So far these last couple of weeks, we have written and talked about trading ranges, January calendar ranges, inflation, stagflation, and precious metals.

And, we have also talked and written about the Transportation sector as the prime example of not only trading ranges, but also why we believe the market will hold trading range support levels.

Plus, we have talked iShares Transportation Average ETF (NYSE:IYT) as the best hope for the economy both because of the eventual end of COVID and the infrastructure package.

There are 3 reasons to focus on Transportation.

- IYT has upheld support thus far

- IYT could have a mean reversion trade (will explain)

- IYT can prosper from inflation to a degree

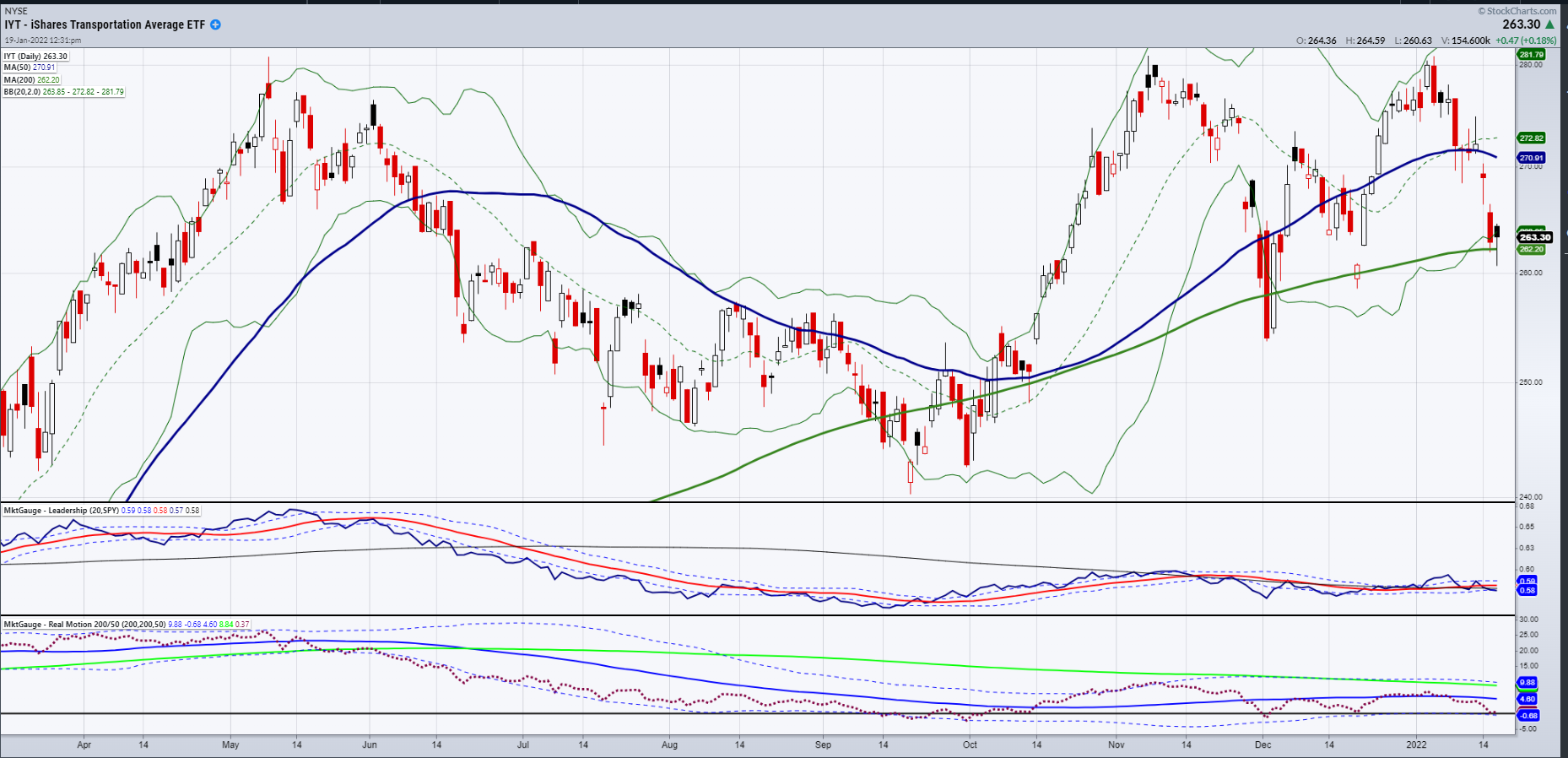

Looking at the support level, IYT is sitting on the 200 daily moving average.

More importantly, IYT is holding the 50-week moving average, well outperforming some of the other members of the Economic Modern Family-Retail via SPDR® S&P Retail ETF (NYSE:XRT), Biotechnology via iShares Biotechnology ETF (NASDAQ:IBB), and Small Caps Index—iShares Russell 2000 ETF (NYSE:IWM).

Secondly, looking at the chart and our proprietary indicators, IYT looks ripe for a mean reversion. A mean reversion trade implies that a stock’s price has traded to an extreme low (or extreme high), and that the price has a strong probability of returning to its normal pattern.

On our proprietary software, we measure the mean reversion when momentum, using the dotted line on the Real Motion indicator, crosses below the Bollinger® Band, or the dashes. Then, we wait to see if the dotted line can cross back over the BB.

Furthermore, the price on the price chart above, which broke below the green BB, now needs to close above it. Hence the work is not done. IYT must move up in momentum and in price, clearing over 263. Then, the risk to Wednesday’s low would be clear.

Transportation is a key barometer to watch and potentially trade to take advantage of theses support levels. Even in an inflationary time, with low supply and rising demand, that “hoarding” mentality can continue to move goods along to a point of course.

Furthermore, we still see an endgame for COVID. That should surely give a boost to underperforming sectors in IYT—particularly airlines and cruise ships.

Of course, the advantage of trading ranges, is when they break, you have a low risk and quick exit, plus the understanding that patience is your friend until a new support level proves out.

Please click on the links to hear my most recent segments on Making Money With Charles Payne, BoomBust on RT America, and Ticker News out of Australia

ETF Summary

- S&P 500 (SPY) 450 major support

- Russell 2000 (IWM) 204-205 major support back over 216 better

- Dow (DIA) 350 major support

- NASDAQ (QQQ) 365 the 200-DMA support

- KRE (Regional Banks) 73.00 a buy area to watch for

- SMH (Semiconductors) 287.00 support then 269

- IYT (Transportation) 260 the 50-WMA major point to hold

- IBB (Biotechnology) 128 major support

- XRT (Retail) 80 support to hold-back over 85 better

- Junk Bonds (JNK) 106.50 key

- SLV (Silver) Another gap up and now ready to test the 23 level

- USO (US Oil Fund) 58 support

- TLT (iShares 20+ Year Treasuries) Held the 200-WMA and rallied. 140 support

- DBA (Agriculture) 20.31 best close in 6 years-close to taking that out