We are entering the heart of the Q2 earnings season, with a deluge of S&P 500 members expected to come out with results by the end of the current week.

Picture So Far

Currently, we have at hand earnings reports from 97 S&P 500 members that represent 28.1% of the index’s total market capitalization. In fact, the picture to have emerged so far is an extremely healthy one.

According to the latest Earnings Trends, the bottom line has expanded 8.4% until now from the same period last year. This is driven by 5.1% higher revenues, with 78.4% of the companies reporting better-than-expected earnings and 72.2% outperforming the Zacks Consensus Estimate on the top-line front.

What Lies Ahead?

We will get a clearer picture regarding the current reporting cycle by the end of this week. According to the above report, 812 companies including 183 S&P 500 players are scheduled to report during the course of the current week.

In addition, the above report projects S&P 500 companies to end Q2 with bottom-line growth of 8.6% year over year. Additionally, stocks in the highly sought-after fraternity are projected to end the quarter with their top line expanding 4.7%.

Notably, 11 of the 16 Zacks sectors are expected to see their bottom line expand on a year-over-year basis.

One such sector is the highly diversified Transportation sector. In fact, the participants from this space are likely to end Q2 with the top and the bottom line expanding 9.6% and 6.9%, respectively. Both these figures compare favorably to the readings in Q1, when revenues grew 6.9% and earnings contracted 17.8%.

Already, the sector has seen strong Q2 earnings reports from key players, like United Continental Holdings (NYSE:UAL) , Union Pacific (NYSE:UNP) and Kansas City Southern (NYSE:KSU) that have surpassed expectations on both the fronts.

Transportation Stocks to Watch for Earnings on Jul 25

Given this backdrop, investors interested in the transportation space will keenly await Q2 reports from key sector participants like JetBlue Airways Corporation (NASDAQ:JBLU) , Hawaiian Holdings (NASDAQ:HA) , Canadian National Railway Company (NYSE:CNI) and Trinity Industries (NYSE:TRN) .

According to our quantitative model, a company needs the right combination of two key ingredients – a positive Earnings ESP and a Zacks Rank #3 (Hold) or better – to increase the odds of an earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The Long Island City, NY-based JetBlue Airways focuses on providing high-quality customer service. We expect the company to report better-than-expected earnings per share in this quarter on the back of improving unit revenue trends. This is because it has an Earnings ESP of +3.57% as the Most Accurate estimate is at 58 cents, while the Zacks Consensus Estimate is pegged at 56 cents. Also, it currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Our model had predicted an earnings beat earlier too. When we issued its Q2 earnings preview article, the company had an earnings ESP of +5.46% and carried a Zacks Rank #2 (Buy).

Hawaiian Holdings Inc., the parent company of Hawaiian Airlines, focuses on providing scheduled air transportation of passengers and cargo. We expect the company to report better-than-expected earnings per share in this quarter. This is because it has an Earnings ESP of +5.23% as the Most Accurate estimate is at $1.61, while the Zacks Consensus Estimate is pegged at $1.53. Also, it currently has a Zacks Rank #3 (read more: Is Hawaiian Holdings Likely to Beat Earnings in Q2?).

Based in Montreal, Canadian National Railway Company is engaged in the rail and related transportation business. We expect the company to report better-than-expected earnings per share in this quarter. This is because it has an Earnings ESP of +2.00% as the Most Accurate estimate is at $1.02, while the Zacks Consensus Estimate is pegged at $1. Also, it currently holds a Zacks Rank #2.

Our model predicted an earnings beat earlier either. When we issued its Q2 earnings preview article, the company had an earnings ESP of +2.02% while the Zacks Rank remained the same.

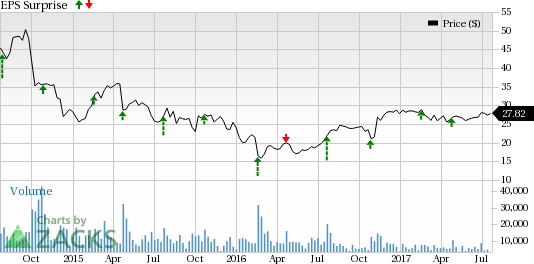

Dallas, TX-based Trinity Industries provides products and services to the energy, transportation, chemical and construction sectors, across the globe. The chances of the company beating the Zacks Consensus Estimate in this quarter are less as it currently has an Earnings ESP of -6.45% (Most Accurate estimate is 2 cents below the Zacks Consensus Estimate of 31 cents) and carries a Zacks Rank #2 (read more: Will Trinity Industries Disappoint in Q2 Earnings?).

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

JetBlue Airways Corporation (JBLU): Free Stock Analysis Report

United Continental Holdings, Inc. (UAL): Free Stock Analysis Report

Hawaiian Holdings, Inc. (HA): Free Stock Analysis Report

Trinity Industries, Inc. (TRN): Free Stock Analysis Report

Kansas City Southern (KSU): Free Stock Analysis Report

Union Pacific Corporation (UNP): Free Stock Analysis Report

Canadian National Railway Company (CNI): Free Stock Analysis Report

Original post

Zacks Investment Research