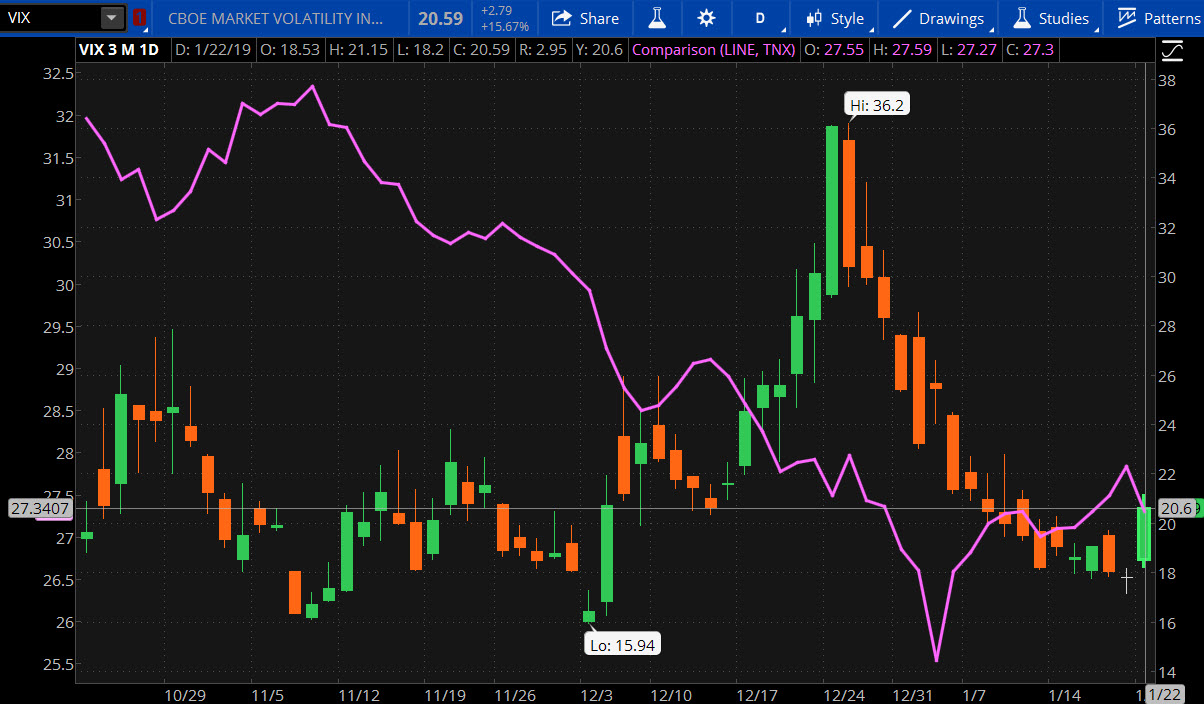

The so-called “three horses” of risk might be reflecting some of these concerns, as both U.S. Treasury notes and VIX galloped higher. Gold, the third risk marker, barely rose, however. The 10-year Treasury yield, which falls when bond prices rise, dipped back below 2.75% Tuesday after flirting with 2.8% last week. (See chart below).

U.S./China Meeting News Drags Market

Stock markets around the world were already down even before news came at midday of a canceled meeting between U.S. and Chinese trade negotiators. The media said the disagreement was over intellectual property issues. However, White House economic adviser Larry Kudlow came out right before the close to say that the cancellation news was incorrect, and the market got a late lift from that, though futures tracked lower again in post-market trading.

Earlier in the day, softness seemed to stem from a double-barreled batch of bad economic news over the long U.S. holiday weekend, including China’s Q4 growth falling to 6.4%, the weakest since 2009. For all of 2018, China’s economy grew 6.6%, the slowest since 1990.

Also, the International Monetary Fund (IMF) said it sees the world economy growing 3.5% in 2019 and 3.6% in 2020, down 0.2 and 0.1 percentage points, respectively, from its previous estimates.

Selling picked up in the afternoon after the negative news on China talks that Kudlow later denied. There are only about five weeks left for the two countries to make a deal before U.S. tariffs are scheduled to rise. Intellectual property issues might be tying things up, according to a Bloomberg report over the weekend.

The bearish China news hit the Dow Jones Industrial Average ($DJI) particularly hard, because some of its 30 names have businesses so closely tied to China. The stocks that come to mind are Boeing (NYSE:BA), Caterpillar (NYSE:CAT), Apple (NASDAQ:AAPL), Goldman Sachs (NYSE:GS) and 3M (NYSE:MMM). At one point, these five stocks alone accounted for about 250 points of the $DJI’s 400-point losses. This kind of market action shows why many investors keep a closer eye on the broader S&P 500 Index (SPX), which has far more components and doesn’t get buffeted around so easily by weakness in a few names.

That said, both the SPX and the NASDAQ (COMP) were down more sharply than the $DJI by late Tuesday, a sign that selling was pretty much across the board. At one point, 29 of the 30 $DJI names were lower on the day, with only McDonald’s (NYSE:MCD) barely poking its head above water. Eventually, a few others joined it, so the day wasn’t a complete $DJI washout.

Banks Step Back

Financials, which had been showing signs of life so far in 2019, took it on the chin Tuesday. That was especially true for Morgan Stanley (NYSE:MS), which fell nearly 3% and just hasn’t recovered its mojo since last week’s disappointing earnings report. Other big banks fell, too, which might have had to do in part with the pressure on Treasury yields.

Also from a sector standpoint, some of the cyclicals that led last week brought up the rear Tuesday. Communication services, energy, consumer discretionary, industrials, and information technology all fell 2% or more. It’s just one day, but that looked like quite a contrast to the “risk-on” kind of trading seen much of last week.

It’s getting toward the middle of earnings season, but so far, there hasn’t really been a lot of clarity on earnings calls about how executives see the tariff situation potentially affecting their businesses. It’s still up in the air, and companies might be struggling with what to do next. This could be making investors nervous, perhaps contributing to a more conservative type of trading. If executives seem conservative about their next steps, it might stand to reason that investors would feel the same way.

On the data side, there wasn’t much help from the U.S. economy Tuesday as existing home sales for December decreased 6.4% month-over-month to a seasonally adjusted annual rate of 4.99 million. That was under the Briefing.com consensus of 5.25 million) and total sales were 10.3% lower than the same period a year ago. Sales declined in all regions despite mortgage rates coming down during the month. This would seem to add another chapter in the ongoing story of a slowing U.S. housing market and could play into those fears about the global economy easing.

If you’re trying to take any positives out of Tuesday’s retreat, the markets did rally back a bit from their lows in the final minutes of the session. Also, some analysts said stocks might have gotten over-bought last week, making them ripe for a sell-off. In addition, the SPX managed to close above its 50-day moving average of 2625, a level that could represent technical support.

All that aside, the China situation is probably going to be front and center going into Wednesday, and any sign that more serious background issues potentially threaten negotiations might mean a chance for continued selling.

FIGURE 1: FLASHES OF RISK-OFF? Though the Cboe Volatility Index (VIX - candlestick) fell in recent weeks and the 10-yr Treasury (TNX - purple line) rose over the same period—two indicators of a "risk-on" trading environment, both VIX and TNX reversed course in Tuesday's session. Data source: Cboe Global Markets. Chart source: The thinkorswim® platform from TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future results.

TD Ameritrade® commentary for educational purposes only. Member SIPC. Options involve risks and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options.