There was a time when fast-food patrons were satisfied with Burger King’s Double Whopper.

But eventually, diners yearned for more than just two flame-broiled meat patties.

Well aware of the growing inadequacy of its double-pattied Whopper, Burger King introduced the Triple Whopper, which comes complete with three patties and has 1,230 calories (with cheese).

Bristling with ground beef, the Triple Whopper seems to have enough protein and saturated fat to fill the hungry bellies of America… for now.

This level of excess may seem absurd to most of us, but our gluttony is on display in more aspects of life than simply fast-food menus -for instance, our investment choices.

There was a time when double-leveraged exchange-traded funds (ETFs) were sufficient, as well.

Now, triple-levered ETFs are all the rage.

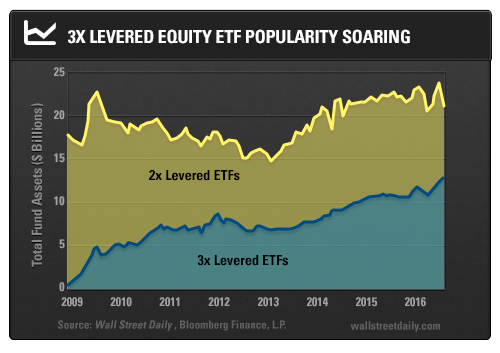

The 59 triple-levered equity ETFs currently trading have a combined asset value of $12.8 billion. By comparison, assets for double-levered funds total $8.4 billion.

In aggregate, there’s a lot of levered speculation going on here.

Proponents of leveraged ETFs might argue that these funds provide day traders with a more liquid alternative to put or call options.

However, judging by the swelling of fund assets, it’s likely that many retail investors are mishandling leveraged ETFs.

Volatility Decay

Triple-levered ETFs seek a return equivalent to positive or negative 300% of the underlying index on a daily basis.

Because of this daily resetting, levered ETFs are unsuitable long-term investments.

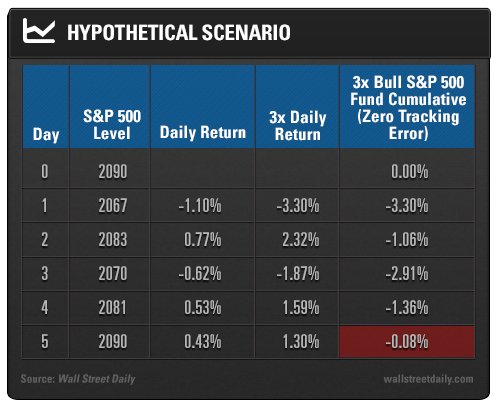

Let’s suppose that the S&P 500 Index has a bit of volatility over five hypothetical trading days, but ends the period at the same level at which it started.

These theoretical returns are provided in the table below:

The final column is the cumulative return for a theoretical triple-levered SPDR S&P 500 (NYSE:SPY) ETF, which provided exactly three times the return of the index each day.

As you can see, the fund wound up with a slightly negative return, despite the fact that the S&P 500 finished flat over the five days. This divergence helps to illustrate the adverse effects of compounding and market volatility on leveraged ETFs.

The minor loss depicted in this example may seem trivial, but the impact can be significant over longer periods of time.

The PowerShares QQQ Trust Series 1 (NASDAQ:QQQ), which tracks the Nasdaq 100 Index, has fallen 1.6% this year.

Therefore, it may be expected that the PowerShares QQQ Trust Series 1 (NASDAQ:QQQ), a triple-levered Nasdaq 100 bear fund, produce a gain. However, SQQQ is down even more, with a 5.3% loss year to date.

Meanwhile, the ProShares UltraPro QQQ (TQQQ) is down 9.1%, which is greater than three times the loss of QQQ.

It’s been a relatively tame year, too. At higher levels of volatility, triple-levered funds can suffer a dramatic loss of value.

Plus, trading costs due to portfolio turnover (daily rebalancing), along with relatively high management fees, tend to make triple-leveraged funds very poor performers in all but the smoothest of trending markets.

Thus, if you want to make a longer-term, directional bet, it’s best to use options. After all, puts and calls have embedded leverage and benefit from higher volatility.

Holding levered funds too long isn’t the only mistake investors are making, either.

Hyper-Trading

In 2000, Brad Barber and Terrance Odean performed a study of over 66,000 household brokerage accounts. They found that most active investors underperformed. Overtrading—likely resulting from overconfidence—was a prime culprit.

With their juiced returns, triple-levered ETFs cater beautifully to investors prone to overtrading in this financial market casino we now have.

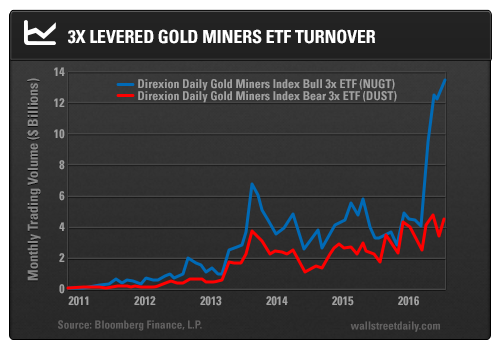

As you’re probably aware, gold has been having a good year so far, and gold miners are benefiting handsomely.

The following chart shows the monthly turnover (trading volume) for the Direxion Daily Gold Miners Bull 3X Shares (NYSE:NUGT) and the Direxion Daily Gold Miners Bear 3X Shares (NYSE:DUST). Keep in mind that both NUGT and DUST have lost over 90% of their values since inception.

As you can see, the trading activity has soared for NUGT this year.

Other commodity-related vehicles are currently changing hands at a frenetic pace, as well.

The popularity of the VelocityShares 3x Long Crude linked to S&P GSCI Crude Oil Excess Return (NYSE:UWTI) and the VelocityShares 3x Long Crude linked to S&P GSCI Crude Oil Excess Return (NYSE:UWTI) have absolutely exploded. These exchange-trade notes (ETNs), which have imbedded credit risk, are also being overtraded. We’re even getting media stories of retail investors making easy money by trading these products.

These anecdotes are misleading, however.

On average, people are losing money with mathematical certainty. And if investors were hurting themselves by churning their brokerage accounts before triple-levered ETFs existed, they’re now losing money three times as fast.

Triple-levered funds are essentially derivatives with tickers. They can be a valuable tool for adept short-term traders, but their growing popularity suggests misuse by the masses.

Just as a diet of triple-decker burgers can be hazardous to your health, abuse of triple-levered funds can be dangerous to your wealth.