While Presidents typically have little influence in the direct moves in the market, Thursday's loss was pretty much all his. Instead of inspiring some level of confidence, markets spun off in the other direction. For the Russell 2000, this means in the space of a few weeks the index has plunged to a level last see in June 2017. The damage in the S&P and NASDAQ was not as bad, although still not great, but their respective 2018 lows are still intact.

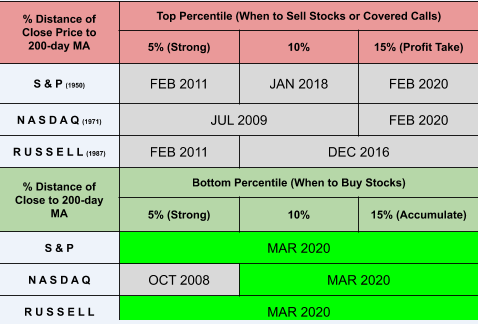

The S&P is currently 18% below its 200-day MA and has pushed into the 5% zone of historic weak price action, last seen in December 2018. The Russell 2000 is now 27.8% below its 200-day MA, which is well beyond the 1% zone of historic weak action since 1987 (21% below its 200-day MA); while this market may slink or continue to crash lower, we are likely close to a swing low - certainly investors should be fishing for opportunities in Small Caps. The NASDAQ is the most 'resilient' of the indices but now finds itself 14% below its 200-day MA which is now in the 10% zone of historic weak action; if we get to 18% below its 200-day MA, then the NASDAQ will have reached a level last seen in 2008...

The other point of interest has come from the Volatility Index. From 2012 through to 2018, volatility entered a lengthy lull—which after the fear experienced during the Tech peak of 2000, the September 11th attacks, and the credit crisis in 2008—struck as really unusual. However, there was a warning sign during 2018 when fear started to stir in the markets, but has since exploded in 2020.

With the rapid shift from all-time highs to terrible lows, the idea of a buying opportunity now seems absurd. However, price action suggests we are near to a low of significance, even if markets go on to make new lows.

For those who are looking for a little more direction, this post by J.C. Parets is worth reading. However, if you are an investor or someone buying for a pension 10 yrs+ down the road, today's market discounts will prove to be excellent value, but to take advantage requires ignoring the news and the noise around what's happening, and just look at the figures.