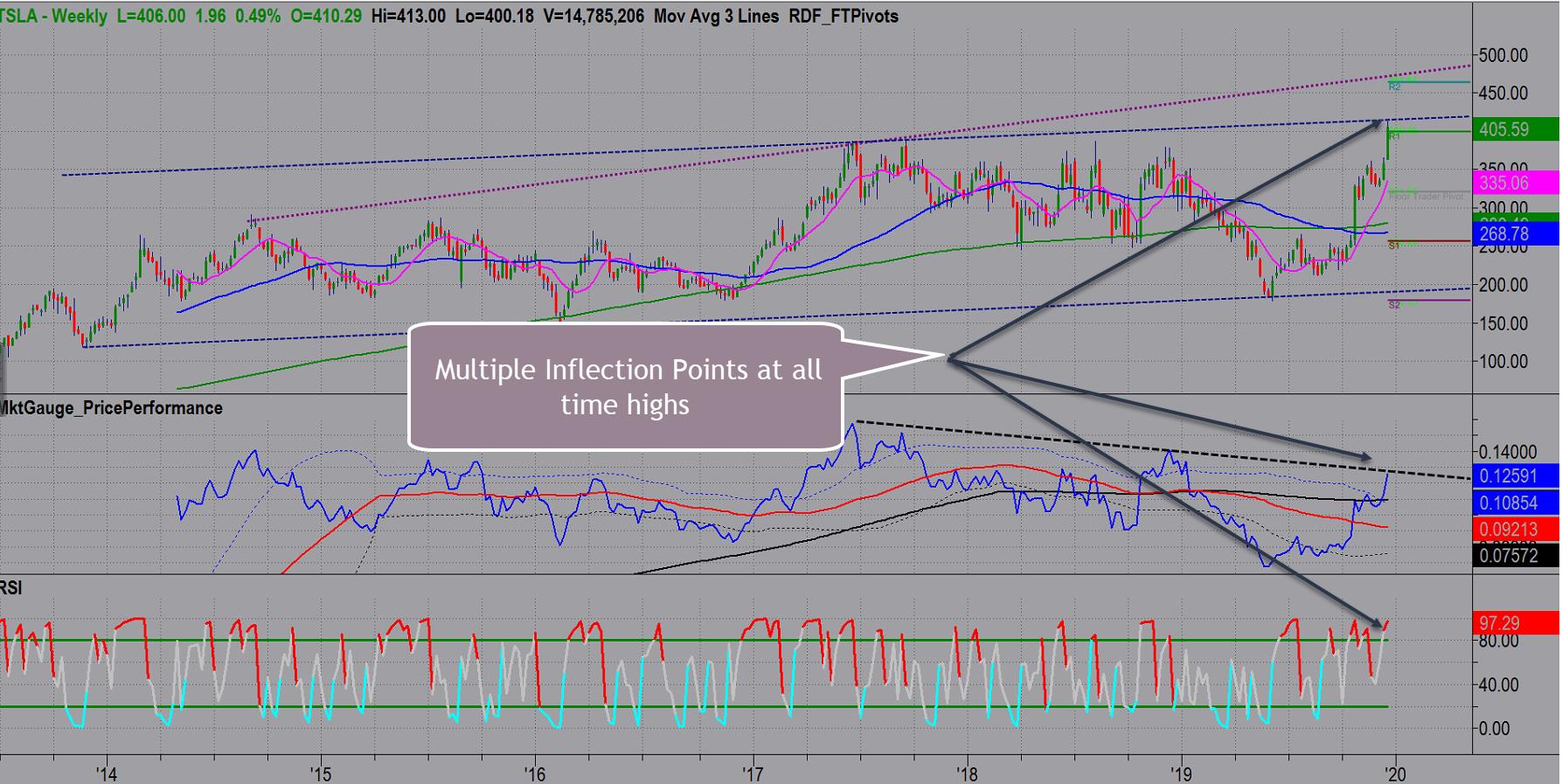

Nothing like an impeachment of the President to fuel the markets to new highs. Talking about counter-intuitive, Tesla (NASDAQ:TSLA) hit also all-time highs and closed out the week over $400, destroying short-sellers who have lost billions in one of the most hated stocks by Wall Street pros. The short-covering may not be over yet either, as the recent price action could attract even more new buyers once the short-term overbought situation works itself off. As the chart above shows, we hit the top of the trading multiyear trading channel, an important annual floor trader pivot (R1) and the upper trendline of relative performance versus the S&P 500 that started in mid-2017.

This week’s highlights are:

- Risk Gauges are still in bull mode but backed off from 100% bullish

- The Nasdaq 100 is leading the charge up and running rich with a doji day as it closed at all-time highs with an inclusive doji pattern

- Semiconductors continue their tear, looking to close out the year up over 60%

- Volume patterns are showing major buying pressure

- The Retail sector continues to poorly perform this year, as does the Transportation sector which should be respected as a yellow flag for the major indexes

- Both Value and Growth plays are leading themes relative to the S&P 500